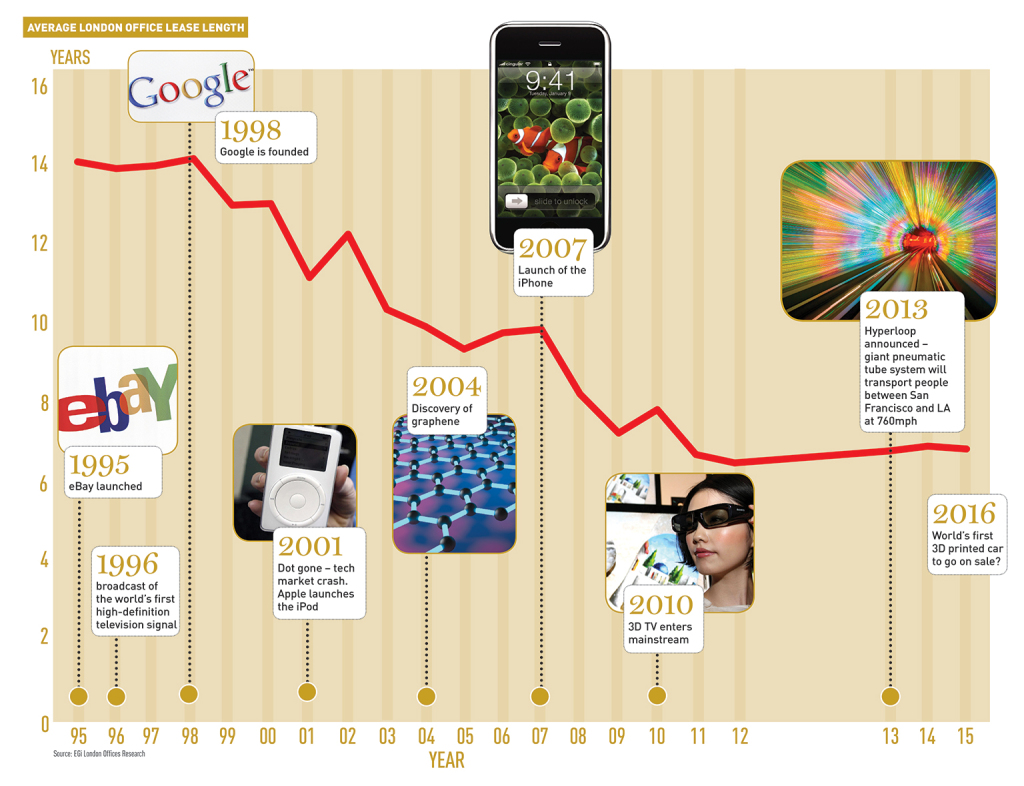

Fuelled by tech innovation and the sector’s need for flexibility, commercial leases in the UK capital have halved in the past two decades. But is that enough to attract the most agile of tenants?

Fuelled by tech innovation and the sector’s need for flexibility, commercial leases in the UK capital have halved in the past two decades. But is that enough to attract the most agile of tenants?

US tech giant Yahoo claims it is struggling to find a London office due to the capital’s lengthy leases. And when a tech unicorn (any company valued at more than $1bn (£691m), it is time for the industry to listen. EG took to the data vaults to find out what has happened to lease lengths over the past two decades.

Since 1995, the average lease length in London has halved, according to figures from EGi’s London Offices Research. Shrinking leases have become a fact of life for London landlords, but the speed of descent might surprise a few. While rents have quadrupled, lease lengths have slipped from an average of 14 years in 1995 to less than seven years today.

That fall is now starting to show signs of plateauing, with agents reporting that leases are moving in landlords’ favour. But when giants such as Yahoo claim that London is out of kilter with the rest of the world, landlords may have to accept that, even for the unicorns, a long lease is likely to become little more than a myth.

Graham Shone

Senior analyst, EGi

If you asked experts in the field to choose the occupier sector that has influenced the London office market the most over the past few years, I wonder how many would respond with “tech”, “media”, or “TMT”.

Looking at the statistics for the past 20 years, there is a clear indication that some elements of the market follow the wider national economic trend. Crashes have been accompanied by dips in aggregate rental tone, boom times by rental growth. Nothing surprising there – nor in the reversal of this trend when it comes to incentivisation, which declines in a stronger market.

That strength is showing now – with incentives at a 13-year low and rental tone as high as it has been since EGi began monitoring the market, due in no small part to the ongoing office supply shortage.

Average deal sizes lifting upwards in recent years is interesting. The strangle on office supply in central London means that overall leasing figures are increasingly underpinned by large prelets: as much as a quarter of all space taken in Q4 2015 was prelet.

However, we have not seen an uplift in lease lengths, which we would expect to accompany such a fiercely competitive scramble for space – and particularly one underpinned by those prelets (traditionally deals which see longer leases signed).

Average lease terms have only moved downwards since the mid-1990s, as businesses continue to recalibrate their requirements for physical space in the quest for increased flexibility. While it would be reductive to pin this entirely on the influence of one sector, TMT occupiers cannot be ignored.

You have only to look at the changing composition of London office occupier types over the past few years to get a grasp of the how the sector’s importance has grown. Tech operators occupy 5.3m sq ft more across the capital than they did at the start of 2010 – boosted in no small part by companies seeking shorter-term lets and flexible lease conditions.

With such metamorphoses, will we perhaps see these general trends move further towards a pure reflection of a tech occupier rather than the diaspora of occupier types across central London? TMT. [Time Might Tell].