No wonder Leeds office agents are clapping their hands with joy: in any given year there is usually considerable supply or considerable demand, but in 2016 both are expected to occur at the same time – a blue moon event for the property market.

Demand first: “Current enquiries for immediate existing space (more than 10,000 sq ft) total 500,000 sq ft and rising. This is against the backdrop of only 250,000 sq ft of existing stock, which is around nine months’ supply,” says CBRE senior director Jonathan Shires.

Then there are the large requirements: despite a run of companies agreeing deals in the past 12 months, there are still a number who could come forward over the coming year. These include Npower (75,000 sq ft), which is widely expected to make a move into the city centre, Yorkshire Water (80,000 sq ft) and an unnamed financial services occupier (100,000 sq ft).

Indigenous firms may not be the only sources of demand, according to Alan Syers, portfolio director at Evans Property Group. “We expect to see new businesses coming in to take up some of the new space,” he says.

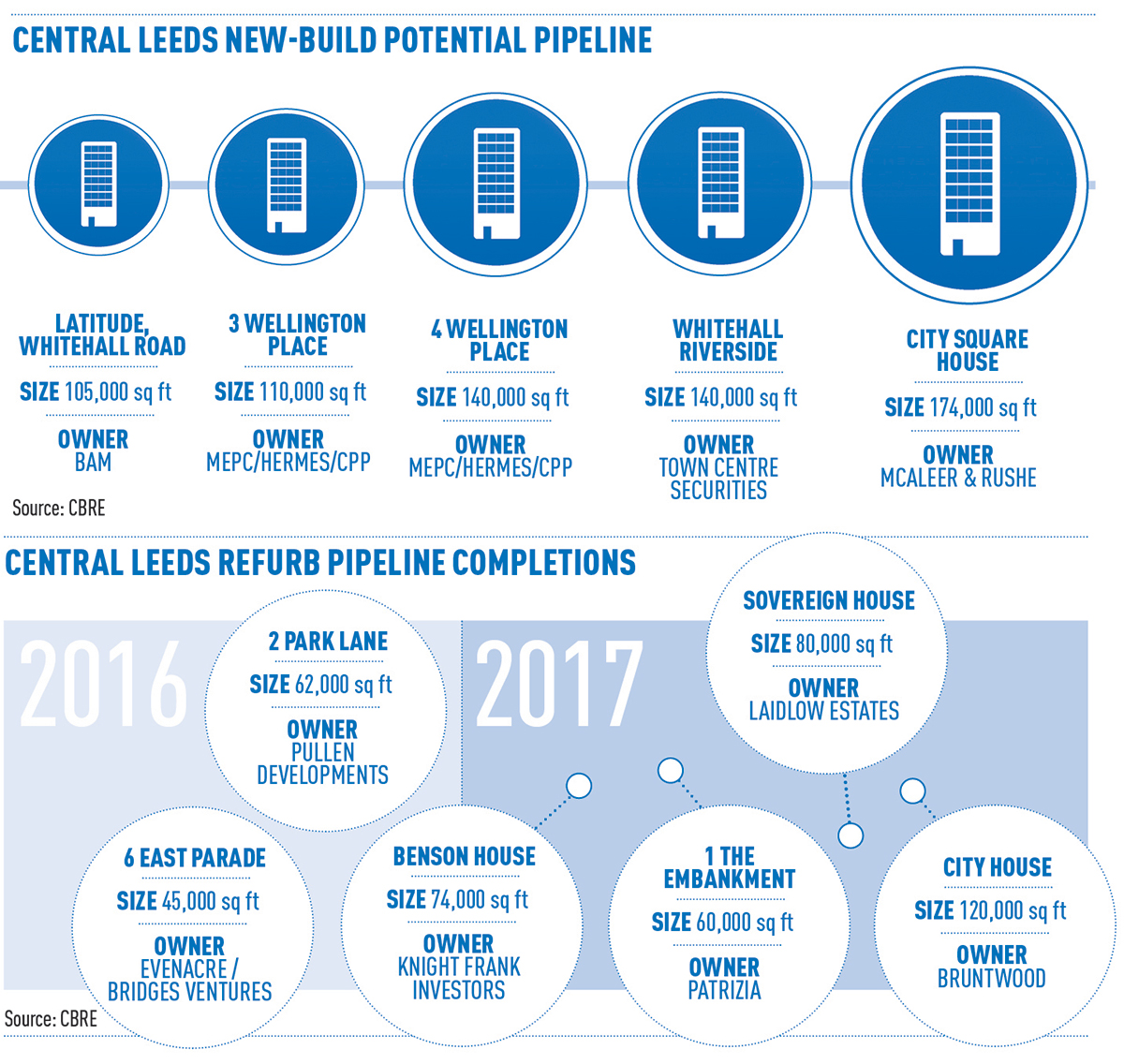

There will be plenty of new space to choose from in 2016 – five major schemes will complete in the city centre, adding around 540,000 sq ft of new stock, about 70% of which is still available.

