It is hard to bring up the subject of Ireland’s National Asset Management Agency without a pained expression spreading across the face of property professionals who went through the financial crisis. After all, this is the agency responsible for clearing up the €74bn (£60bn) mess left when the Celtic Tiger became a scared kitten and the memories of that catastrophe could make the hardest soul wince.

It is hard to bring up the subject of Ireland’s National Asset Management Agency without a pained expression spreading across the face of property professionals who went through the financial crisis. After all, this is the agency responsible for clearing up the €74bn (£60bn) mess left when the Celtic Tiger became a scared kitten and the memories of that catastrophe could make the hardest soul wince.

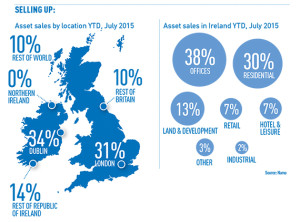

But by the end of December 2015, the agency had removed nearly €64bn of the loans it acquired from a mix of banks and almost single-handedly revived the real estate market in Ireland. With just €10bn of loans remaining, this year looks to be the last big hurrah for the agency.

Brendan McDonagh, chief executive of Nama, says: “This demonstrates that Nama is delivering on its mandate and will deliver a significant surplus for the taxpayer over its lifetime. This contrasts sharply with the predictions of some commentators when Nama was set up that it would lose up to €8bn.”

According to those familiar with Nama’s process, the trick has been its ability to adapt to the prevailing market.

“It was criticised at first for being slow to sell, but when the market heated up following the sale of Project Rock and Salt, it went on a selling binge,” says one former investor in the agency’s loan portfolios who did not wish to be named.

Slow is of course relative, but in the first three years of its existence, Nama sold €2.5bn of loans. Then, after 2013, came a flood of assets.

At least for the Irish market, the slow start had been the plan all along, but a review sped the process along, says McDonagh. “A major focus of this review was to assess the commercial feasibility of accelerating loan and asset sales, particularly in Ireland, over the period to 2016,” he says.

Planned or not, the timing could not have been better for the agency. As European markets improved generally, the fact that Ireland was a country with a strong legal code and benefited from being in the euro made it attractive to investors, particularly emergent private equity funds.

An agent who worked closely with Nama on the pricing of some of its portfolios, who wishes to remain anonymous, says the way the agency approached the launch of some of these early portfolios enhanced this growing feeling.

“It took advantage of their interest in the Irish market and then eased them in. In particular, a mix of attractive single assets in portfolios combined with smaller loans made companies like Starwood, Apollo, Kennedy Wilson Europe and the now almost infamous Cerberus sit up and take notice,” he says.

McDonagh points out that this is not a one-sided process. “We typically engage specialist loan sales advisory firms to advise on the composition of loan portfolios and on the timing and structure of sales processes. This is decided on a case-by-case basis, in conjunction with debtors and receivers. Investors also engage with us on assets they are keen to purchase,” he says.

The process not only enhanced the attractiveness of the portfolios but also of Irish property itself, leading to a loop that has kept the Nama portfolios profitable, despite a drop in the quality of the underlying assets. As a result, Nama is now on track to beat its targets.

“We are succeeding in getting the best achievable financial return from the loans we acquired,” says McDonagh. “We are on course to deliver a surplus of at least €2bn for the taxpayer in addition to repaying the €31.8bn senior and subordinated debt we issued to acquire our loans.” All two years ahead of the 2020 deadline set by the Irish government in 2009.

However, selling portfolios of loans, many of which are not in default, can have its problems, not least for a body so overtly political. Some borrowers were pulled into Nama without much say and now their loans are in the hands of a company they don’t know.

But the worst headlines for Nama have come from the sale of Project Eagle to Cerberus. The portfolio’s purchase led to allegations of backhanders to Northern Irish politicians – strongly denied by all parties – and a continuing investigation by the Serious Fraud Office and FBI.

Fortunately, this has not slowed Nama’s progress towards selling the last of its portfolios. “2016 has already seen the launch of three more projects, code-named Emerald, Ruby and Abbey, with a rumoured two more due by the year’s end,” says McDonagh.

Once these are done, Nama will move on to delivering on two new government mandates. “These are to fund the delivery of key grade-A office, retail and residential space in the Dublin Docklands strategic development zone and Dublin’s central business district and to fund the delivery of up to 20,000 new homes in areas of proven demand, as long as both achieve commercial viability.”

Once this has been done, the future is less certain for the agency, but hopefully it won’t have to deal with another crash any time soon.