A further 1.1m households will be renting privately in the UK in the next five years, according to research from Savills.

A further 1.1m households will be renting privately in the UK in the next five years, according to research from Savills.

The projection is based on data from the English Housing Survey, which says that over the past 10 years, 17,500 households have entered the private rented sector every month. But while demand continues to grow, government policies are expected to slow supply from private investors.

Savills says the double whammy of mortgage regulation and stamp duty taxation will slow the appetite of buy-to-let investors to expand their portfolios.

The institutional private rental sector is set to benefit massively from this growth in renters, but at present rates of building has no chance of addressing current demand.

“Policies that curtail buy-to-let are going to limit the number of new rental units and this is likely to inflate rents,” said Jacqui Daly, director of residential investment research at Savills.

“This presents an opportunity for institutional investors, though the market cannot scale up that quickly. Given that there are shortages of rented housing already, we need at the very least for institutional build-to-rent deals to replace buy-to-let investment.”

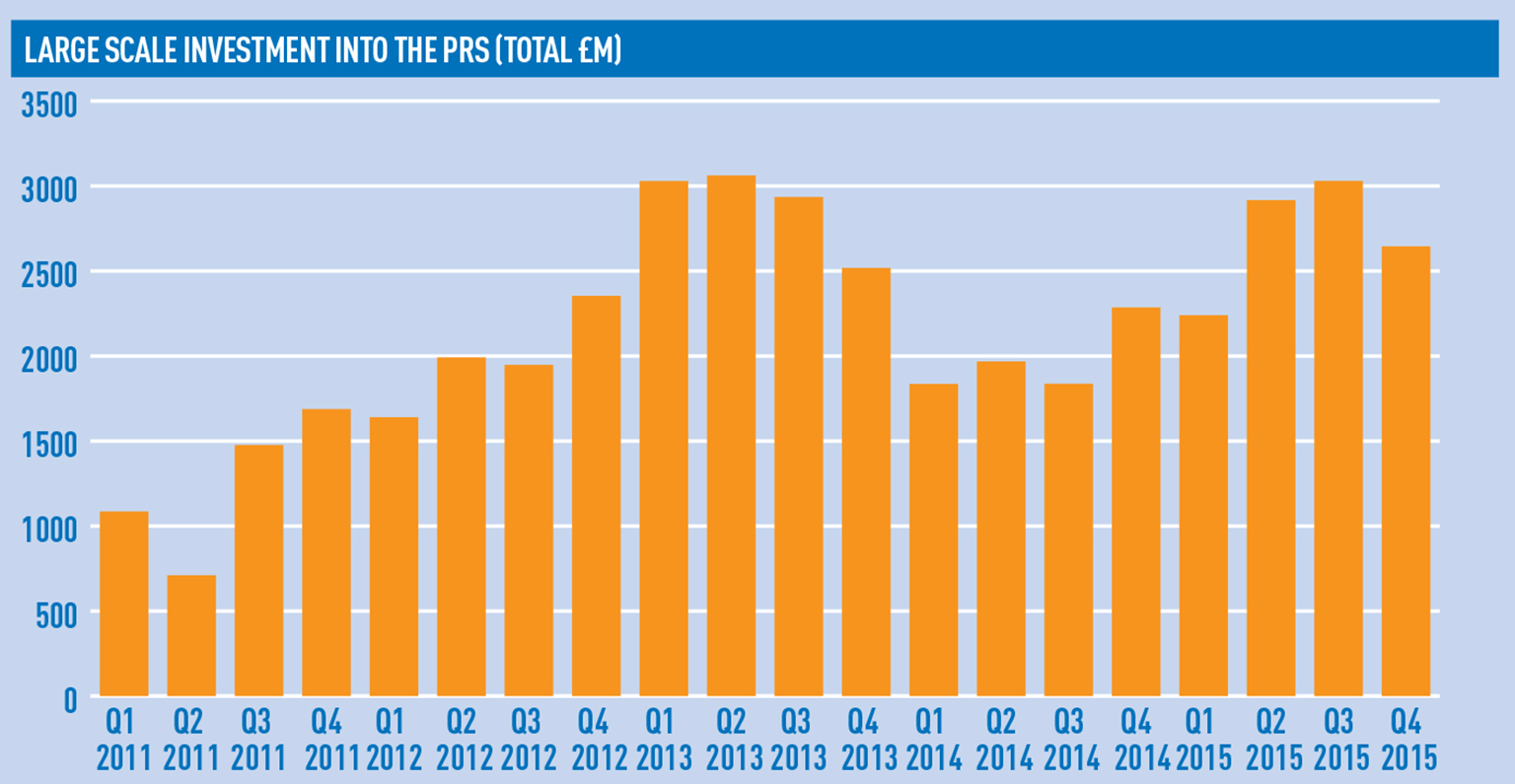

Savills said that rolling large-scale investment into the PRS reached £2.6bn in 2015, an increase of 57% since 2011. However, the thousands of units being created represent a fraction of total demand.

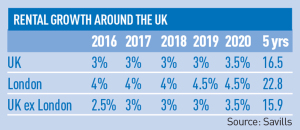

Rents are predicted to rise by 16% in the sector over the next five years.

To send feedback, email alex.peace@estatesgazette.com or tweet @EGAlexPeace or @estatesgazette