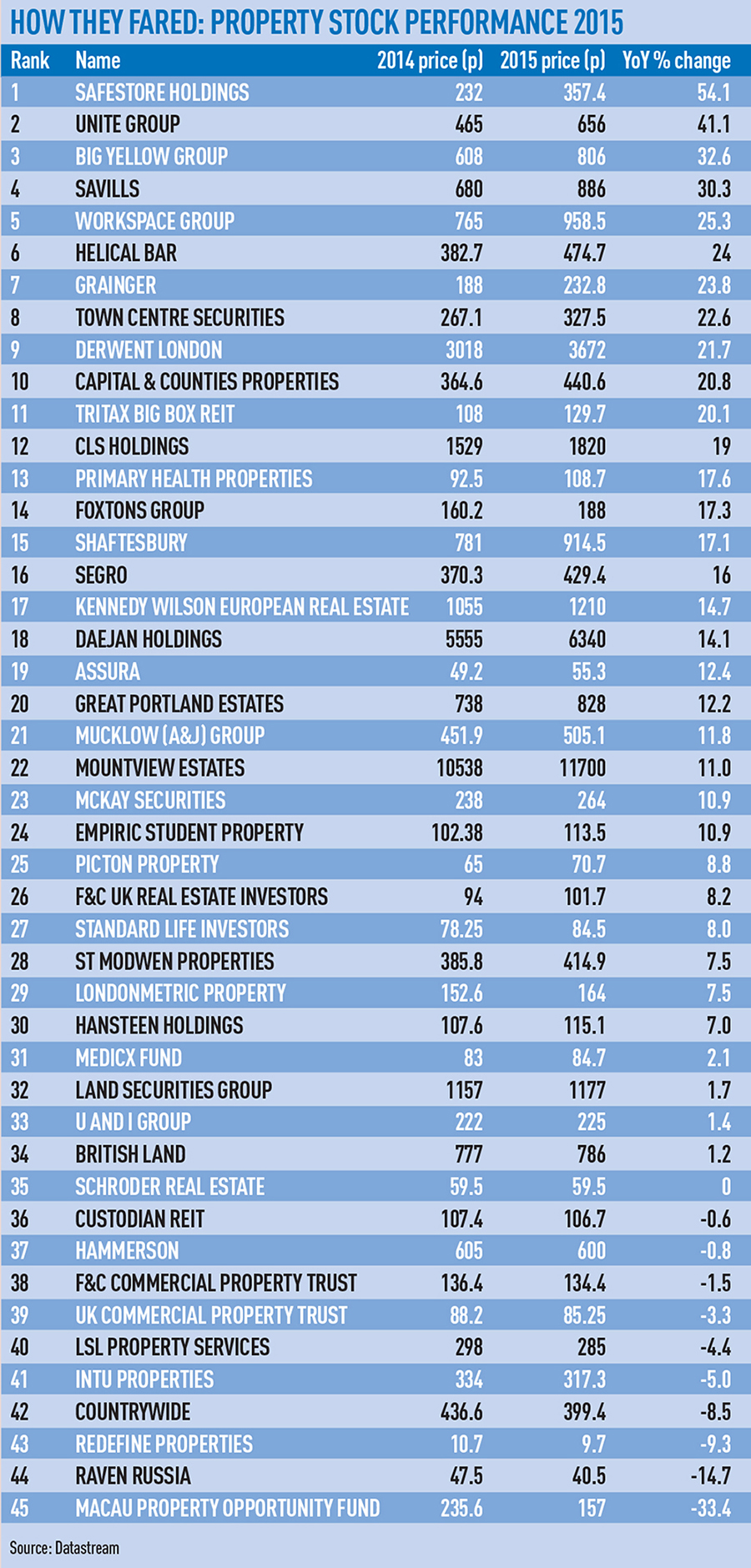

During 2015 property stocks performed spectacularly in the UK, with the sector up by 7.5% over the year compared with a fall in the FTSE 350 of 4.8%. Returns were strongest at the start of 2015 but slowed as the year went on. With the market now arguably towards the end of the cycle, the year ahead is unclear. Here five leading real estate analysts give advice on where investors should put their money in the new year.

“Income and rental growth will drive NAV”

There is little scope for further declines in yields in 2016, and that income and rental value growth will be the drivers of NAV growth, which we forecast to average around 10% over the year, down from 16% in 2015.

The best performances could come from income-focused companies, namely Picton and Capital & Regional, and those with above-average NAV growth potential: Helical Bar, McKay and St Modwen. The outlook for the residential land bank holders, Inland Homes and Urban & Civic, remains positive.

With a strategic review due from the management at Grainger in the new year, we could see an upward re-rating of the company’s shares.

John Cahill, director, real estate equity research, Stifel

“Regionally invested groups are being rewarded”

Regionally invested groups that have achieved the arbitrage between higher-yielding property assets and low-interest debt are being rewarded for the quality of their income stream and potential dividend growth (Capital & Regional +24%, Town Centre Securities +23% and CLS Holdings +19%).

The outlook remains optimistic, with the caveat of geopolitical risk and the uncertainty surrounding the Brexit referendum. We expect groups that offer operational services, such as office campuses, student halls or experiential shopping centres, rather than a passive landlord approach, will lead performance in 2016.

Sue Munden, property analyst, Panmure Gordon & Co

“Income as a growing proportion of returns will continue”

The regional players will benefit from the outflow of capital from London and the theme of income becoming a greater proportion of total returns will continue.

Other beneficiaries will be companies that fit in with other trends. SEGRO has been a beneficiary of e-commerce and it also ticks the box on the higher dividend yield.

Development in the context of most of these companies is small, but those that can enlarge on this and create meaningful value will be of interest. Capital & Counties is one that I have highlighted on that front.

Alison Watson, real estate equity analyst, Investec

“Self-storage is a key emerging sub-sector”

The sector laurels go to the niche firms run as business operators, which can generate high and sustainable cash flow.

Self–storage is a key emerging sub-sector, with Safestore (+54.1%), last year’s top performer, and Big Yellow (+32.6%) both having further growth potential in a sweet spot of rising occupancy and rental tension. These were followed by student housing firm Unite Group (+32.6%) and Workspace (+25.3%), which have both seen cashflow earnings increase rapidly through strong development pipelines, which is likely to be a continuing theme for both into 2016.

With petro-currencies under pressure, we have been cautious on prime central London residential for 18 months. However, despite this, stocks exposed to this market still turned in more than 15%, while residential investor Grainger (+24%) has shown that build-to-let has potential.

Mike Prew, managing director, European real estate equity research, Jefferies International

“Solid 8% growth in London offices”

Returns are slowing and risks are rising but we nevertheless think we are set for solid 8% capital growth in London offices.

We are most concerned about the Brexit referendum. Arguably, this is at least partly priced in as stocks have de-rated significantly. British Land and Land Securities are trading at NAV discounts that are typically followed by a period of NAV declines, which we think is unlikely and which is backed up by reliable leading indicators such as the RICS quarterly monitor.

Some of the de-rating in UK REITs is likely to be sustained, though. Not only is the return profile diminishing while risks are rising, but this sector is also offering more compelling equity stories elsewhere in Europe. Buying in Spain is now more consensual than it was a year ago but remains a source of outsized returns with an unusually asymmetric risk reward.

Bart Gysens, head of European property research, Morgan Stanley