Less than 48 hours after touching down in London from Shanghai, Jacob Loftus is sitting in one of the ground-floor break-out areas of the City’s Alphabeta building. He is talking about the circular escalators incorporated into a Chinese department store complex, pictures of which he shared on Twitter. But Resolution Property’s head of UK investment did not travel halfway around the globe to go shopping. He was meeting his new counterparts following Chinese conglomerate Fosun’s agreement to take a majority share in Resolution last summer.

Less than 48 hours after touching down in London from Shanghai, Jacob Loftus is sitting in one of the ground-floor break-out areas of the City’s Alphabeta building. He is talking about the circular escalators incorporated into a Chinese department store complex, pictures of which he shared on Twitter. But Resolution Property’s head of UK investment did not travel halfway around the globe to go shopping. He was meeting his new counterparts following Chinese conglomerate Fosun’s agreement to take a majority share in Resolution last summer.

The year 2015 was one of change for the London-based property investor-developer. Fosun’s arrival came at the same time as the departure of long-time partner Robert Wolstenholme, who joined Resolution four years after it was founded by Robert Laurence, though Wolstenholme still retains links with the company as a consultant. The changes have helped propel Loftus through the ranks since he joined six years ago. Just turned 28, he does not seem fazed by the responsibility of a senior position. Polite and enthusiastic, there is just a glint of the steely eyed determination necessary to close deals in one of the world’s hottest property markets.

And Loftus is expecting to be doing those on a larger scale now Fosun is on board. He shies away from specifics, but suggests that future London purchases will be at least £100m. That means considerably chunkier buildings than Resolution has been used to recently. The company has made a name for itself turning around buildings in peripheral locations and rethinking the space, primarily for office use.

Loftus cut his teeth on projects like the Bonhill Building, 15 Bonhill Street, EC2. The 110,000 sq ft property, purchased in 2012 for £33.1m, was reborn as new-generation workspace and around one-third was promptly leased to tech sector darling Mind Candy, before being sold on in 2014. The £43m, 220,000 sq ft Alphabeta Building, EC2, was a larger variation on the same theme. Purchased last summer by Sinar Mas Land, it is fully let to occupiers including We Are Social and Open Table.

In 2013 Resolution purchased the former Wickhams department store block in Whitechapel for around £10m and redeveloped it as an office media hub with ground-floor retail. The 90,000 sq ft refurbishment completed in 2014 and let quickly to tenants including Central Working. Other projects already in the pipeline include a mixed-use scheme in west London and another office rejuvenation in Whitechapel (see box).

Loftus is coy about the details of future schemes. He will not be drawn on the purchase, reported by Estates Gazette last December, of Thomas More Square from Land Securities for around £300m. The 1980s-vintage 566,000 sq ft office campus would be on a larger scale than recent Resolution projects.

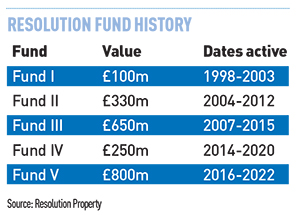

Loftus also won’t confirm whether Thomas More Square is the debut investment for its fifth fund (see box). Understood to have a value of around £800m, the fund will have Fosun as its majority investor, though, again, no hard numbers have been revealed.

While Resolution expects to continue scouring the capital for refurbishment opportunities, the bigger lot sizes resulting from the Chinese cash injection may make things trickier for Loftus. “It limits the scope of opportunities you can identify in central London,” he admits.

Loftus expects to be buying in the capital for at least the next couple of years. Chinese investors retain a strong appetite for the city, and CBRE last month confirmed that it expected the total invested by Chinese players into London to exceed the 2015 total of around £3bn. Loftus says: “We are in a low interest rate environment and prime yields are still within the long-term band, so are sustainable. Cutting-edge office workspace will continue to be a central theme for London.”

He started his property career at the tail end of the last recession. Has that shaped his approach when considering potential deals? “It has certainly kept my feet on the ground,” he says. “In my first six months at Resolution I don’t think we did a single deal. A big part of my learning curve was learning how to work out distress.”

Exactly how financially successful Resolution has been with its London refurbishments is hard to judge, but it sold both Alphabeta and the Bonhill Building for roughly double what it paid for them, achieving yields of 4% and 4.7% respectively. Take construction costs into account and it is clear that the company still made healthy gains for its investors, although it won’t confirm whether it has hit its 20% returns targets. While Loftus is bullish about London in general, is he not bothered about buying in the fringes, which historically have been much harder hit in a downturn? “I am not concerned,” he says, suggesting that rental convergence is already happening.

He is similarly unfazed by the prospect of Brexit: “I am not sure it will really affect London real estate should it happen, as I don’t think foreign investors will massively divest. The uncertainty is more of a damaging factor.”

Loftus may be firmly entrenched in Resolution for now, but he is clearly one to watch. Brought up in St John’s Wood, he studied in the US, graduating from Boston University with a politics and international relations degree. An MSc in real estate from South Bank University followed once he had landed a job at Resolution. Originally there for a two-week internship, a staff shortage saw him continue to turn up at the office until he was offered a job.

Although tipped as a next-generation figure, Loftus is reassuringly old-school in some ways: “Real estate is very much a personal relationship business. Building a relationship and connecting with someone has ever more meaning,” he says.

Resolution in numbers

Founded 1998

Number of staff 25

Current confirmed redevelopments/refurbishments in London 2

Amount of London offices redeveloped/refurbished 2011-2016 800,000 sq ft

Amount of London offices leased 2011-2016 400,000 sq ft

Number of assets held in London 1998-2016 15

Current preferred lot size £100m+

Current London developments

Location 45 Whitechapel Road, E1

Purchase price £32.5m

Current size 65,000 sq ft

Redevelopment plans Current consent for 217-bed hotel being revised to 90,000 sq ft office-led refurbishment, plus residential. Planning application expected March 2016.

Old Gramophone Works (pictured)

Old Gramophone Works (pictured)

Location Notting Hill, W10

Purchase price £18m

Current size 0.6 acres on canal-side

Redevelopment plans 150,000 sq ft scheme comprising 90,000 sq ft creative-media style offices, 30,000 sq ft loft apartments, art galleries and music studios. Planning application expected April 2016.