We are at the time of year when researchers and economists dust off their crystal balls to formulate their housing market forecasts.

This is no longer just a case of saying we think UK house prices will go up or down by a certain percentage in the coming 12 months.

To provide a meaningful market forecast it is important to look over a wider timeframe, with a view to establishing where different markets are in the cycle and what their capacity for growth is over the medium term.

It is also increasingly important to understand how prices interact with transactions, people’s ability to get on or trade up the housing ladder, and the shifting patterns of tenure.

The here and now

That means having a clear understanding of the here and now.

The effects of the mortgage market review are becoming a little clearer. Mortgage approvals and consequently transaction levels appear to have reached a plateau, as affordability tests on borrowers and loan-to-income restrictions on lenders limit the amount homebuyers can borrow.

As a result, levels of mortgaged owner occupation are falling and, pertinently, the cost of mortgage deposits remains high.

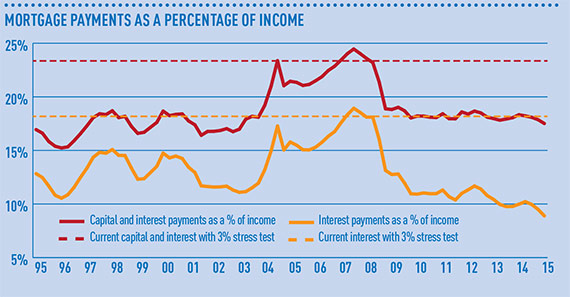

In contrast, interest rates are at an all-time low. This means those already with a mortgage continue to benefit from low costs of housing.

Interest rates will undoubtedly rise, but are expected to do so gradually. This is important because affordability ratios remain highly sensitive to interest rate assumptions.

For those seeking a new mortgage, this means they will be constrained by the higher interest rate assumptions adopted in the stress testing of affordability now required by mortgage regulation.

What of the future?

The Bank of England’s desire to avoid a debt-driven housing market boom – specifically given the effect that would have on the banking sector – means that mortgage regulation is here to stay.

As a result, earnings growth will also be a key driver of house prices both nationally and regionally. And this means the recovery should spread geographically.

Mortgage regulation will limit the mid-term capacity for house price growth in the mortgaged market, particularly where housing affordability issues are most acute.

Geographically, London, and particularly its inner boroughs, has seen much higher house price growth over the past 10 years than the rest of the country. Even those regional markets that have historically followed London closely have been left in its wake over this period.

This has left London with less capacity for house price growth going forward, and means there will be a change to the geography of house price growth.

More households are likely export their housing wealth out of London as they look to stretch their buying power further. A less London-centric economic recovery will also act as a catalyst for moderate price growth across the commuter zone.

As the economic recovery spreads further north, so house price growth will in all likelihood follow, though its timing remains less assured. But even as growth returns to the rest of the country, transaction levels are also unlikely to be restored to pre-crunch levels and demand for private renting will continue to rise.

This means, for the housing crisis to be addressed, other tenures will still need to be encouraged.

Lucian Cook is director of residential research at Savills