There may have been strong results from the majority of listed real estate companies and REITs over the past month’s results season, but shares in the real estate sector have performed poorly.

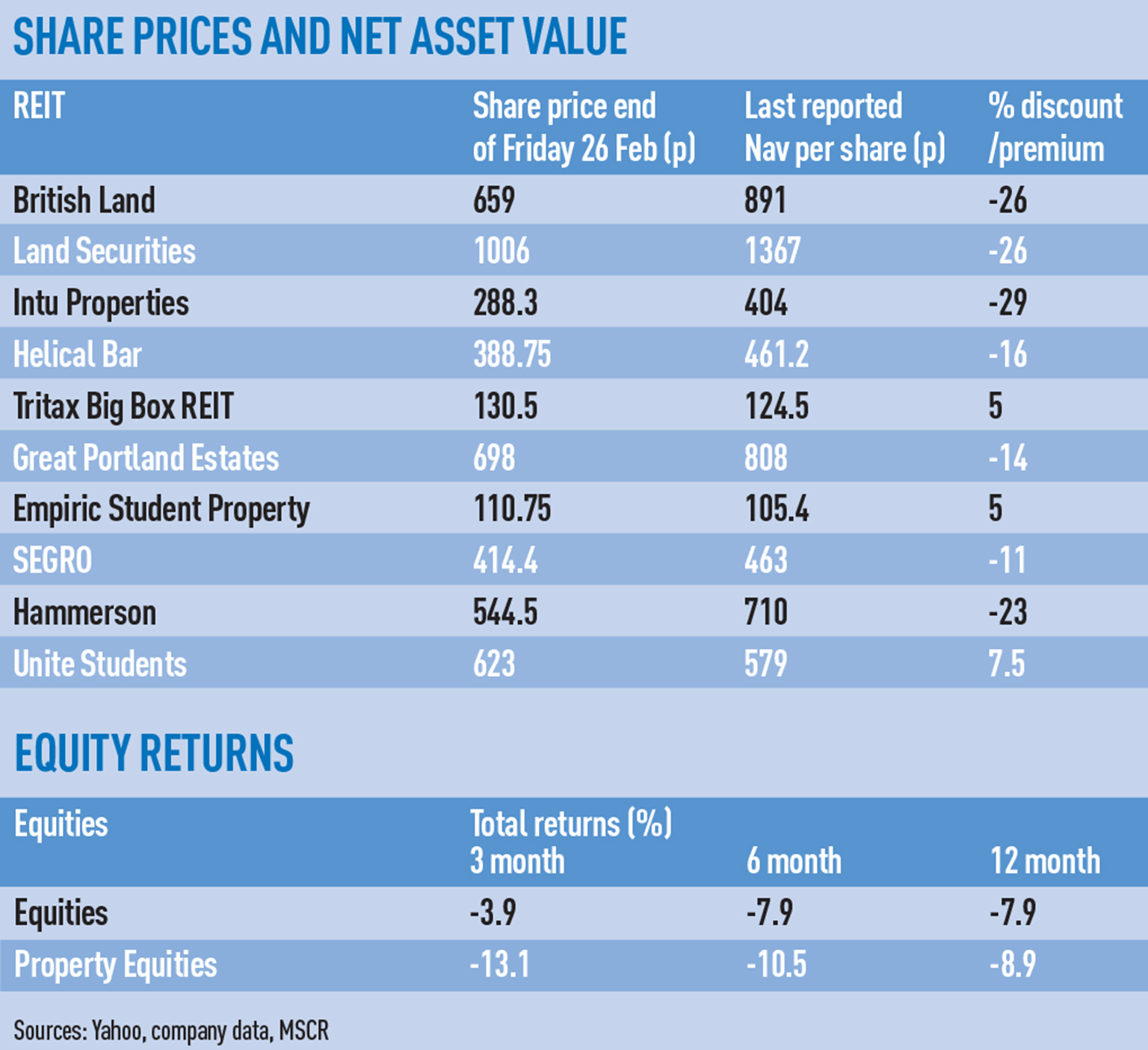

Despite strong valuations, improving profits and increasing rental income, many listed companies, including British Land and Land Securities, are trading at a large discount to their net asset value.

In other words, investors see the real estate that underpins the listed sector as being worth more, and in some cases much more, than the companies as a whole.

Some of the discounting is down to real estate being caught in the general slump in global equities, says Mike Prew, managing director in Jefferies’ real estate equity research team. But it is the real risk of falling capital returns matched to slow income growth that is giving impetus to current events, he adds.

“There is little in the way of rental growth, so the only way to hold the REIT shares is for a high-dividend yield to reflect all those risks,” says Prew, “and with the limited earnings growth in most of these companies, the only way for the [proportionate] dividend to go up is for the share price to go down.”

From an investor’s point of view, the recent slump is not an anticipation of a broader collapse in real estate values, says James Wilkinson, co-chief investment officer at BlackRock’s real estate securities group.

“The market is not necessarily saying that asset values will fall by that much,” he says. “It is not always the case that discounts to NAV are followed by physical property market corrections. And of course, we human beings often suffer from confirmation bias – tending to look for evidence to support our prejudices.”

Confirmation bias may make markets more likely to correct as direct real estate trades follow the pattern of the discount, but the statistics show that it is by no means certain. Figures from REITA (now the BPF) show that between 1989 and November 2014, listed property companies traded at an average of a 16.5% discount to the underlying NAV, so situations such as the present are by no means abnormal.

David Church, founding partner of Leon Partners, believes that the biggest problem the current situation brings is restricting the ability of listed companies to access fresh capital from the equity markets.

As a result of companies’ shares trading at a discount to the value of their property, one route being explored in the US is arbitraging the price difference by selling properties to buy back shares.

Wilkinson says: “Share buybacks can be effective in generating incremental returns, particularly when financed by sales at book value.

“It takes absolute conviction for management and their boards to go down that route, however,” he adds.

Church says there may even be the unusual phenomena of firms taking themselves private. “Public companies will consider buying back shares but few will. After a sustained period of underperformance and frustration at discounts to NAV, many will consider swapping public equity with private equity again. Few will, but some may.”

Another possible outcome of companies trading at a discount is an increase in M&A activity as private equity and growing companies look to buy portfolios on the cheap.

Jaime Riera, co-head of the EMEA real estate group at Credit Suisse, says that although the possibility of consolidation has grown for some companies, it is unlikely to happen among the major REITs.

“I think when you look at the sizes of these companies and at how local they are, it is not easy to see big acquisitions in the sector,” he says.

Wilkinson also believes history has made boards wary of M&A activity in the real estate sector.

Companies trading at a dramatic discount to NAV has put a new dimension on the listed sector and the type of activity that may follow.

Church says: “To solve the cyclical challenge, companies could try to focus the equity market on metrics other than third party valuations. There is no other sector in the stock market where a third party’s valuation forms the key basis for a company’s capital structure.”

To send feedback, e-mail mike.cobb@estatesgazette.com or tweet @MikeCobbEG or @estatesgazette