“There is a huge amount of energy in the city. We are seeing unexpected enquiries emerging – not necessarily local companies,” says James Dipple, chief executive at MEPC, which is developing Wellington Square on behalf of Hermes and CPP. Dipple says the speed of regeneration in Leeds is changing perceptions of potential occupiers and surprising those who have not been to the city for some time.

Next year is shaping up to be a bumper one. But already local property people are asking what will happen after that, especially if most of the new space is taken by the end of 2016. Encouragingly, several major refurbishment schemes are either on site or expected to start within the next 12 months and these will deliver more than 330,000 sq ft in 2017. Less certain, however, is the prospect of new development, even though at least 670,000 sq ft is planned (see graphic).

One of the first expected to arrive was McAleer and Rushe’s City Square House, but a joint venture with Opus North recently collapsed and it is unclear how and when the scheme will proceed. As a result, the focus has moved to Wellington Place, where Number 3 (110,000 sq ft) and Number 4 (140,000 sq ft) could start next year, with completion in 2018.

Around 90,000 sq ft of offices could also complete during that time at the Tower Works regeneration project in Holbeck, if plans by joint venture partners HCA and Carillion are approved.

Sanderson Weatherall partner Richard Dunn, says: “The South Bank offers a different proposition to central Leeds, with Holbeck Urban Village already a base for the creative and digital industries in the city, along with corporate occupiers.”

That still leaves a question mark over 2017. “I cannot see anything coming out of the ground until more pre-existing space is committed,” says Shires. If that turns out to be the case, 2017 may be less blue moon and more simply the blues.

Investment

Buyers in search of higher returns are looking to regional cities such as Leeds for opportunities. This was highlighted by Legal & General’s purchase of a 50% stake in Scarborough Group’s 200-acre out-of-town regeneration scheme at Thorpe Park. The UK institution paid £162m. The first phase includes 60,000 sq ft of offices and 300 homes.

Private buyers have also been active. Earlier this year Patron Capital Partners picked up The Mint on Sweet Street from Deltalord for £30.3m, reflecting a yield of 7.5%. Prime office yields are lower, having fallen by 50bps in the first half of the year to 5.25%.

Rents

The surge in prime office rents across the UK has arrived in Leeds, making landlords happier and deals for occupiers more expensive. “Until recently you would quote £25 per sq ft, have a scrap and end up at around £22. Now £26 is achievable,” says Eamon Fox, partner at Knight Frank.

Local agents suggest that PwC’s prelet of 55,000 sq ft at Roydhouse Properties and Marrico Asset Management’s Central Square has set a new benchmark of £27.50, with £28 expected on new lettings at buildings due to complete next year.

“With build costs of £150 per sq ft, the rent needs to be at least £26 to deliver a decent building,” adds Fox.

Surprisingly, rents for new space from the previous generation of development are only slightly lower than those for space currently under construction.

“Why such a small gap when the building specifications are colossally different?” asks Rod Mordey, European director at Rockspring. “You would think occupiers would gravitate to the better build.” Rockspring, with joint venture partner CDP Marshalls, is aiming to achieve £30 per sq ft for the 5,000 sq ft terrace top floor when its 6 Queen Street scheme completes next year.

Despite a new wave of space coming on stream in the next few months, market commentators cannot see the £30 per sq ft rental hurdle being breached for large lettings until the next generation of buildings in 2017 at the earliest, even though this has already happened in other regional centres such as Birmingham and Manchester.

Leeds seems unable to close the gap, but some, like CBRE senior director Jonathan Shires, see that as a potential positive. He says: “If we sell it right, that puts Leeds into the bracket of value for money, which is attractive for those considering northshoring.”

Refurbs

The sizeable chunk of new offices due to complete next year is likely to widen the gap between new-build and refurbished space. Prime rents are pulling away towards £30 per sq ft, leaving prices for refurbished space at around £22 per sq ft.

But it is not all about the money. Refurbished schemes generally offer greater lease term flexibility and more generous incentives. This is significant at a time when the rent-free period for prime space has almost halved to 12 months on a 10-year lease or six months on a five-year term.

However, to date fewer refurbishment schemes have come forward than market observers might have expected. “It is complicated and expensive and not every investor has the appetite to do that,” says Alan Syers, portfolio director at Evans Property Group.

Several properties are now in the pipeline (see left) and while there is occupier demand, whether owners will take on further work remains to be seen.