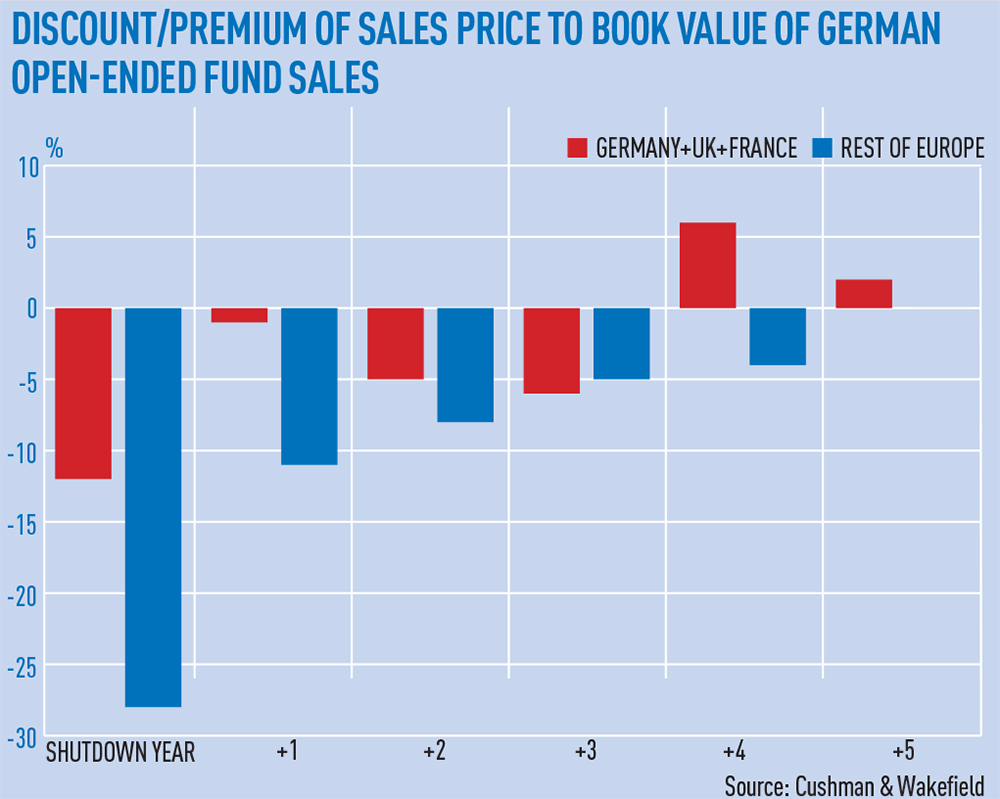

Discounts on the assets sold by German open-ended funds have fallen to 4% over the first six months of the year, according to research from Cushman & Wakefield.

Discounts on the assets sold by German open-ended funds have fallen to 4% over the first six months of the year, according to research from Cushman & Wakefield.

The discount is a sharp reduction on the 13% for the whole of 2014, when more than €5bn (£3.6bn) of assets were sold.

Magali Marton, head of EMEA research at Cushman & Wakefield, said: “German open-ended funds have benefitted from the current booming investment market in Europe and therefore have managed their assets sales in 2015 successfully so far.

“Depending on the country, the pricing achieved to book value has ranged from a -26% discount in the Benelux to a premium of 47% for assets traded in the UK, with German assets sales reflecting a 6% discount.”

The research also showed that the pace of sales is now slowing following the upswing in disposals during 2014. The first half of the year saw €1.7bn of assets sold compared with €2bn for the same period the year before.

Most of those assets sold in H1 2015 were in Germany with about €910m from the jurisdiction sold up to the end of June. This compared with €500m from the next biggest market, the UK. Disposal of assets from other regions reduced dramatically from a 12-month average of €1.9bn in 2013 and 2014 to just €250m in H1 2015.

C&W expects the German market to be the greatest source of asset sales with 31% of the share from the funds. Benelux countries and France will be the next-largest, it estimates, with a 26% share and an 18% share respectively.

The disposals will come from the 18 funds that have still to liquidate from the €82bn German open-ended funds market. The assets remaining in these funds will see a further €9bn enter the market before the cut-off date for liquidation, 31 December 2017.

A series of German open-ended funds decided to close following the introduction of the German Capital Investment Code in 2012, which put restrictions on the operations of new open-ended funds.

At the time there were fears that the market would struggle to absorb the estimated €18.5bn of real estate that had to be sold. Careful management of the sales process and increased interest in European real estate has helped to ease those fears with a total of €23bn estimated to complete before the end of the liquidation window.

Marton added: “We expect sales to grow over the rest of the year and in 2016 and these funds should continue to demonstrate some proactivity in their liquidation process.