The extent of the alleged over-valuing of the White Tower portfolio was this week revealed in court documents submitted to London’s Commercial Court.

The extent of the alleged over-valuing of the White Tower portfolio was this week revealed in court documents submitted to London’s Commercial Court.

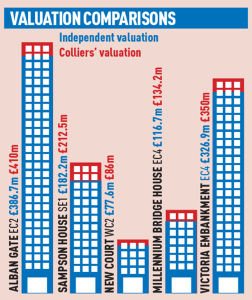

The special-purpose vehicle issuer of the distressed £1.12bn CMBS issued by Société Générale, in 2006 – White Tower 2006-3 – is suing Colliers International UK, previously part of Colliers PLC, for as much as £34.8m.

SocGen hired Colliers to write an independent valuation report in 2008 on each property in the portfolio to ensure that it provided “acceptable security” based on an LTV ratio of 83%.

The claim is being defended by the firm’s insurer. The case is to go to trial early next month.

The bulk of the portfolio secured against the loan was sold to Carlyle Group in 2010 for £671m. The total portfolio was sold for £1.1bn.

To send feedback, email david.hatcher@estatesgazette.com or tweet @hatcherdavid or @estatesgazette