New office construction started in London in the year to the end of September has reached its highest level for more than 13 years.

New office construction started in London in the year to the end of September has reached its highest level for more than 13 years.

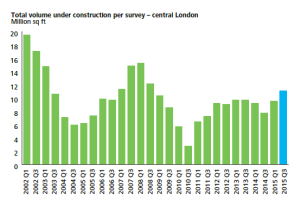

Work on 7.5m sq ft of office space has been carried out since October 2014, according to Deloitte Real Estate’s London Office Crane Survey.

The latest survey – which captures the six months from the start of April – registered 26 new office starts, following the 31 new schemes recorded in the previous six-month period.

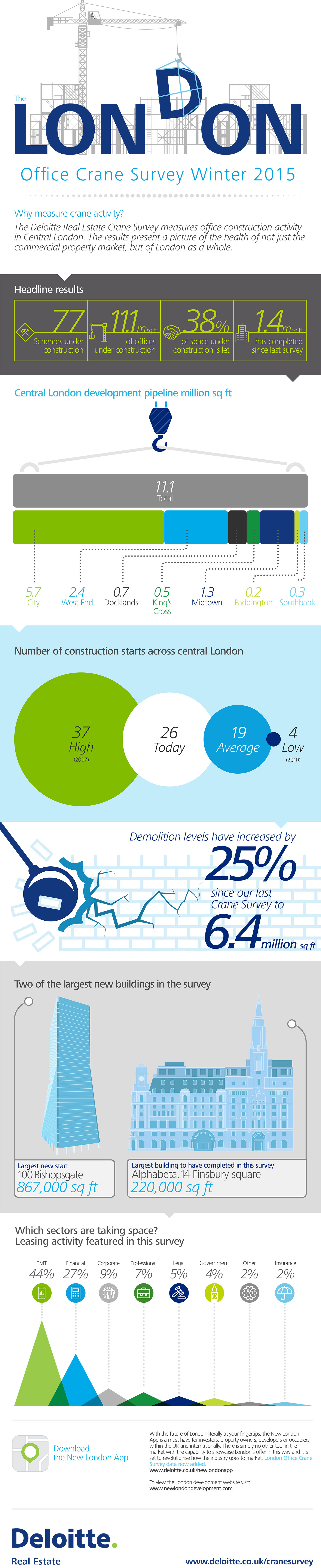

The 26 new starts reflect an 18% increase in development activity by floorspace thanks to major projects including Brookfield’s 100 Bishopsgate, EC2, which totals 867,000 sq ft, getting under way.

In total 11.1m sq ft is currently under construction in central London spread across 77 schemes.

The surge in starts comes as a dearth of new space was delivered this year.

Just 2.5m sq ft has been completed this year – 1.4m sq ft of which completed in the latest survey period – the lowest since 2012 and well below the five average grade-A take-up of close to 5m sq ft.

The lack of new space has encouraged occupiers to commit to prelets and 4.3m sq ft of the 11.1m sq ft under construction is now already committed, up 22% from the March crane survey.

The low availability appears to be encouraging developers to commit to further new starts.

Deloitte registered a 25% increase in demolition activity during the period and is now forecasting that completions in 2018 could be the highest since 1992.

It has also significantly increased its forecast for 2019 completions that it partially attributed to changing delivery times, which could be hit by a lack of construction capacity.

Around 7m sq ft of space is expected to complete in 2017, rising to more than 8m sq ft in 2018 and just under 8m sq ft in 2019, all well in excess of average take-up.

Deloitte Real Estate head of City leasing Steve Johns said developer sentiment remained high, pointing to 21 new speculative starts during the period.

“Cranes will be dominating London’s skyline for the foreseeable future as construction activity keeps pace with healthy occupier demand,” he said.

| Starts by submarket | |||

|---|---|---|---|

| Submarket | Starts this survey | Total now under construction | percentage prelet |

| City | 13 | 5.7m sq ft | 40 |

| Midtown | 6 | 1.3m sq ft | 41 |

| West End | 4 | 2.4m sq ft | 31 |