The European retail real estate market ended 2015 on a high, with investment volumes surpassing the 2007 peaks. Consumers were also feeling good, having benefited from the mix of rising wages, near-zero inflation and price deflation giving UK households more buying power. And, despite forecasts of a bloodbath on the high street, retailers also had a decent end to the year, with Christmas trading statements revealing positive sales.

Delivering our results to the market last month, we were pleased to demonstrate Hammerson’s continued strong growth against this backdrop. And despite a slightly bumpy start to 2016, characterised by volatility in global markets and uncertainty around the UK’s relationship with the EU, consumer fundamentals are strong. This is demonstrated by data from our latest Hammerson Retail Tracker, which showed a 4.2% increase in our UK shopping centre sales in the first seven weeks of the year.

However, I believe the sector is now entering a different environment: following a period over recent years when yields tracked interest rates lower, the consensus is that rates will now remain low for longer and yields are expected to stabilise. As a result, income growth will be key to delivering good performance.

In order to achieve this, the focus will shift to superior asset management strategies. This is particularly important in a retail environment where the market is beginning to question how long consumer confidence will last.

For the retail real estate market, the strategy is simple and I think easily identified by a few principal criteria. Fundamentally, owning the right real estate in the right locations is paramount.

First, let’s consider selecting the right market and finding segments where a leading position can be achieved. This might be based on geography or it might be segmental. Economic and consumer fundamentals are clearly important at a macro level, but drilling down to understand the performance of individual cities is crucial. For us, the fundamentals of Birmingham are just as important as those of the UK as a whole.

Next, the asset itself must have characteristics that match it to the latest consumer trends. With an endless array of brands, channels and formats, shoppers are gravitating towards experience, convenience and luxury. And this year, as the traditional pure-play, online brands continue to recognise the value of physical presence, this will change the way in which we incorporate these offers into the retail experience.

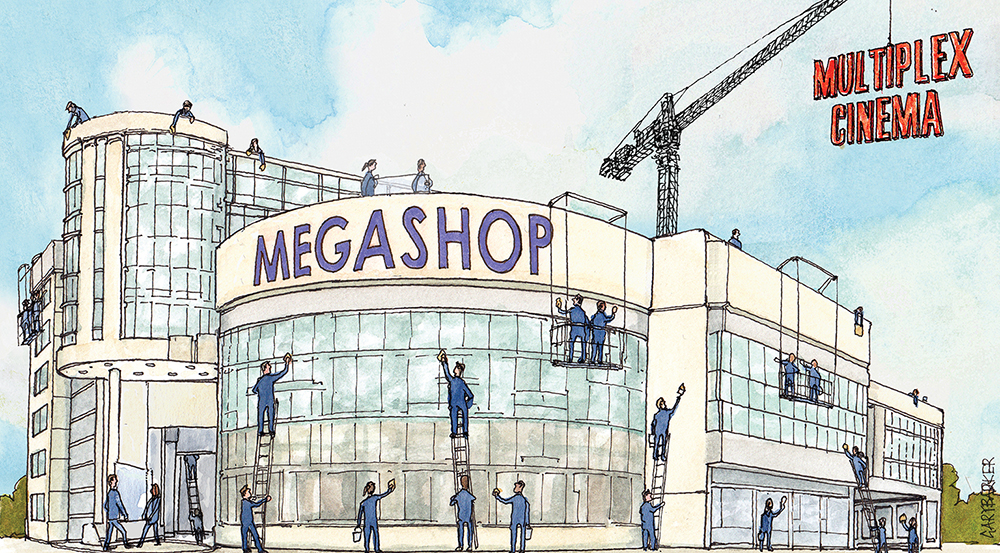

The final criterion is to identify asset management opportunities, where landlords can apply specialist expertise and initiatives to add value. This might include the basic hygiene factors, such as improving customer service facilities, and introducing a comprehensive digital infrastructure, or changing the tenant mix and even upgrading the leisure and catering offer to improve footfall.

While global economic and political events are not within our control, delivering the very best retail experience through exciting asset management strategies, in the right locations, will be key in 2016.

David Atkins is chief executive, Hammerson