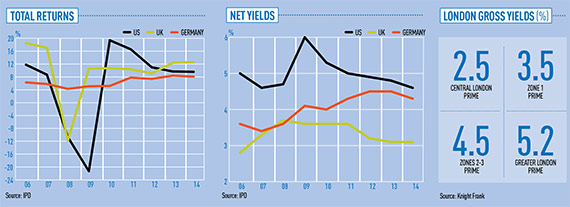

An influx of international capital targeting UK residential opportunities has been attracted by returns that continue to outpace those of the more mature European and US markets.

With the demographics of renting underpinning growth for years to come, the sector is seen as a safe bet.

However, the return profile of UK residential assets still shows a continuing reliance on capital growth for investment returns, not income, according to IPD.

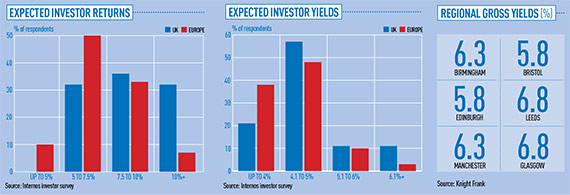

Separate research from Internos shows a willingness among European funds to accept lower returns than their UK-based counterparts, owing to the Europeans’ greater familiarity with the PRS.

But the same research shows they would still like to receive a level of income roughly similar to that of UK investors.

As a result, some investors are targeting rental growth – 8.8% in the UK over the past two years – while others are looking for sites they can develop in partnership with public land owners or private house builders.

But a growing trend over the past 12 months has been to target regional assets in key centres, which, according to Knight Frank’s PRS Yield Guide, provide a considerably higher income return than London investments.

Nick Pleydell-Bouverie, partner at Knight Frank, said: “Continuing low bond yields and volatility in equities make London an attractive income play for investors in the sector, especially when potential rental and capital growth are taken into account.

He added: “But the real story is the growing investment into the regional markets, where yields are higher, and land prices are significantly lower, giving that extra bit of room for many investors to find assets that match their return profiles.”