Recent figures have revealed a 39.6% increase in the turnover of the UK restaurant industry.

Recent figures have revealed a 39.6% increase in the turnover of the UK restaurant industry.

The numbers are significant, with a rise from £15.5bn to £21.6bn. So what has driven this? We know that consumer spending has been tight, the UK population has not increased significantly and property costs have continued to rise (be it in terms of utility costs, rents, business rates or fit-out costs).

So is this growth sustainable, sensible and something that ultimately could lead to oversupply, price cutting and therefore fierce competitive headwinds which not all will survive?

In my view, the current growth is not sustainable and is starting to mirror the “slow car crash” that we have seen in the supermarket space. Forewarned is forearmed, as investors in La Tasca and Tragus, who exited the market last year, will testify.

There are a number of new operators along with established operators on this growth path. Names include Franco Manca, Chilango, Wahaca, Honest Burgers, Smashburger, Ed’s Diner, Bill’s, Frankie & Benny’s, Byron, PizzaExpress, Prezzo, Five Guys, Tortilla and Nando’s.

Tipping point

So why do I think we have reached a critical point with this market? The main reason is supply outstripping demand as well as fierce competition for locations, which ultimately leads to over-renting.

In addition, we have seen the impact of the living wage rising from £7.85 to £8.25 per hour; significantly higher than the national minimum wage of £6.70 per hour, and the new minimum wage premium for over 25s of £7.20 per hour, which will come into force across the UK in April 2016.

Many existing and new food operators are talking of significant growth which, in part, is being driven by a hot investment market that is very much growth-driven. A typical model is to acquire a growing and popular small chain and then expand from, say, five outlets to 50 – and then sell it on the basis of the growth potential.

The next owner then looks to double this number and then sell on again based on a growth agenda. At some point the steam runs out and someone is left with too many outlets which are not delivering the sales and profitability that they had modelled. This is nothing new, as the cyclical nature of economics has shown us.

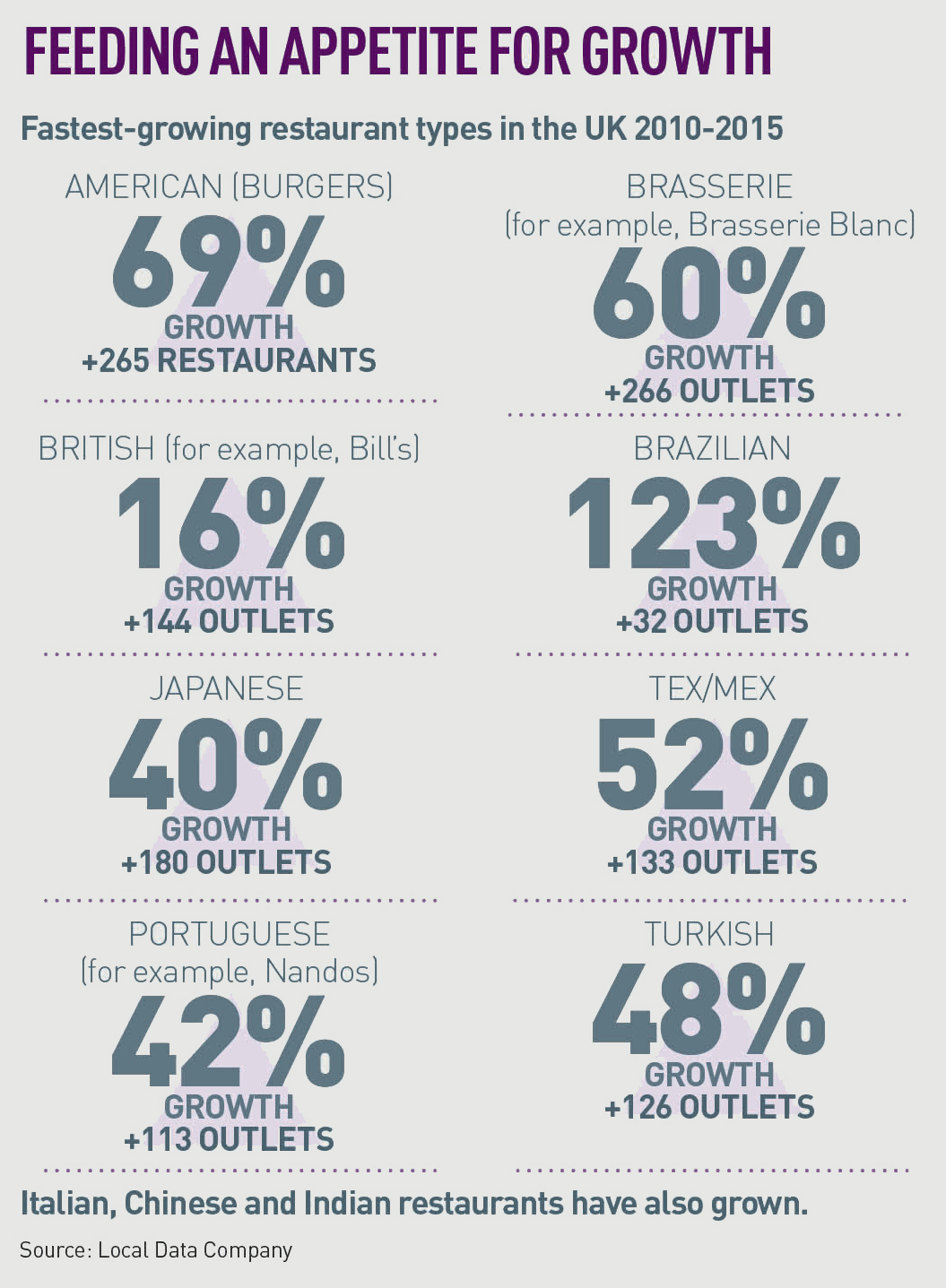

So where is my evidence of this potential “car crash”? Analysis of the LDC data gives me the evidence base to my thoughts above. At the top line, the net increase in restaurants (this excludes coffee shops, fast food takeaways, sandwich shops and fish & chip shops) in the last five years has been 20%, which is a net increase of 14,000 new restaurants across Britain.

To put this in context regionally, the East Midlands has seen a 57% growth in burger restaurants in past 12 months, with Grantham, Newark, Towcester and other smaller places seeing increases in their burger offer.

What are your thoughts? Is this growth sustainable? Can prime centre rents continue to grow as they are? And remember, most of these restaurants, unlike shops, sign 25-year leases and on average spend £500,000 to £1,000,000 on fitting out these restaurants.

Matthew Hopkinson is director at the Local Data Company