Newcastle agents landed one-fifth more deals than last year despite the shortage of quality office stock in the city centre, writes Jim Larkin.

Newcastle agents landed one-fifth more deals than last year despite the shortage of quality office stock in the city centre, writes Jim Larkin.

Hard work by agents to pull in 20% more deals than in the same period last year saw Newcastle’s tentative recovery take hold.

Nearl y 338,000 sq ft of office space was disposed of in the city but, exacerbated by a shortage of quality stock in the city centre, the average deal size dropped to 3,600 sq ft from 4,162 sq ft last year. This has helped to create a healthy out-of-town market in developments such as Quorum and Cobalt.

y 338,000 sq ft of office space was disposed of in the city but, exacerbated by a shortage of quality stock in the city centre, the average deal size dropped to 3,600 sq ft from 4,162 sq ft last year. This has helped to create a healthy out-of-town market in developments such as Quorum and Cobalt.

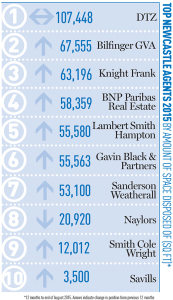

DTZ, now Cushman & Wakefield, remained the top agent. In a market in which C&W previously had no presence, DTZ comfortably outperformed its rivals, disposing of the most space for the second year in a row. It completed the most deals and was also involved in the biggest – the sale of the former PwC building at 89 Sandyford Road to Newcastle University.

The largest letting was to iparadigms which took 19,775 sq ft at Wellbar Central through Knight Frank and Gavin Black.

Going up: Bilfinger GVA

Last year GVA saw its ranking fall from first to fifth after one of the quietest years on the deals front in recent memory, but this year it shoots back ahead of all but one of its competitors. It acted on almost twice the number of deals seen last year and also signed up one of biggest lettings, with Ubisoft taking 17,000 sq ft at the new Haymarket Hub in a deal jointly brokered by Lambert Smith Hampton.

Going down: JLL

JLL finished second last year helped by a string of deals at Baltic Place, but this development is now being marketed by Bilfinger GVA and C&W. In fact, JLL is no longer marketing any city centre office space, so it is little surprise to see it fall out of the top 10. It has now been a few years since JLL had a dedicated Newcastle office. It is, however, still acting on out-of-town projects in the North East.