Can Dover progress from a place to pass through to a destination in its own right? Claire Robson assesses its multi-million pound development projects

Despite being one of the UK’s most strategic locations, Dover has struggled to fulfil its potential. Millions of lorries, ferry and cruise passengers arrive there every year, yet the town itself has been largely overlooked, and perceived as little more than somewhere to pass through.

When pharmaceutical giant Pfizer closed its European headquarters there in 2011 with the loss of 2,000 jobs, Dover hit a new low. The site was made an enterprise zone and a year later the site’s new owner, a Palmer Capital-backed consortium, announced it planned to develop Discovery Park, a scheme comprising 2.8m sq ft of laboratory and office space. Eyebrows were raised.

When pharmaceutical giant Pfizer closed its European headquarters there in 2011 with the loss of 2,000 jobs, Dover hit a new low. The site was made an enterprise zone and a year later the site’s new owner, a Palmer Capital-backed consortium, announced it planned to develop Discovery Park, a scheme comprising 2.8m sq ft of laboratory and office space. Eyebrows were raised.

“It was certainly a leap of faith,” says Discovery Park managing director Paul Barber. “Dover has traditionally been seen as a place people go through rather than go to. At the outset London agents declined the opportunity to get involved because they did not want to be associated with something they believed would fail. We proved them wrong.”

Today, the 200-acre park is the largest science and technology facility in Europe. It is already home to 125 tenants employing close to 2,500 people. Occupiers range from tech start-ups to global pharmaceutical names such as US genetics specialist Mylan.

Now 74% of Discovery Park has been let, Barber hopes the scheme will be fully occupied within the next three years. Future plans include up to 1.3m sq ft of production space, together with up to 500 new homes.

“Discovery Park has brought recognition that Dover can attract major occupiers,” says Dover District Council’s head of inward investment, Tim Ingleton. “Its success is testament to the strength of local public and private sector partners working together to get development off the ground.”

Ingleton hopes investors will start to see the town in a new light. He believes a clear vision for growth from the local authority, backed by the early adoption in 2010 of Dover’s Local Development Plan, is starting to bear fruit.

It has become far easier to challenge perceptions since the High Speed 1 rail link cut the journey time to London to just 67 minutes. A town seen by many as being out on a limb is now within commutable distance to London.

“Getting HS1 into Dover has really helped position it and attract occupiers,” says Clive Lynton of developer Bond City. It has begun enabling works in Dover town centre on a 120,000 sq ft retail and leisure scheme, St James Dover. Due to complete in spring 2017, it is 70% prelet, having attracted Marks & Spencer, Cineworld, Next, Travelodge, Frankie & Benny’s, Bella Italia and Nando’s.

Lynton is enthusiastic about the town’s ability to capture more retail spend, be it an increase in visitors south of the scheme as a result of the Port of Dover’s ambitious expansion programme (see box), or new housing to the north.

Dover’s Local Plan allows for development of a further 14,000 homes. Work has begun on an urban extension of Whitfield which will eventually incorporate 5,750 homes. Meanwhile, three housing projects are under way in Deal and at the beginning of January the government announced it would directly commission the building of 500 homes at Dover’s Connaught Barracks.

As well as helping address local housing need, it is hoped the projects will appeal to those working in London lured by a coastal home an hour’s commute from the capital.

Yet whatever progress the town has made, it can still be difficult to make commercial development stack up.

Kent developer Quinn Estates is involved in a number of residential and commercial schemes around Dover in areas such as Deal and Hammill.

“We have seen some uplift in rents, but there is still a viability gap which we have had to overcome by making our schemes mixed use,” says Quinn managing director Mark Quinn.

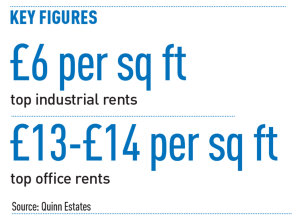

He adds: “Office rents are around £13-£14 per sq ft and need to increase another £4 per sq ft to make pure office development viable. Similarly, new industrial space goes for around £6 per sq ft and needs to move to £7 per sq ft.”

Quinn says Discovery Park has been a huge success, but the packages the enterprise zone has been able to offer occupiers have meant that until it is full, any new office schemes in the area will struggle to compete.

While great strides have been made, there is still work to be done in improving Dover’s image and boosting demand from investors and occupiers alike.

For Dover Council’s Ingleton, priorities for 2016 include maintaining momentum at Discovery Park, the construction of St James Dover and early infrastructure works to facilitate port expansion.

Also, challenging the notion that Dover is disconnected remains an ongoing task. Keeping Kent accessible has not been easy in recent times and images of chaos on Dover’s roads as a result of Operation Stack have done little for the town’s reputation.

Operation Stack is implemented by Kent Police to manage freight traffic when there are delays crossing the channel. Junctions 8 to 11 of the A20 effectively become a lorry park as it is temporarily closed to all other traffic.

Operation Stack is implemented by Kent Police to manage freight traffic when there are delays crossing the channel. Junctions 8 to 11 of the A20 effectively become a lorry park as it is temporarily closed to all other traffic.

Last summer, strikes in Calais coupled with attempts by migrants to reach the UK meant the operation was triggered for a staggering 32 days, causing gridlock for businesses, commuters and tourists.

In his Autumn Statement, chancellor George Osborne pledged a £250m package to find a solution to Operation Stack by building an off-road lorry park to be used whenever delays occur. Two sites – one west of Stanford, near Hythe, and one off junction 11 of the A20 – have been shortlisted and a public consultation is now under way.

Ingleton welcomes the news but urges it must be coupled by a broader look at traffic management. He also supports a push for a third Thames crossing to further ease congestion for hauliers heading to and from the Port of Dover.

“It is great to see cranes over the town again,” he says. “It is going to be a busy year for construction activity and we want everyone to know Dover is open for business.”

Thinking big

The Port of Dover is set for major expansion. Following its recent investment programme to refurbish and improve access to its Eastern Dock, the port is about to embark on its Dover Western Docks Revival. Its centrepiece, a £120m cargo terminal set to double capacity, will complete in late 2017, with further phases providing a marina and waterfront development, together with a logistics park.

The new marina, due to complete around 2019, will provide a key regeneration opportunity to transform non-operational land for retail, leisure and commercial use. Linking with the St James Dover town centre retail scheme, it is hoped the new waterfront offer will persuade the 13m passengers Dover handles every year to spend more of their time and money in the town.

Savills has been appointed to advise on the opportunities presented by DWDR. Head of commercial research Mat Oakley, says: “You cannot simply assess the quality of Dover’s catchment by looking at drive times. You have also got to factor in tourists and the millions of people travelling through the port.”

He adds: “There is a huge opportunity to start catering for those people. The more you look into it you realise the challenge is not about persuading people to come into Dover, but giving them a reason not to hurry through.”

The port plans to work closely with private developers to realise its vision and has signed an agreement with Bride Hall Real Estate to begin work transforming the waterfront.

Bride Hall managing director Nick Desmond says there is potential to develop up to 500,000 sq ft of mixed-use waterfront over the next 10 years.

The developer is looking to secure early wins by offering A3 convenience for port passengers, converting some listed waterfront buildings for residential use and possibly attracting a hotel.