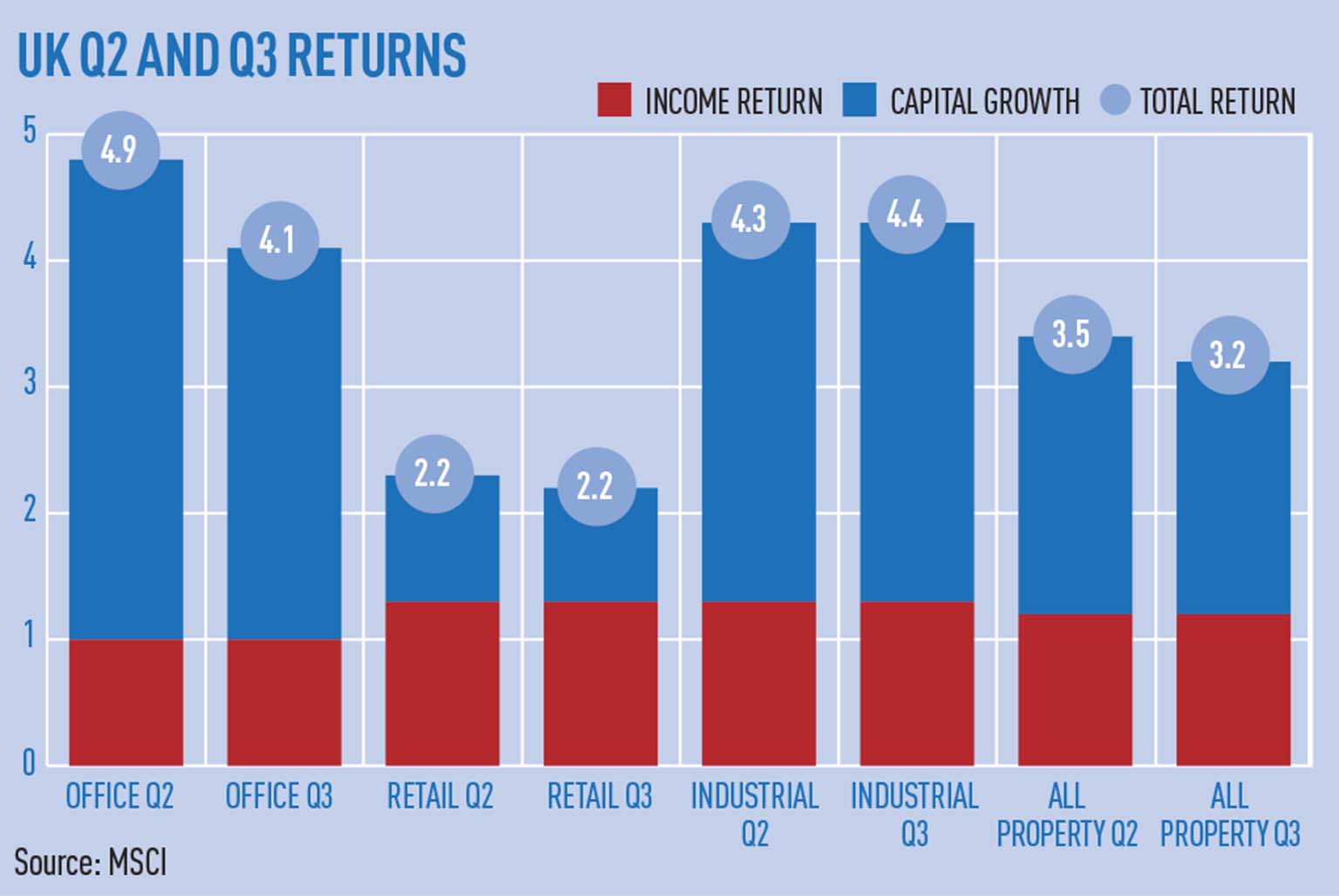

UK commercial property returns slowed to 3.2% in the third quarter of 2015 according to the MSCI/IPD UK Quarterly Property Index.

Capital growth dipped from 2.2% to 2%, led largely by slowing returns in the London and South East office markets.

Capital values in the City grew by 3.6% for the quarter, down from 4.4% in Q2, while those in the West End slowed from 4.5% to 3.1%. South East offices saw growth slow to 3.2% from 3.6%.

Average yields for London offices hardened to 3.3% in the West End and Midtown, and 3.6% in the City. In the South East they have dropped below 5%, prompting more caution among investors.

Outside the South East, office values and returns were more consistent, as a growing number of investors targeted relatively discounted assets.

Overall, office returns declined from 4.9% to 4.1% for the quarter, remained steady in the retail sector at 2.2%, and marginally increased in the industrial market by 10 basis points to 4.4%.

Rental growth slowed from 1.2% to 1% in Q3.

Rental growth ‘to double’

Rental growth rates will almost double over the next few years as occupier demand compounds a lack of supply, predicts Legal & General Property.

The firm’s Fundamentals Report said rental growth would average 2.8% pa from 2016-18, double the current 1.5% rate.

It said 28% less space was available than in 2010, owing in part to a lack of development and the proliferation of office-to-residential conversions.

L&G said office and industrial rents would see the most significant growth, with retail seeing more modest rises.