Estates Gazette has an exclusive first look at East Anglian legal firm Birketts’ annual property industry survey, which highlights concerns over Brexit and taxation. Mark Simmons analyses the results

Government policy

While devolution is a big issue for many UK urban areas, it isn’t a particularly hot topic in East Anglia (see Key Future Issues right). “It is relevant in this part of the world, but slightly peripheral to other issues,” says Birketts partner and head of property Chris Schwer.

Respondents said

• “We are still failing miserably to deliver sufficient housing stock to meet the UK’s needs.”

• “Government cuts to rents and the removal of grants for sub-market rents have had an impact upon the feasibility of affordable housing schemes. This will require us to change focus on the types and tenures of schemes in the future.”

• “Dialogue with planners and highways has been seriously curtailed and replaced with pre-application charges at exorbitant levels for meetings.”

Taxation

“I’m surprised business rates did not come higher on the list than corporation tax,” confesses Birketts partner Chris Schwer. SDLT would likely have received a higher billing if more respondents had been aware of the unexpected changes contained in the 2016 Budget (see footnote below).

Respondents said

“The unforeseen changes/implications of recent SDLT changes are a concern, for example smaller developers buying houses to redevelop could get caught by the additional charge.”

FOOTNOTE

Birketts interviewed 122 professionals representing companies with interests in commercial and/or residential property across Cambridgeshire, Suffolk, Norfolk and Essex, in March 2016. The survey was commissioned ahead of the 2016 Budget, though some responses were received after this year’s Budget was announced.

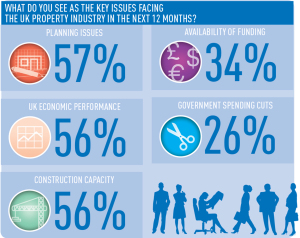

Key future issues (2016/2017)

Surprising omissions from the list include Brexit (only one respondent raised it as a concern) and the 2017 rating revaluation (flagged by none). Less surprising is that only one-third of businesses marked funding as an issue, reckons Birketts partner Chris Schwer: “East Anglia is quite a cautious part of the world – people here resort to lending less than other, more entrepreneurial parts of the country.”

Respondents said

• “Banks still do not like anything to do with bricks and mortar. The government needs to stop relying on small builders/developers to provide social housing and local infrastructure.”

• “Funding is the single most important driver.”

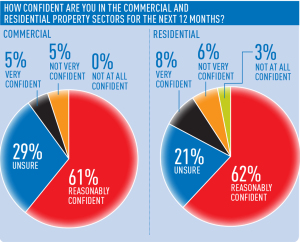

Market confidence

Respondents said

• “There is no strong evidence of growth in commercial property rents, patchy demand and insufficient inward investment.”

• “Our commercial properties are mostly high street shops and offices. In these sectors we do not see stability or growth.”

• “There is still plenty of money looking for an ‘investment home’. Commercial property is still a good medium-/long-term option.”

• “Residential developments are being built to too high a density, which is creating problems with car parking and storing up many problems for the future.”

• “[Housing sector performance] could be strong, but the new SDLT and concerns over the economic outlook in the near future may cool the market, especially for buy-to-let investors.”

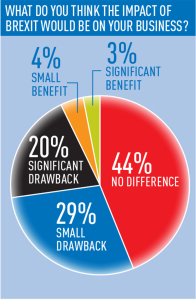

Brexit

Birketts partner Chris Schwer says he is waiting hopefully for an informed debate on European Union membership, though he admits it might be in vain. He adds: “I was surprised at how strongly people were for staying in, when anecdotal evidence suggested to me people were firmly in favour of going out.”

(Approximately half of respondents saw Brexit as a negative for their business, while less than 10% believed it would have a beneficial impact.)

Schwer says: “It is inevitable that an exit would have an adverse effect to start with because of the upheaval, in the same way that German unification was initially disruptive.”

Respondents said

• “The uncertainty over the consequences of a withdrawal is likely to undermine consumer confidence and cause people to hold back from high-value purchases like a new home. Our industry relies significantly upon European migrants in our national workforce.”

• “Many of our clients are EU businesses and nationals, who have already advised that a Brexit would result in a revision of their investment strategy and portfolios.”

• “It is hard to determine how Norfolk will be affected in property terms, as it is generally a local market.”

• “The demand for affordable housing will remain the same. We anticipate there may be a slight change in tender prices based on the availability of labour, but anticipate very little effect.”

• “The housebuilding sector does not like uncertainty and Brexit would create a number of years of uncertainty both in economic and political terms.”