- Fears over the residential market, especially in London, have hit property company share prices since the start of the year

- But the practicalities of home ownership for generation rent have mitigated self-storage firms’ share price falls

Jitters have gripped the residential sector this year, particularly in London, where the market is rife with fear over buyers walking away from deposits, while high end homes are being overpriced and supply outstrips demand.

These fears have been reflected by the poor share price performance of the residential giants. Some general property company shares have bucked the negative trend and posted success stories recently. Residential property stocks, following a near four-year bull run, have not.

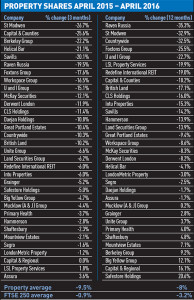

Developers with sizeable London residential exposure – St Modwen, Capital & Counties and Berkeley Group – make up the biggest three fallers since the start of the year, during which time their share prices have fallen by more than 20%.

Advisers with a large residential element to their businesses – Savills and Foxtons – have also seen their share prices drop by 20.1% and 17.6% respectively.

Mike Prew, managing director of Jefferies, said: “We’ve been in a bear market since the middle of last year and witnessed the negative effect of an oversupply of prime central London real estate and a general weakening in demand for London offices and shopping centres.”

In a bull market, listed property companies are able to raise cash quickly and negotiate debt efficiently. In bear markets these advantages are often swept away by a tide of negative sentiment that manifests itself by a share price fall.

This is not a fair reflection of the current situation, however. The FTSE 250 has not had a storming start to 2016 and has suffered a 0.9% dip. But property share prices have plummeted, on average, by 9.5%.

This is not a fair reflection of the current situation, however. The FTSE 250 has not had a storming start to 2016 and has suffered a 0.9% dip. But property share prices have plummeted, on average, by 9.5%.

“The sector was outperforming by up to 15% from April to August last year. It’s been a 16% underperformer since its peak,” Prew said. “It started off with a wave of enthusiasm: a growing economy, maybe some inflationary pressures, maybe UK interest rates going up. But it has morphed into what we have now, which is largely the opposite: a febrile economy with Brexit worries and so on.”

Only two of the 32 property companies in the FTSE 250, Assura and LSL Property Services, have posted a rise in share prices since January, with growths of 3.6% and 1.8% respectively, while Capital & Regional saw no change.

Over the course of the past year, property stocks have also underperformed the overall market, but not as dramatically. The FTSE 250 has fallen by 3.2%, whereas property stocks have fallen by 4.4% on average.

Big Yellow and Safestore have seen share price falls of 4.7% and 5% respectively since the start of the year.

But over the past 12 months the self-storage sector has been a clear winner. The pair are two of the top three best-performing shares over the period, with Capital & Regional lodged between them with a 16.1% rise off a low base.

Prew said: “Self-storage companies’ performance is partly a result of generation rent’s inability to be owner-occupiers.

“And for those people actually able to buy property, modern apartments are completely lacking in storage space because floor areas have shrunk.

“There’s good long-term growth there,” he added.

The biggest faller over the past year has been developer Raven Russia. Its share price has dropped by 35.3% as a result of Russia’s political instability and the effect

of trading sanctions.

Property stocks have experienced major fluctuations since the second half of 2015. Lower share prices may not mean a collapse in values but they do reflect the prevailing sentiment that real estate is not in vogue.