Brookfield Asset Management has secured $9bn (£6.2bn) of equity commitments for its latest global real estate fund.

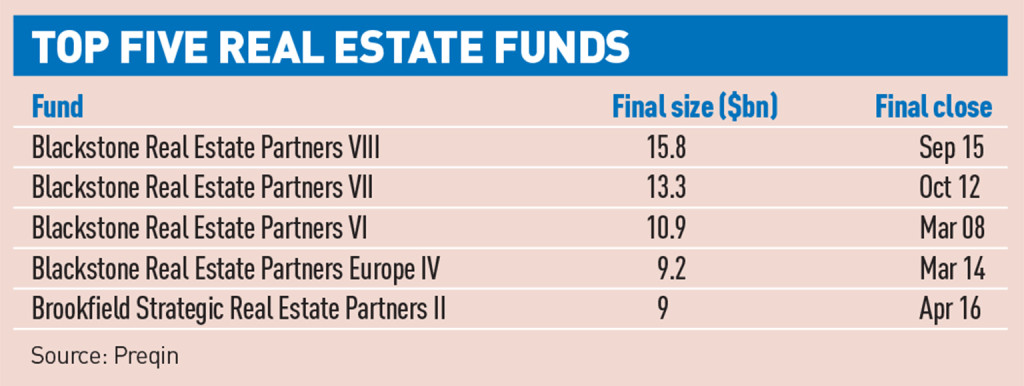

The cash input makes the Brookfield Strategic Real Estate Partners II the fifth-largest real estate fund of all time and the largest fund raised by any company other than Blackstone.

The vehicle exceeded its initial fundraising target by $2bn.

The fund has more than 100 institutional backers including pension funds, financial institutions and sovereign wealth funds. Brookfield has also committed $2.3bn through Brookfield Property Partners.

The fund will target North America, Europe, Australia, Brazil and other “selected markets”.

It has already deployed $4bn in investments across Europe, the US and Brazil. Among these was the purchase of Centre Parcs from Blackstone for £2.4bn last summer.

• To send feedback, e-mail mike.cobb@estatesgazette.com or tweet @MikeCobbEG or @estatesgazette