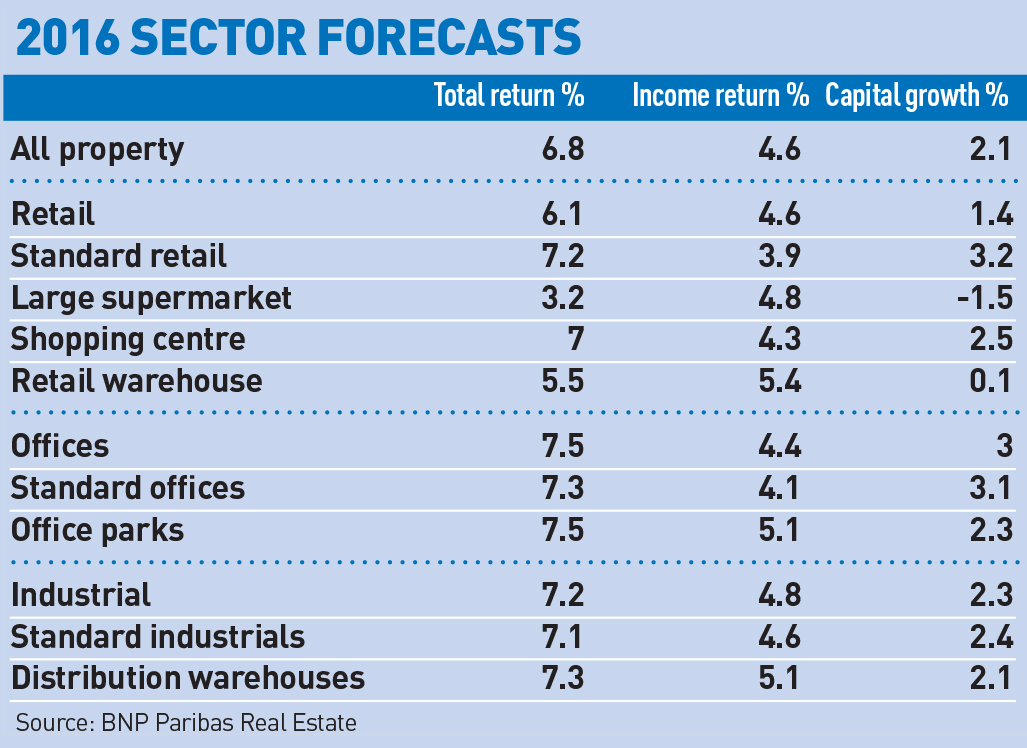

UK real estate total returns are set to drop to 6.8% in 2016, according to forecasts from BNP Paribas Real Estate.

This marks a significant decline on the 13.1% recorded in 2015 by IPD.

The forecast takes into account the cautious start to the year seen in financial markets. The advisory firm is concerned by the volatility in the Chinese economy and the trajectory of monetary policy in the UK and US.

According to Simon Durkin, head of research at BNP Paribas Real Estate, the forecast accounts for the increased risk being observed in the market, and the view that the market reached its peak last year in terms of investment, and the year before for capital growth.

John Slade, UK chief executive at BNP Paribas Real Estate, said that the market fundamentals for UK real estate remained strong.

“We do see a number of pollutants that are clouding sentiment in financial markets and causing some pessimism, and there is a danger that this pessimism becomes self-fulfilling,” he said.

“At a macro level we see record employment and strong wage growth, but while fiscal and monetary policies remain sensibly synchronised, both the chancellor and governor of the Bank of England are appropriately cautious.”

Laurence Mutkin, global head of G10 rates strategy at BNP Paribas Real Estate, is forecasting UK GDP growth of around 1.75% in 2016 and around 2% in 2017, which, coupled with “unthreatening inflation” pointed to “a shallow trajectory of policy rate rises in the UK and US, and further policy easing in the euro area and maybe elsewhere”.

He added: “The market now expects no UK rate rise for a minimum of two years, and even discounts some chance of a rate cut in the interim.”