As commercial property markets up and down the country start to at least sound a note of caution, if not actually cool down, the same might be expected in the East Midlands industrial sector. But the key players here – from developers to investors – are having none of it. Instead there is bold talk of speculative development for at least another two years and a gradual increase in prime rents.

Surprisingly, this seems to be less agent hyperbole and more a reflection of pent-up demand in a region that is perennially popular with a broad spectrum of occupiers.

Not that anyone is suggesting the market is about to go crazy. “Space that will be specced will mainly be close to the M1, and then only at prime or super-prime locations,” predicts Burbage Realty director James Harrison.

So the lessons of the early 2000s – when investors put up sheds in some unlikely locations only to see them stand empty during the recession – seem to have been well digested.

“While we are seeing speculative development, there isn’t the weight of money being ploughed into big box developments we saw last time round,” notes Stuart Waite, Derby-based associate director at Innes England.

Midlands developer St Modwen is one of the carefully confident brigade. Last month it finished BG87, a speculatively built 87,300 sq ft warehouse at its 1m sq ft Burton Gateway development on the border of the East and West Midlands. It has already submitted planning applications on the next two units (108,000 and 220,000 sq ft), the smaller of which it plans to start constructing this summer.

“There’s very little new product in the area, so we see rents increasing,” says the firm’s senior development surveyor Ian Romano.

Also expected to start speculatively this summer is St Francis Group’s 270,000 sq ft Cransley Park scheme at Kettering, where Rockspring/Hanover PUT are forward-funding the whole development to the tune of £26m. Five units of between 25,000 and 100,000 sq ft are expected to complete by this time next year.

“We’re courting local interest,” says James Hill, industrial director at letting agent LSH, “as this is the only scheme in Northamptonshire catering for smaller occupiers.”

With demand across the region generally outstripping supply, prime rents have finally breached the £6 per sq ft barrier, though, as with speculative development, no-one is forecasting stratospheric City of London offices-style leaps.

“Flexibility is more of an issue for occupiers than an extra 50p on rent,” says Innes England’s Waite. “Developers want 15-20 year leases, whereas occupiers want 10 years with a break at year five. So leases need to move out – which they are doing.”

Unit sizes are also shifting. Mid-box space (50,000–100,000 sq ft) has been letting almost as quickly as it is built and LSH calculates there is only around three months’ worth of supply available. That doesn’t mean future builds will be mid-sized.

LSH’s Hill explains: “There’s a view that bigger boxes have been neglected in the past 24 months, but we’ve yet to see anyone speculatively develop above 300,000 sq ft in this region.”

The medium-term development pipeline is encouraging. Large scale schemes like Rail Central (see box) and Derby’s Infinity Park are set to provide new space.

At the latter, where hi-tech transport-related firms are being targeted, Marketing Derby managing director John Forkin expects occupiers to be able to move in from late 2017.

He adds: “I’m not sure if developers will build speculatively to tickle the market though.”

New railfreight terminals on track

For around 20 years, Prologis’s ‘DIRFT’ scheme has been synonymous with rail-served logistics in Northamptonshire. But now it’s time to think again.

Later this month developer Ashfield Land starts formal public consultation on its proposed Rail Central scheme. Up to 8m sq ft of logistics space could be developed south west of Northampton, just down the line from DIRFT.

Ashfield is quick to allay concerns that the two schemes may be going head to head. While the third and final phase of DIRFT is already on-site, the first buildings for Rail Central would not be ready for occupation until 2021.

Also in the region, Roxhill’s 6m sq ft East Midlands Gateway railfreight terminal is to go ahead, after the government overruled the national planning inspectorate. Campaigners have threatened a judicial review.

Is the A1 the new M1?

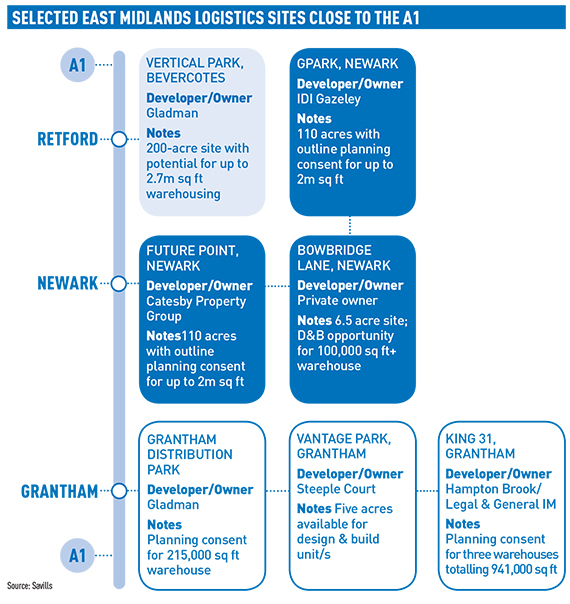

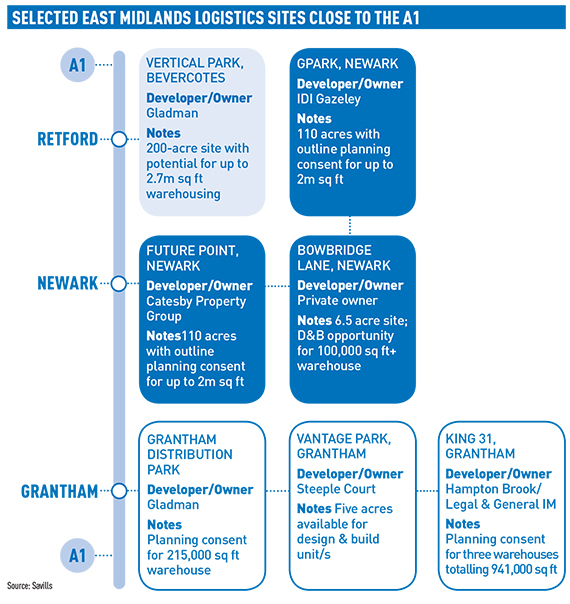

Historically the poor relation of the two major north-south road arteries which bisect the East Midlands, the A1 is starting to be seen by both developers and occupiers in a new light. A shortage of developable land and low availability of second-hand sheds close to the M1 has seen potential demand shift to the east around Grantham and Newark.

“The A1 corridor is now seen as a much more viable alternative,” says Victor Ktori, head of commercial at Savills’ Nottingham office.

“It’s not that the M1 has lost its lustre, but there is now a lot of consented land on the A1 and that’s looking very attractive.”

Savills calculates that there are 18 potential logistics sites on the A1 in the East Midlands, ranging from virgin land to built-out units, which are catching the eye of would-be occupiers. One of the most recent to land there is Brazilian-owned Moy Park. Ktori, who advised the UK food producer on its search for a 120,000 sq ft distribution hub, says four locations were considered, but a six-acre plot fronting the A1 came up trumps.

Yet the significant price differential that made the eastern corridor appealing may soon disappear.

“Not that long ago, it was possible to pick up land at £250,000 per acre,” says Ktori, “but now that’s risen to £300,000, a significant increase from an occupier’s perspective,” he says.