Institutional investor confidence in real estate returns has declined over the past three years as looming interest rate rises and soaring asset values dampen appetite.

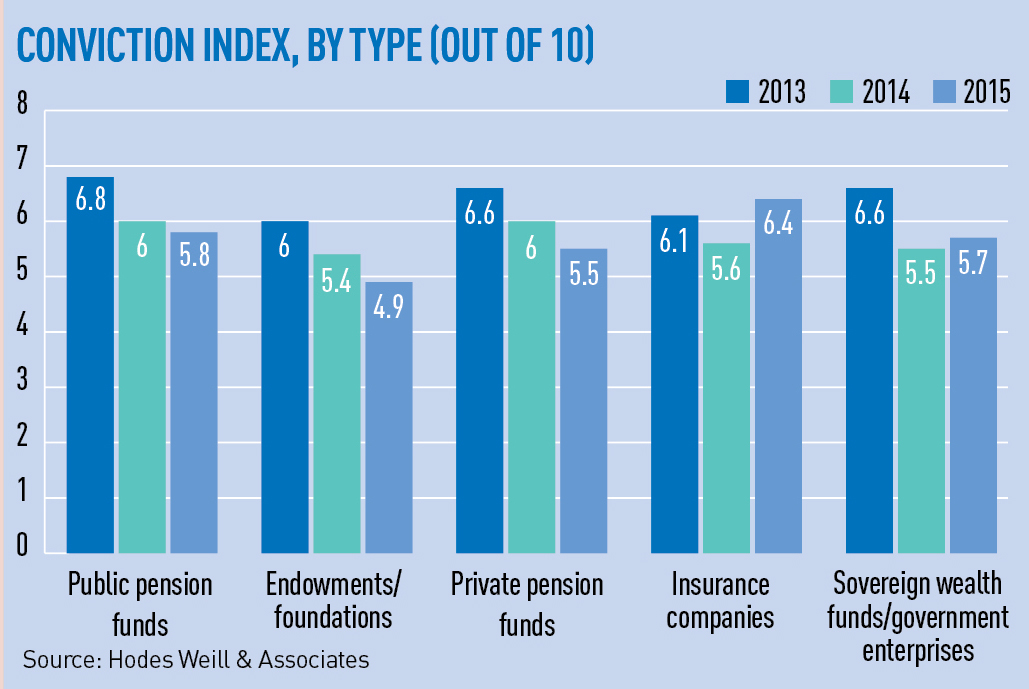

Research by US institution Cornell University’s Baker Programme found that, on a scale rising to 10, confidence in property has declined from 6.4 three years ago to 5.6 for 2015.

The decline was driven by a pensions industry that was “nervous of repeating previous mistakes”, said Will Rowson, a partner at Hodes Weill, which jointly authored the Real Estate Allocations Monitor report.

The research also found that sovereign wealth funds’ confidence in property had slipped from 6.7 to 5.7 over the period.

Insurance companies, however, bucked the trend and were feeling marginally more positive – from 6.1 to 6.4.

Despite the growing pessimism, 30% of investors said they planned to increase their allocations to real estate, while 8% anticipated a cut.

Investors are also looking at shorter-term investments, as a preference for close-ended funds rose to 79% in the 2015 report from 61% in 2013.

At the same time there is growing appetite for risk, with 76% preferring value-add to core, compared with 68% two years previously.

This is particularly the case for investors in the Americas, where 84% prefer this strategy.

EMEA investors retain a preference for core, driven by lower return targets of 7.1%, versus 8.6% for American funds.

The regional differences in investment style also extends to cross-border investments, where Asian investors look overseas more often than their American and EMEA peers.

EMEA edged North America as the destination of choice for Asian investors, with 58% preferring to buy in Europe.

Just 37% of APAC investors are currently focused on domestic investment. By contrast, 87% of EMEA investors are looking to invest in Continental Europe and 75% in the UK, while 95% of American investors intend to focus on the North American markets.