The rate of construction inflation may finally be set to ease, according to research from Arcadis.

The volume of construction output for private housing – which grey by 24% in 2014 – is forecast to slow to 5% next year and 2% in subsequent years.

This is in part due to the cost of schemes making them less financially viable, particularly in a small but significant part of the London market, combined with slowing demand from overseas markets. This in turn could lead to an easing in cost and price increases for schemes going forward.

With demand slowing, there are indications that contractors are starting to display a greater willingness to secure schemes and wrangle less over initial costings.

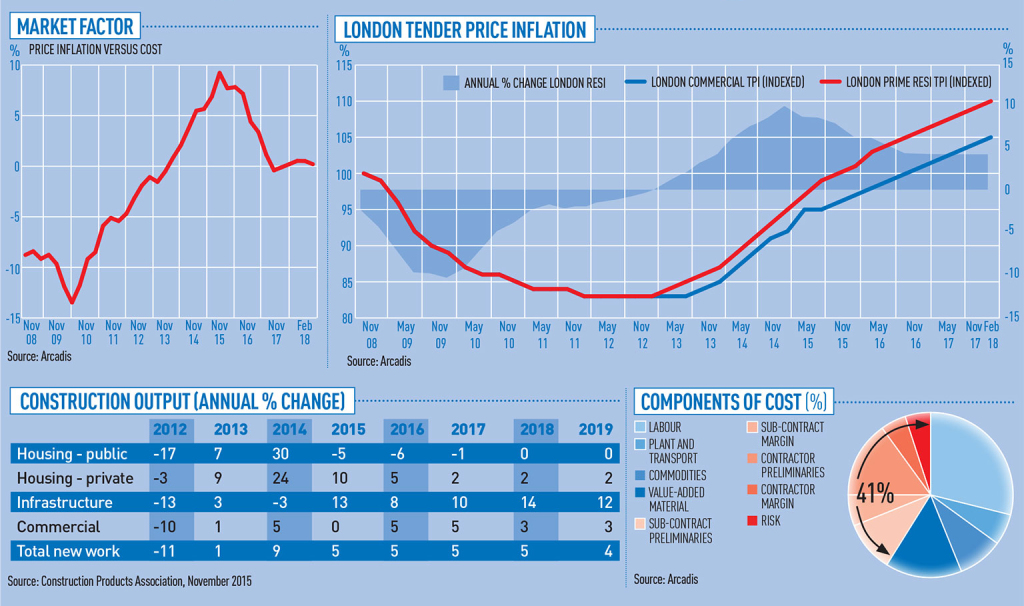

Arcadis predicts that for London residential, where demand has been driving the rest of the UK market, tender price inflation will slow from almost 10% at the beginning of 2015 to around 4% by 2017.

“Inflation will be returning to historic trend, rather than the hyper inflationary increases we have seen in the past two years,” says head of strategic research and insight Simon Rawlinson.

“There was a sense this year that projects are losing momentum – but now contractors and subcontractors are a little bit more focused on getting the workload, so there is a balance coming back.”

This balance is illustrated by Arcadis’ market factor estimate, which looks at the difference between increases in pricing and the rise in costs of materials and labour.

While the costs of a small range of materials has risen over the past 12 months, other inputs, such as energy costs and the price of imported goods, have fallen. As a result, much of the increase in construction prices paid by developers has been through contractors increasing their margins after years of under bidding.

Arcadis predicts this gap will decrease to zero, from 10% in February, as the two realign – though prices will still be increasing overall.

Despite this, around 41% of construction costs for developers now come through non-physical costs, such as pre-contract preliminaries and risk insurance, as they increasingly have to pay upfront to de-risk the development process.