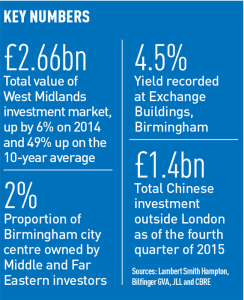

Chinese money is pouring into UK property – £2.3bn in the final quarter of 2015, most of it outside London. So why is the tap barely dripping in Birmingham?

Unlike Manchester – which scooped Beijing Construction Engineering Group backing for the £800m Airport City project and a new citywide residential partnership with Chongqing Jinstar – Birmingham has yet to see much Chinese money. A light shower of deals suggests investors have the West Midlands region in view (see side panel) but Birmingham’s share of the Chinese financial tidal wave isn’t enough to get anyone wet.

That could be about to change. Late last month PGC Capital, a private equity fund based in China, broke ground on its first development in Birmingham’s renowned Jewellery Quarter.

PGC Capital’s Jewel Court development will see the site in Legge Lane redeveloped as 77 luxury apartments for sale. Completion is due for spring 2017.

Shanghai-based PGC Capital, a new venture with links to the Wan Hai Lines shipping dynasty, aims to channel capital from Chinese state-owned and listed companies and high-net-worth individuals into UK projects that will offer the greatest returns and least amount of risk. Sectors of interest include property, energy and infrastructure, initially in Birmingham, but extending to Manchester and beyond. Although the value of the deal hasn’t been disclosed, PGC says it targets lot sizes of £30m-£50m.

Chief executive Denise Li says: “We anticipate significant returns on investment in the next five years.”

Citing the relocations to Birmingham by HSBC and Deutsche Bank, and the city’s shortfall in new housing development, Li says Birmingham was an easy choice for the firm’s UK debut.

“PGC Capital was only launched in 2014. We undertook a detailed study of several metropolitan cities in the UK before we selected Birmingham for our first project,” she says.

The reassurance provided by warm words from the public sector has also been influential – a factor, it is said, in much Chinese investment.

Says Li: “While we were visiting Birmingham at the end of January, we met with John Clancy, the new leader of the city council, who is committed to improving the housing situation.” (See p72)

Now that PGC has a pin on its map of the Midlands, Li’s focus is shifting elsewhere. “We are already in detailed discussions with other significant land owners in Manchester and Leeds with the intention of delivering similar numbers of homes,” she says.

Many hope – and some expect – this first toe-in-the-water to be followed by a tropical storm of Chinese investment.

Ben Kelly, director at JLL, is among those looking forward to the downpour. “Chinese investors have visited Birmingham, but the deals just haven’t come yet because they are still looking to place most of their resources in central London. But in 2016 we will see significant investment in the regions.”

Kelly says Manchester won deals because Chinese investors scented a strong infrastructure proposition and unequivocal public sector support – two factors that provide them with comfort. Birmingham can offer a similar mix, he says, and hints that the Curzon Street masterplan is an opportunity Chinese investors are already considering.

Kelly says Manchester won deals because Chinese investors scented a strong infrastructure proposition and unequivocal public sector support – two factors that provide them with comfort. Birmingham can offer a similar mix, he says, and hints that the Curzon Street masterplan is an opportunity Chinese investors are already considering.

Meanwhile, perils in the Chinese economy will simply push more Chinese money overseas. “We’re going to see a huge spike in capital exiting China,” he says, predicting that some of it will come to Birmingham.

The difficulty is that much Chinese investment is carried out below the radar.

Savills director Ned Jones says Chinese buyers have been flirting with Birmingham buys since late 2014, but so far their pricing has been too conservative. “When they bid, they can’t compete with the UK funds. Chinese names are said to have been on the active interest list on some high-profile sales – Snowhill is mentioned – but either did not bid, or bid low.

“To win in bidding competitions they will have to go up the risk curve – perhaps consider private rented sector, or student housing,” he says.

London agents watching Chinese investors look north say they have yet to adjust to local market conditions. Chris Bampton, director at Colliers International, says: “They just aren’t as competitive as other buyers. They just haven’t got there yet.”

However, Bampton is sure they will rapidly grasp local pricing structures.

Today Asian ownership remains a rarity in central Birmingham. In 2013 Bilfinger GVA calculated just 2% of the city core was owned by Middle Eastern investors – and put Far Eastern ownership at zero, or near to it. Three years on, senior director Jonathan Hillcox sees no reason to change those estimates.

“Chinese investors are opportunity driven. So far Manchester has had the opportunity, and they would have come to Birmingham if we’d had an opportunity for them. The result is that Birmingham’s Chinese investment is small scale, based on private wealth, but we know the bigger Chinese investors are looking at the city,” he says.

Chinese money

An unnamed Chinese investor has acquired the 50-acre student housing campus at Beaconside, Stafford. Bilfinger GVA advised on the sale. Contracts for the 350,000 sq ft complex have been exchanged and completion is due in November. The university says the purchaser plans an educational use, but will not elaborate.

There are also some signs – small ones – that lone high-net-worth individuals from China and Hong Kong are active in the West Midlands property market, looking at lots of £2m-£5m with value-added potential. Coventry and Solihull are mentioned. Gingko Tree Investments, the sovereign wealth fund, is also said to have been on reconnaissance trips but the organisation is so fabulously discreet it is hard to know if this is truth or wishful thinking.

Meanwhile, rumour is filling the investment vacuum. Chinese money was said to have been behind M7 Real Estate’s £38.3m acquisition of The Green, a 47-acre regeneration project in Solihull. M7 has acquired the site on behalf of M7 Real Estate Investment Partners IV, a newly formed Jersey-based investment company. But director Teresa Gilchrist says Chinese money was not involved.

The big sales

Chinese buyers arrive at a hectic time for the city’s investment scene. Lambert Smith Hampton says that £2.66bn was transacted in 2015, while JLL estimates that £400m of transactions are in progress. Yields have plunged to 4.5% at mixed retail and leisure scheme Exchange Buildings, Birmingham. The 25,800 sq ft block changed hands for £40m when Aviva Investors sold to Orchard Street last month.

Key deals boosting the figures included the £307m sale of the NEC and the £140m purchase of Colmore Plaza by Ashby Capital.

But two big deals did not feature in the list – and these may indicate changing sentiment in the market.

Tristan Capital Partners is understood to have twice failed to sell the Cube, after acquiring it for £37m in 2012, to TH Real Estate, most recently at an asking price of £55m. Pricing and then the complexities of tenure are said to have deterred a deal at the 110,000 sq ft mixed office, retail, residential and leisure scheme.

CBRE and Capital Real Estate Partners advised, the latter confirming it is off the market. Birmingham sources suggest a sale as part of a portfolio disposal is now the most likely option. TH Real Estate would not comment.

The £285m sale of Three, Four, Five, Six and Nine Brindleyplace has reportedly collapsed. A gulf-based buyer was said to be inching towards exchange of contracts for the 638,000 sq ft portfolio. The long-awaited sale by Lone Star and Hines – via a corporate vehicle – was unusually complex. The jv has decided to retain the assets. It is believed the drop in oil prices, is affecting some Middle Eastern buyers. CBRE is advising, but was not available to comment.