The top-performing unlisted UK property fund for the past five years is set to shed its remaining assets.

UBS’s Central London Office Value Added Fund put its final four properties on the market in January as a single portfolio, expecting to attract bids of around £250m – a 4.8% yield.

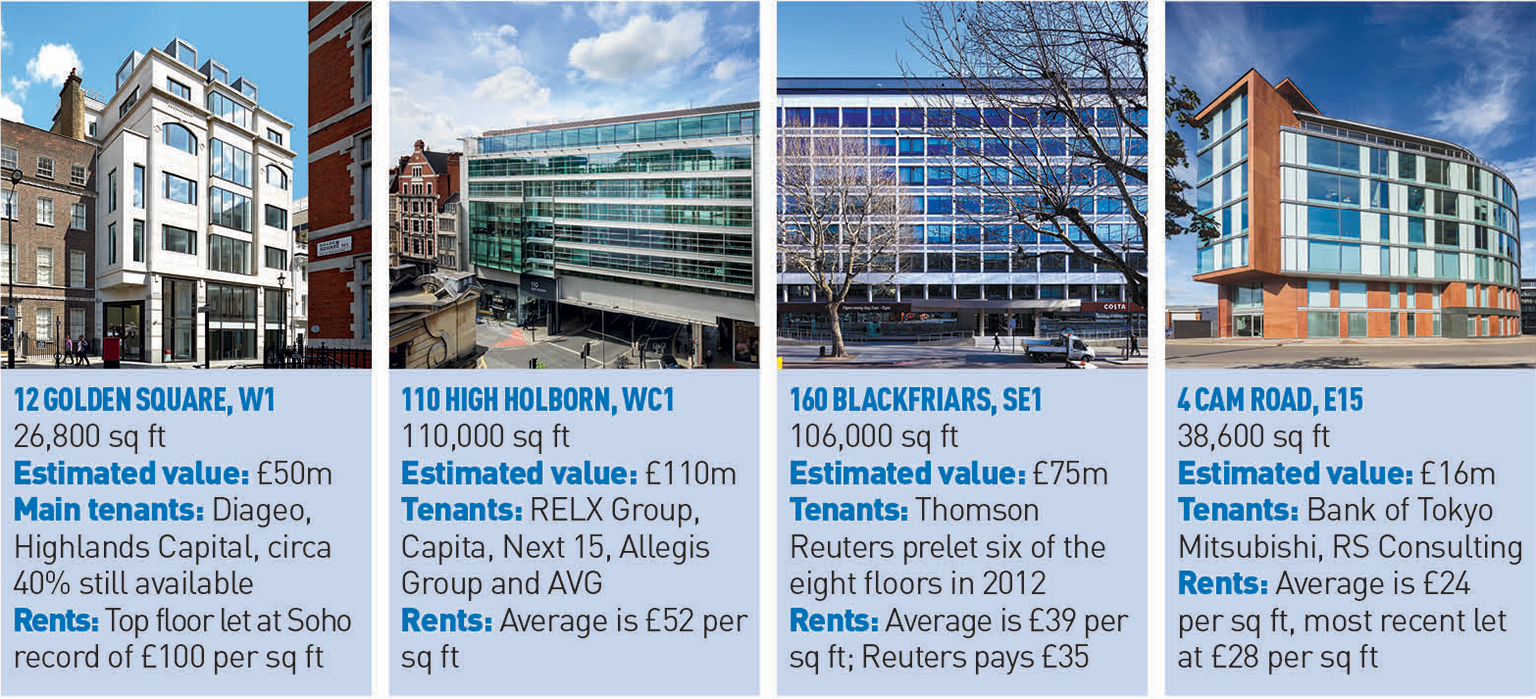

The properties – 110 High Holborn, WC1; 12 Golden Square, W1; 160 Blackfriars Road, SE1; and 4 Cam Road, Stratford, E15 – have been bought by four separate buyers.

Singaporean investor UOL Group has agreed to buy 110 High Holborn, Estates Gazette’s own HQ, for £98.75m through a wholly owned Hong Kong subsidiary. The 110,000 sq ft office was guided at £105.19m – a 5% yield.

UBS’s Triton Fund is understood to have acquired 12 Golden Square. The West End asset was offered at a guide price of £51.1m – a 4.25% yield.

A joint venture between Angelo Gordon and Endurance Land is in talks to buy the 105,935 sq ft 160 Blackfriars Road for £74m. It was expected that bids would be in excess of £75.25m – a yield of 4.25%.

The 39,022 sq ft Stratford office has been bought by a private UK-based individual for £16.8m – a 5.6% yield.

The total income generated by the four assets is £13m pa, reflecting an average rent of £44 per sq ft across the 290,000 sq ft of lettable area.

Five of the nine buildings bought by the closed-ended fund have already been sold.

CLOVA was launched in June 2011 with £110m of equity and returned 23.4% over its life before closing in December 2015, topping the AREF/IPD Property Funds Index for total returns over five years.

Tudor Toone and Knight Frank acted for UBS; C&W advised EL and AG on Blackfriars; Gerald Eve acted for UOL Group on 110 High Holborn.

All parties declined to comment.

• To send feedback e-mail louisa.clarence-smith@estatesgazette.com or tweet @LouisaClarence or @estatesgazette