Can we use the word “crisis” yet? According to some in the South East industrial property scene, yes – with bells on.

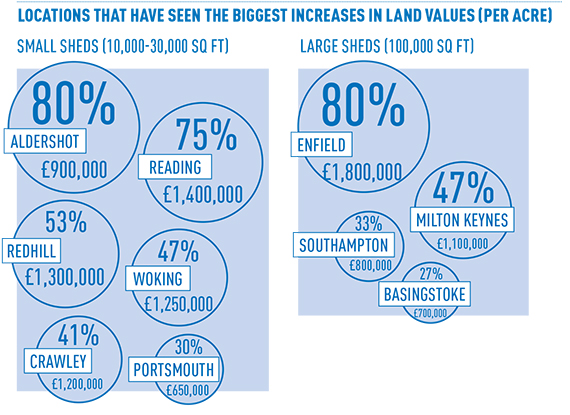

Industrial land has never felt less affordable. Average large-plot land prices in the South East have jumped by 32% in the past year, according to Colliers International, but in some areas rises were astronomical (see graphic, p76). Pressure from residential developers is the main culprit – but intense competition among industrial developers has turned up the heat.

The pressure is strongest in the airports’ slipstreams. Crawley, Gatwick’s near neighbour, has seen rents rise from £9-£10 per sq ft to £11.50, but land prices rose by 41% in 2015 – and 85% since 2013 – to stand at £1.2m per acre. In Reading, the Heathrow effect has helped lift rents from £8-£9 per sq ft to £11 over two years, while land prices shot up by 75% to £1.4m per acre.

“If Crawley land is £1.2m an acre, then £1.5m just doesn’t raise eyebrows any more,” says Len Rosso, head of industrial at Colliers International.

Unhappily for the industrial sector, rising land prices are beginning to hurt as construction costs make eyes water. Carter Jonas (using Building Cost Information Service data) says a new-build warehouse in Oxfordshire might cost £75 per sq ft, and refurbishment might be £94 per sq ft. Some larger units are cheaper – perhaps £30-£40 per sq ft – but these are still big numbers.

The consequence is that development appraisals don’t add up in a growing list of high-priced locations. The supply of new industrial premises could be choked just as demand seems at its strongest.

“This is a serious problem,” says Rosso. “Combine land prices with rising construction costs and it’s very difficult for developers. Yes, rents have gone up, but without that, developers just couldn’t buy land at these prices.”

“This is a serious problem,” says Rosso. “Combine land prices with rising construction costs and it’s very difficult for developers. Yes, rents have gone up, but without that, developers just couldn’t buy land at these prices.”

Developers have adopted different escape strategies. Some, such as SEGRO, say the answer is inventive design. SEGRO says it is developing a new template for incorporating industrial and residential uses into a single masterplan at the 30-acre former Nestlé site in Hayes, west London, which could roll out elsewhere. The mix improves viability – and appeals to the growing last-mile delivery logistics market, it says.

Others, such as MEPC, say developers should think about yields, instead of looking at land prices (see box, p75).

But for many in the South East, the answer lies in the exercise of political influence – or, better, political muscle.

Ben Wiley is head of industrial agency at Strutt & Parker and soon to be chairman of the UK’s Industrial Agents Society. He says a few words in a few ministerial ears would do no harm at all.

“The housing agenda has pushed out the protection of industrial land in the South East,” says Wiley. “That’s a concern we need to voice, but sheds are not as politically friendly.

“Land prices are now exceeding their 2007 boom-time peak and we need a political voice. We have to have some protection for industrial sites, because it’s hard to see a market solution.”

The pending review of the National Planning Policy Framework could provide the opportunity, while lobbying from the British Property Federation and the UK Warehouses Association is widely welcomed by agents and industrial developers. But it may not be enough.

Paul Keywood, associate director at planning consultant Turley, says: “Housebuilders have been more skilled at getting their message across. The industrial sector needs to be stronger in its lobbying. We can’t wait another five years for the next NPPF review. The sector mustn’t miss this chance.”

It used to be thought there was industrial land unsuitable for residential development – but in the South East, not any more, says Savills director Graham Brown. “The resi guys will build on almost any site they can get their hands on,” he says – and they invariably get a green light from planners.

“The ideal would be for local planners to intervene to ensure a balance between industrial and residential uses – but planning isn’t in an ideal world.”

Forget land price, think yield

“It’s a perfect storm,” says James Dipple, MEPC’s chief executive. “Yes, rents in the South East are up, but so are land prices and construction costs.”

At the 250-acre Milton Park site in Oxfordshire, MEPC’s viability studies depend on present, not historical, value, so rising land prices are at the front of Dipple’s mind. But so are yields.

And yields are the key as MEPC tries to balance sheds against higher-value uses by mixing and matching. It is also tapping into the huge demand for mid-scale logistics floor space in Oxfordshire.

“Industrial yields are keen, and that feeds into capital values and appraisals,” says Dipple. A refurbished 50,000 sq ft unit could be on the market soon at a rent of £9 per sq ft,” he adds.

Two-deck solution?

Two-deck solution?

The history of two-deck warehouses in modern Britain is short: there’s SEGRO’s 240,000 sq ft X2 unit at Heathrow, and that’s about it. But lessons learned from retail warehousing could be extended to sheds, says Steve Griffiths, director at architect Broadway Malyan.

By going two-deck, its client Costco’s 140,000 sq ft requirements can now be fitted onto sites as small as 6.5 acres, down from 11 acres.

Griffiths says: “The addition of shipping and receiving docks on our raised-level warehouse model shows this could be adapted for a more traditional distribution facility. I also think we are going to see more multi-level, multi-occupier facilities in the future.

“Economically it makes sense for the developer with essentially two developments on one site, and although the build costs will be higher, these costs will easily be negated by the savings made on land, particularly with values around major hubs such as Heathrow

and Gatwick.”

Consequences of rising prices

“We have been looking for a building for over three months but the stock levels in Milton Keynes are depleted, so our only option is to have a building built,” says Simon Dearn, owner of Milton Keynes-based Urban Automotive, which has a 20,000 sq ft requirement.

The story is not untypical. Where industrial supply is already limited, rising land prices do not help.

According to Colliers International, Milton Keynes’ land prices have risen from £650,000 an acre in 2013 to around £1m an acre today.

Yet local agent Kirkby Diamond says supply is at an all-time low. Voids are just 4% – half the national average. Luke Tillison, head of commercial agency, says the need for new-build is now urgent.