Agents pick the most significant Deals (for the six months to the end of January 2016)

The Mailbox, Birmingham

The Mailbox, Birmingham

Type of deal Office letting

Landlord Brockton Capital

Tenant Advanced Computer Software (ACS)

Size 45,000 sq ft

Rent £26 per sq ft

Chosen by Theo Holmes, associate director, CBRE

The leasing to Advanced Computer Software (ACS) is important for Birmingham, demonstrating confident inward investment. The Sunday Times Top Track 250 company is consolidating a number of regional offices into a single site at The Mailbox, bringing some 400 jobs into Birmingham. This deal forms part of a major recruitment drive for the company – and is also part of a strategy aimed at fostering more collaborative working. The move reflects a growing trend among corporate occupiers as they seek better value from their office occupancy costs. For ACS, the opportunity to accommodate its workforce on one floor – at 45,000 sq ft it represents the city’s largest commercial accommodation on a single floorplate – to have its own-branded front entrance, be close to New Street Station, and be part of the vibrant 24/7 mixed-use environment offered by The Mailbox, were all major factors in its decision-making process.

One Brindleyplace, Birmingham

One Brindleyplace, Birmingham

Type of deal Investment

Vendor Trinova Real Estate

Purchaser GLL Real Estate Partners GmbH

Size 68,000 sq ft

Price Undisclosed

Chosen by Matt Long, director, Colliers International

The off-market acquisition of One Brindleyplace by GLL Real Estate Partners last November was significant for the region because it represented yet another strong vote of confidence from a high-profile overseas investor in the strength of the Birmingham office market as a safe haven for funds. The building boasts a long unexpired lease term to Deutsche Bank which made it an even more attractive proposition. The deal is understood to have represented a net initial yield in the region of 5.25%, which further demonstrates the escalating property values in Birmingham city centre. Investor interest in the city continues to grow and with Hines and Lone Star placing several buildings in the Brindleyplace estate on the market just five years after they acquired the portfolio, such interest is expected to continue. I’m sure we will see more investors from across the globe pinpoint Birmingham as a thriving business destination in which to invest.

Parkrose Industrial Estate, Middlemore Road, Smethwick

Parkrose Industrial Estate, Middlemore Road, Smethwick

Type of deal Investment

Vendor First Investments (acting for Braeside Ltd in administration)

Purchaser Mint Property

Size 20 acres (including 10 acres of developable land)

Price £2m-plus

Chosen by Edward Siddall-Jones, managing director, Siddall JonesThis deal is significant as it provides further proof of a shift towards speculative development in the region, which until recently had been fairly stagnant. Now, though, it is enjoying a bounty of large industrial requirements which has fuelled developer confidence and a noticeable increase in values. Mint plans to spec build a selection of warehouse units from 30,000 sq ft. The Black Country has seen a renaissance as prime Birmingham prices have pushed occupiers into the regions to take advantage of lower values and good connectivity. This has been evidenced recently by the first prelet at Parkrose which has seen Loxam Access agree to move from Birmingham city centre. Further D&B space is currently in solicitor’s hands and it is becoming evident that there is a strong market for warehouses over 30,000 sq ft in this location. With a limited supply in the area we are, therefore, expecting a fruitful 2016.

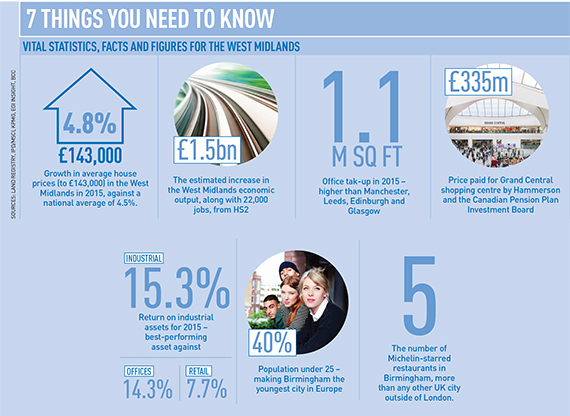

Birmingham blooms

Birmingham blooms

Two healthy signals for the office market emerged in early 2016. Birmingham Office Market Forum revealed record take-up for 2015 of nearly 1m sq ft. Development was also at its highest for 13 years, at almost 1m sq ft, said Deloitte.

Nazir promoted

Waheed Nazir, Birmingham city council’s director of planning & regeneration, was appointed acting strategic director for economy for the next year.

Student granted

In Coventry, Barberry Developments and the city council unveiled plans for a 1,116-bed student scheme – one of the largest in the Midlands. In Leamington Spa, Alumno Developments gained planning for a 187-bed student scheme.

Assay space

TCN UK revealed its plans to transform the Assay Building in Birmingham’s Jewellery Quarter into space for the creative and knowledge sectors.

Dudley at the double

Dudley’s town centre received a boost – first with consent for a Stoford-built hospitality-led scheme, followed by Avenbury’s purchase at auction of the ageing Cavendish House to make way for a retail & leisure scheme.

Stores on the shelf

Stores on the shelf

Three West Midlands Brantano stores were among those left on the market following the rescue deal with Alteri – stores at Birmingham’s Fort Retail Park, Tamworth’s Jolly Sailor Retail Park and Walsall’s Crown Wharf.

EG gauges the trials and tribulations of the West Midlands property market