The Norwegian finance ministry has raised the real estate allocation of its sovereign wealth fund from 5% to 7%.

The NKr7tn (£598bn) Norges Bank Investment Management fund will now be able to allocate NKr490bn into real estate.

Last December the world’s largest sovereign wealth fund said it wanted to take the allocation to 10% by including infrastructure in its real estate business. However, that move was vetoed this week.

The alternative, an increase to 7%, excluding infrastructure, extends a plan to reduce the sovereign wealth fund’s exposure to low-yielding bonds and move towards the better returns that real estate has delivered.

In 2015, real estate returned 10% on investments after currency fluctuations, compared with just 0.33% for bonds and 3.83% for equities.

So far Norges has invested NKr180bn in real estate across key cities in the US and Europe.

Norges Bank real estate management chief executive Karsten Kallevig leads the sovereign fund’s drive into the sector.

Its biggest single market has so far been the US, centring on New York offices and logistics with partner Prologis.

The UK has been Norges’ second-biggest market with NKr48bn of investment in luxury retail and logistics.

The UK was Norges’ first destination for investment following the fund’s move into real estate in 2010. In 2011 it bought a 25% stake in the Crown Estate’s Regent Street, W1, scheme.

Saudi Arabia eyes £1.4tn oil-backed property fund

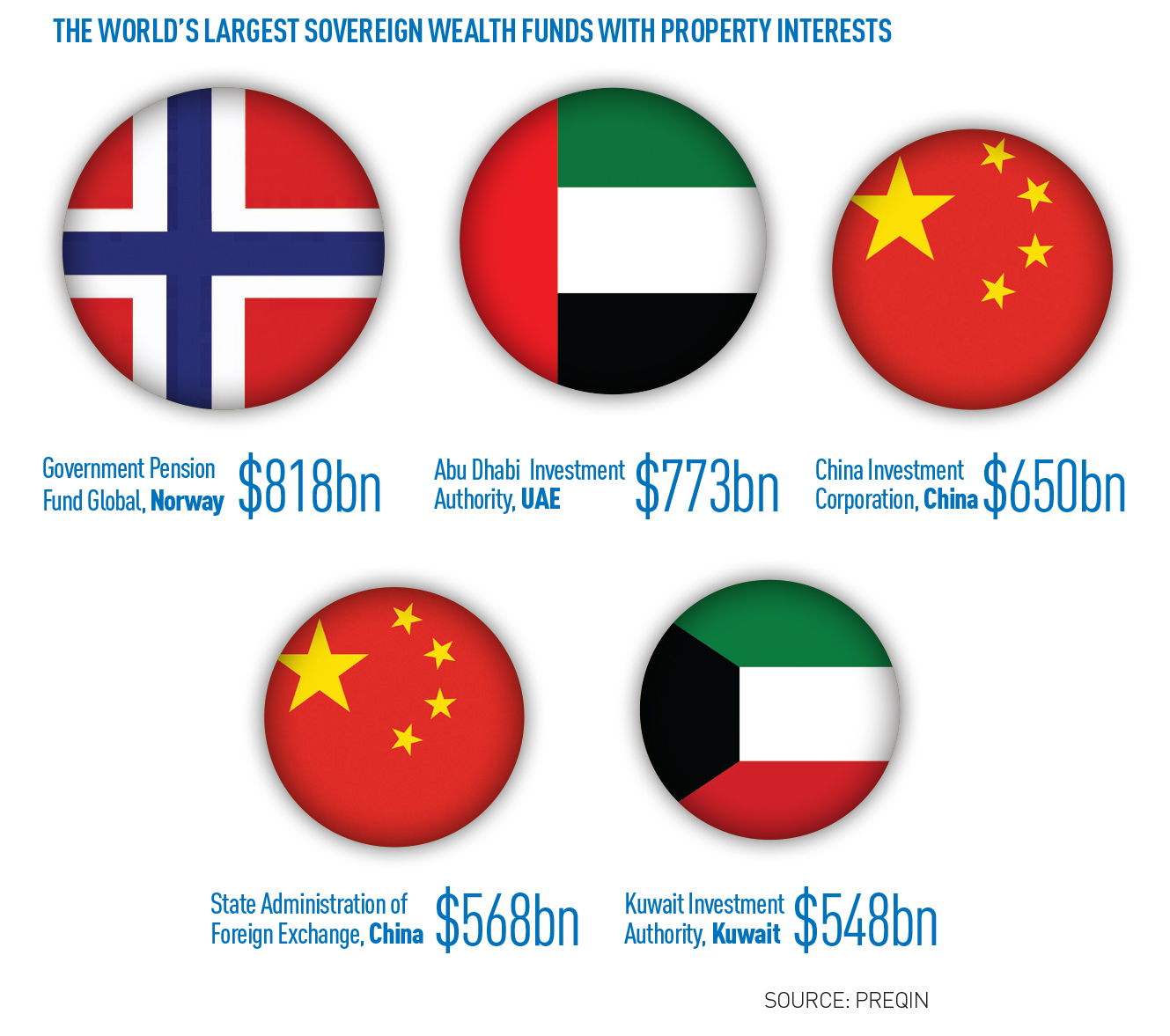

Saudi Arabia is exploring the establishment of a new £1.4tn fund as it looks to diversify its interests away from oil, following the dramatic fall in its price over the past year. The fund will invest in higher-returning assets such as real estate. If the country manages to divest the bulk of its oil interests and establish the new fund, it would become the largest sovereign fund in the world.

• To send feedback e-mail mike.cobb@estatesgazette.com or tweet @MikeCobbEG or @estatesgazette