Morgan Stanley Real Estate Investing has put its stake in the Walkie Talkie up for sale.

Morgan Stanley Real Estate Investing has put its stake in the Walkie Talkie up for sale.

The seller hopes to achieve bids as high as £150m for its 11.7% ownership in 20 Fenchurch Street, EC3, which would reflect a yield close to 3.1% and value the building at £1.3bn.

However, sources close to the other owners of the building valued it at closer to £1bn, which would put MSREI’s stake in the region of £120m, reflecting a 4% yield.

The sale is an opportunity for investors to own a slice of one of Europe’s best-known trophy buildings and gain exposure to a steady income stream. The building is almost fully let and generates revenue of nearly £40m per year.

The minority interest, however, provides little strategic control.

MSREI’s divestment reflects the success the 37-storey skyscraper has achieved since speculative development began at the bottom of the market in 2011, and is likely to result in it taking a substantial profit.

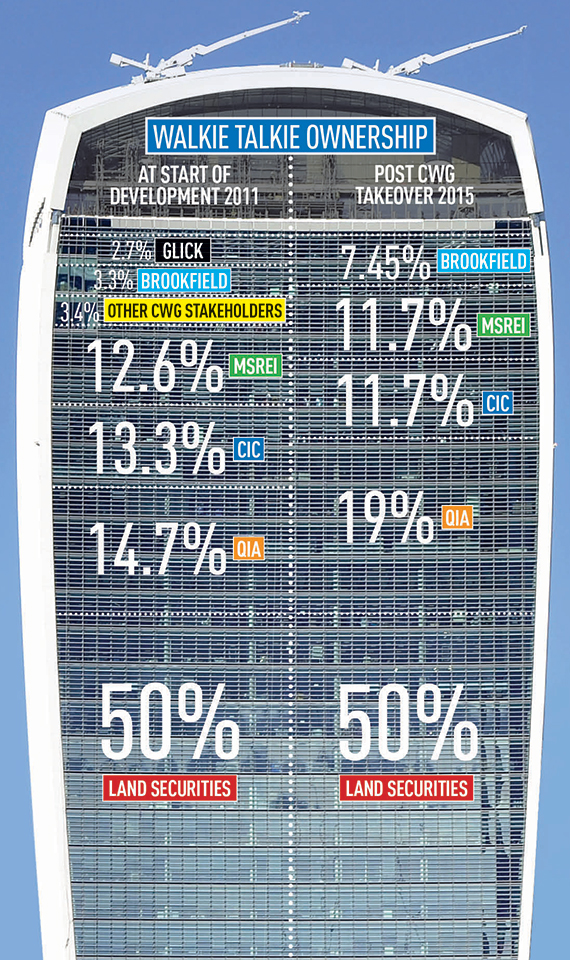

The ownership of 20 Fenchurch Street is complex and intertwined with the £2.6bn takeover of Canary Wharf Group last year (see below).

MSREI owns part of a special purpose vehicle managed by Canary Wharf Group that controls a 50% stake. The other half is owned by Land Securities.

The 670,000 sq ft building includes the Sky Garden, one of London’s biggest tourist attractions, and two restaurants. Since completion in 2014 it has become home to tenants including law firm DWF, Deutsche Pfandbriefbank and traders Jane Street Capital.

Top rents in the building are close to £90 per sq ft and Knight Frank research released this week showed that skyscraper prime rents in London grew by 9.7% in the second half of 2015 – faster than any other city in the world.

Morgan Stanley declined to comment.

CWG refinances 50% stake

Canary Wharf Group has agreed a £200m refinancing of the 50% stake it manages in 20 Fenchurch Street. Bank of China and Royal Bank of Scotland have provided the debt, at a loan-to-value of close to 40% on a £1bn valuation of the building. The loan is secured against the special purpose vehicle that controls the half stake and is not directly secured against the building. Ownership of the stake is split four ways.

Who owns the Walkie Talkie?

In 2010 Land Securities sold a 50% stake in the project to Canary Wharf Group, which at the time included among its principal shareholders China Investment Corporation, MSREI, Brookfield and Qatar Investment Authority.

CWG retained a 15% stake in the project but sold on three equal chunks of 11.7% each to MSREI, CIC and QIA, which they held separately in addition to the fractional exposure they had through their ownership in CWG.

CWG continued to manage the overall 50% interest in the building for all of the investors. When QIA and Brookfield took over CWG last year, which saw CIC and MSREI bought out of the company, they took full ownership of the 15% stake.

However, CIC and MSREI’s stakes in the Walkie Talkie remained in their ownership.

CIC is not looking to sell its stake.

• To send feedback, e-mail david.hatcher@estatesgazette.com or tweet @hatcherdavid or @estatesgazette