Demand for residential assets in December hit a three-month high, according to the RICS Residential Market Survey.

It said the growth in demand was most likely the result of planned changes to stamp duty for buy-to-let investors, prompting them to rush to secure premises before the changes are implemented on 1 April this year.

“The housing market has experienced an unusually buoyant December,” said RICS’s chief economist Simon Rubinsohn. “Potential buy-to-let investors are looking to pick up properties before the increased stamp duty levy comes into force in April.

“If that is the case, then we can expect to see the housing market heating up further over the next few months,” he added.

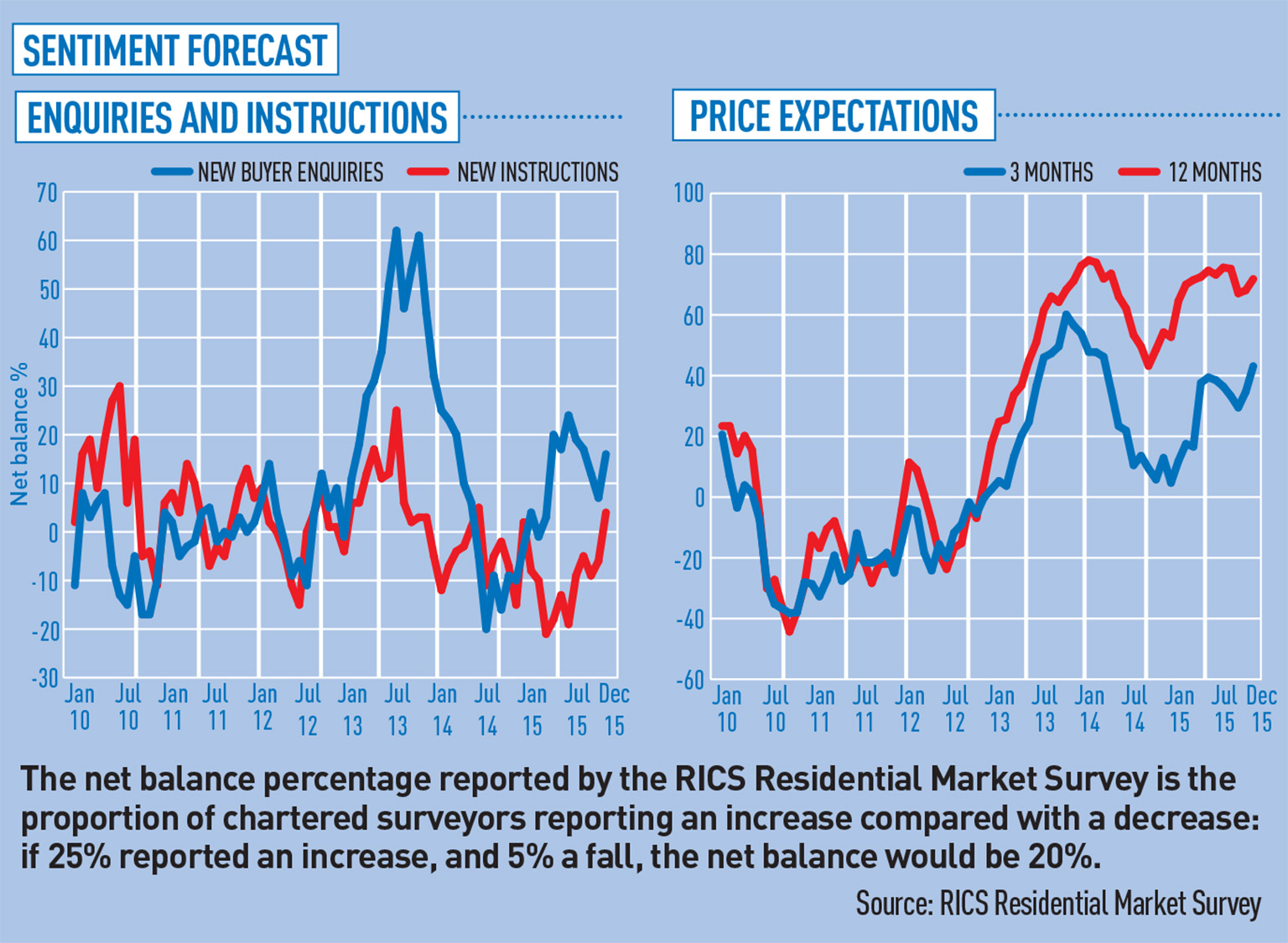

Since measures were announced in November, there has been a 16% rise in new buyer enquiries.

However, for the first time in January, the survey also reported a 4% net increase in instructions to sell properties, a sign of increasing supply.

Although there continues to be a demand/supply imbalance, with enquiries rising at a faster pace than new instructions for the 11th consecutive month, for the first time in two years more areas of the UK reported a rise rather than a decline in instructions.

Sentiment in the survey remains robust regarding future price growth, with almost half of respondents still predicting house prices to rise over the next 12 months. In London and the South East, where 57% and 62% of respondents respectively said the market was expensive and affordability stretched, prices are still expected to rise by 4.8% and 5.2% per annum over the next five years.

To send feedback, email alex.peace@estatesgazette.com or tweet @EGAlexPeace or @estatesgazette