Shell’s decision to close the 120,000 sq ft BG Group office at Reading’s Thames Valley Park, following its takeover of oil and gas exploration firm BG, has hit market confidence.

Shell’s decision to close the 120,000 sq ft BG Group office at Reading’s Thames Valley Park, following its takeover of oil and gas exploration firm BG, has hit market confidence.

The decision – expected since last December – means 800 staff will either relocate to the Shell Centre in London, or take redundancy by the end of this year.

Moving jobs from Reading to London is the exact opposite of what everyone has been praying for. That’s because the Thames Valley was supposed to become the in-shoring destination of choice for cost-conscious London occupiers. Now that aspiration seems dented.

The move comes as speculative developers are talking about their chances of winning relocations from London – difficult timing, for a difficult situation.

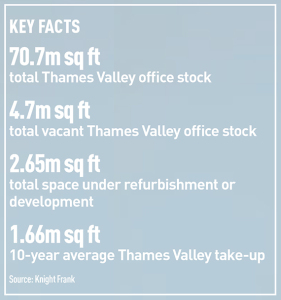

Total named occupier demand in the Thames Valley is hovering around 2.6m sq ft, according to Knight Frank, and appears to be growing fast. Cushman & Wakefield says 81 new enquiries, totalling 1.5m sq ft, appeared in the first quarter of 2016. This attention-grabbing figure is 51% up on the same period last year. Yet nobody is clear how much of this demand comes from in-shoring London occupiers.

Charles Dady, head of south east office agency for Cushman & Wakefield, says: “I don’t think we can draw too many conclusions from the Shell decision. We know the energy sector has its own dynamics at the moment, but we know other London occupiers are talking about relocating part of their operations to the Thames Valley.

“So far it’s not a flood, it’s a trickle, and I thought we’d see more than we have over the past 12 months.”

Jon Gardiner, head of south east office agency at Savills, says: “In-shoring to the Thames Valley is a hope, and it is early days, too. We’re only just seeing tentative steps by businesses relocating to London fringes like Uxbridge or Hammersmith, not Reading. That could change, of course, but you’d struggle to find any moves that prove there’s a trend.”

The only big in-shoring deal so far – Maersk’s move to take 47,000 sq ft at Point, Maidenhead – was agreed in the last days of 2014, and is beginning to feel a bit dated.

The only big in-shoring deal so far – Maersk’s move to take 47,000 sq ft at Point, Maidenhead – was agreed in the last days of 2014, and is beginning to feel a bit dated.

The widely voiced hope is that the spring 2017 rating revaluation will push London occupational costs so far through the roof that relocation to the Thames Valley becomes unavoidable.

But suppose the numbers fail to convince occupiers to come as far out as Reading? Suppose in-shoring remains just talk? For the developers behind the Thames Valley’s 1.4m sq ft of new and 1.2m sq ft of refurbished office space, this is an alarming thought.

Annual take-up averages at just under 1.7m sq ft, so even assuming 2016/17 turns out to be a good year – and that newly completed development arrives on the market in conveniently spaced lumps – could somebody be heading for trouble?

Knight Frank partner Roddy Abram acknowledges poor timing could undo some developer’s calculations, but remains optimistic.

“Assuming the 2.7m sq ft of new floorspace is delivered in the next two years, with take-up at 3.2m sq ft over two years, this equates to 4.1m sq ft available and a vacancy rate of 5.8%,” he says.

According to Duncan Campbell, director at Campbell Gordon, Reading enjoys plenty of potential sources of demand.

“Reading can attract occupiers from a wide hinterland, especially weaker locations in the neighbourhood. We don’t require wholesale relocations from London to let the current supply of new floorspace, because we’re attracting so many occupiers from Reading’s fringes.”

James Finnis, director at JLL, agrees. “Reading’s star is burning very brightly. It’s outperforming many other South East locations,” he says. “But we need to see some deals done – we’ve a long list of big requirements – and it would be good to see them sorted out.”

However, Savill’s Gardiner believes not every new scheme will fly. “It’s been known in the past for Reading to have voids of 10 years, and there’s always a distinct possibility it could take two to three years to let a new building. I suspect the development appraisals probably tend to underestimate the rent they will get, but also underestimate how long they may have to wait to get it.”

James Silver, development director at Landid Property and the man behind Reading’s 147,000 sq ft Thames Tower and Slough’s 115,000 sq ft 1 Brunel Way, insists it’s all looking good. Prelets are already in view, he hints.

“We don’t complete in Slough until 2017 but we’re already walking occupiers round the site. In Reading, the three speculative schemes are all offering something different, and we are already talking to occupiers on Thames Tower,” he says.

Silver won’t say that Ernst & Young’s 60,000-70,000 sq ft Reading requirement is in his sights, or that E&Y has visited his site, just commenting: “It’s exciting to see them in the market.”

He’s also expecting to see plenty of demand from London occupiers fleeing the capital’s high property costs, and is markedly more optimistic about in-shoring than many local agents.

“They will account for a significant take-up over the next few years – perhaps as much of a third of the market – but obviously indigenous occupiers will account for the everyday churn,” he says.

The Thames Valley office markets are in a strange place. Everything looks and feels good. There is no obvious reason to worry. Yet no amount of upbeat chat can disguise a sense that converting known demand into real, signed-up take-up may be harder – and take longer – than many would like.

Record rent

Law firm Gateley will pay £34 per sq ft for a 7,235 sq ft suite at the top of Aviva Investors’ 110,000 sq ft Blade and, in the process, will set Reading’s highest rent for 15 years.

How much further could rents go? Agents and developers are agreed that £37.50 per sq ft is a good place to pitch quoting rents, and most agree that quoting rents of £40 per sq ft are no more than a year away.

Long-term demand

Innovative research by Savills – still in progress – suggests strong long-term demand for Thames Valley office space.

Savills has analysed the likely effect of revenue growth and employment growth on floorspace needs for some of the Thames Valley’s biggest business sectors.

IT/telecoms, media, professional and financial companies with turnovers over £100m growing at a rate of 10% were looked at, and Savills has discovered that Reading’s crop is growing at 37.1%, second only to Bracknell at 44.3%. Other cities are behind, such as Birmingham on 31.5%. This is sure to translate into additional floorspace, they say.

Employment growth is even more striking. This may result in an additional 720,000-895,000 sq ft, depending on the employee density, say Savills.

Green Park

It’s barely a month since Oxford Properties disclosed the £500m sale of Green Park, Reading, to Singapore’s Mapletree Investments. Where the sale leaves speculative development at the 195-acre park is not yet clear.

A string of deals – including Thales’s decision to take 110,000 sq ft and Bayer’s 80,000 sq ft – mean just 100,000 sq ft is left unoccupied, with 94% occupancy.

Market talk suggests a 250,000 sq ft office scheme, probably speculative and quoting rents north of £37.50 per sq ft.

An Oxford Properties spokesman said: “A planning application has already gone in for further development, but what happens next is up to Mapletree. The sale does change things.”

Charles Dady at joint letting agents Cushman & Wakefield, concedes that more building at Green Park “is the next logical move”, but confirms that no decisions have been taken.

“We’re reviewing the next speculative phase,” he says.