Commercial property’s contribution to UK GDP may be far greater than previously thought, according to a major new report.

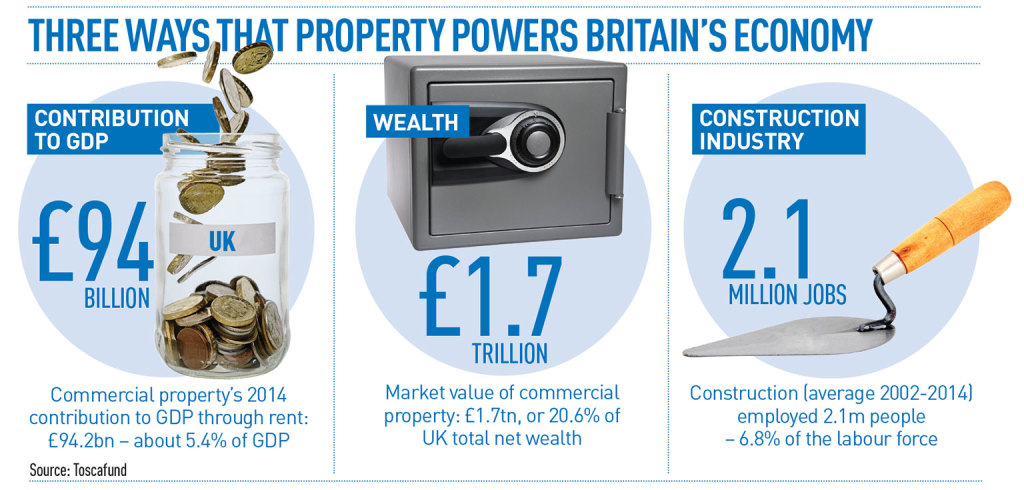

Research by Toscafund, commissioned by the British Property Federation, found that rents paid for property – the conventional national income measure – totalled £94.2bn, or 5.4% of GDP, in 2014.

It also found the market value of commercial property was close to £1.7tn, equivalent to 20% of the UK’s net wealth, and that on average 6.8% of UK workers were employed in construction.

The Office for National Statistics does not currently publish data that measures property’s specific contribution, but previous estimates based on its construction and other related indices have put it at around 4% of GDP.

However, the report found that even the income measure underestimated property’s contribution.

The research, co-authored by Toscafund chief economist Savvas Savouri and London School of Economics professor Richard Jackman, takes account of property’s role in creating value in a range of sectors and broadens the definition of commercial property to reflect all income-producing buildings such as universities and rental housing.

The findings, which will be used by the BPF to lobby government, will raise awareness of the importance of the sector and the need to tax it proportionately, said BPF chief executive Melanie Leech.

Savouri said property should no longer be treated by the government “like an ATM”.

• To send feedback, e-mail Louisa.Clarence-Smith@estatesgazette.com or Tweet @LouisaClarence or @estatesgazette