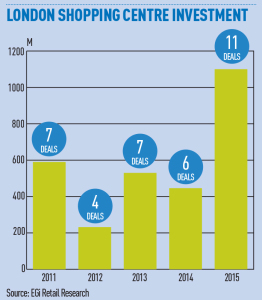

Retail investment in London rocketed in 2015. The capital managed to double its cash totals last year with a massive £1.1bn invested in shopping centres, grabbing a third of the UK’s deals. To put this in context, £2.8bn has been invested in shopping centres in the capital over five years.

But there was a cloud. In quarter four, deals fell short. It left many questioning if last year was the peak of the market and where we went from there. A lot has been made of the Q4 shortfall and how what was set to be a record-breaking year failed at the final hurdle. Overall in the UK, investors signed for more than £6bn of retail investment deals with an additional £1.6bn expected to get over the line. Had this materialised, the year-end figure would have been within a whisker of 2014’s high of £6.2bn.

But the 2014 total was inflated by the mega-deals for Bluewater, Intu Merry Hill and Intu Derby, which totalled a whopping £1.45bn. The absence of these trophy deals makes 2015’s figure all the more impressive.

Drilling down to the capital over five years, 35 shopping centre transactions took place. A third of these were signed for last year. Notable deals include the £270m portfolio of Fulham Broadway, SW6, and the Broadway Shopping Centre in Bexleyheath, the £190m Bentall Centre, Kingston, and the £170m Angel Central, Islington, N1. Deals achieved for the Whitgift in Croydon and St Nicholas Centre, Sutton (pictured), are among the top end in terms of square footage.

So is everyone too hung up on those quarter four stats? With many more schemes being prepared for market in 2016, the hangover has evaporated and prices look set to increase, along with the number of centres changing hands.

Good levels of supply look set to continue in London. Hersham Green in Walton-On-Thames has exchanged for about £15m, New River is under offer to purchase Bexleyheath’s Broadway Shopping Centre for £120m and, only this month, Intu Bromley has been put on the blocks for £260m. Along with Southside in Wandsworth, SW18, being readied for sale, the year ahead should continue to see sustained strong investor interest. There may be some turbulence if June’s EU referendum chimes a Brexit, though the UK’s economic robustness should see interest sustained.

The scarcity of modern stock combined with an increasing population and a hefty footfall boost from tourism are all factors which define the typical high value of a London shopping centre – and make them lucrative cash cows for investors.

Long-running planning obstacles combined with a lack of space has hindered developers from getting the green light for new schemes in Greater London, further increasing prices.

James Child, senior retail researcher, EGi