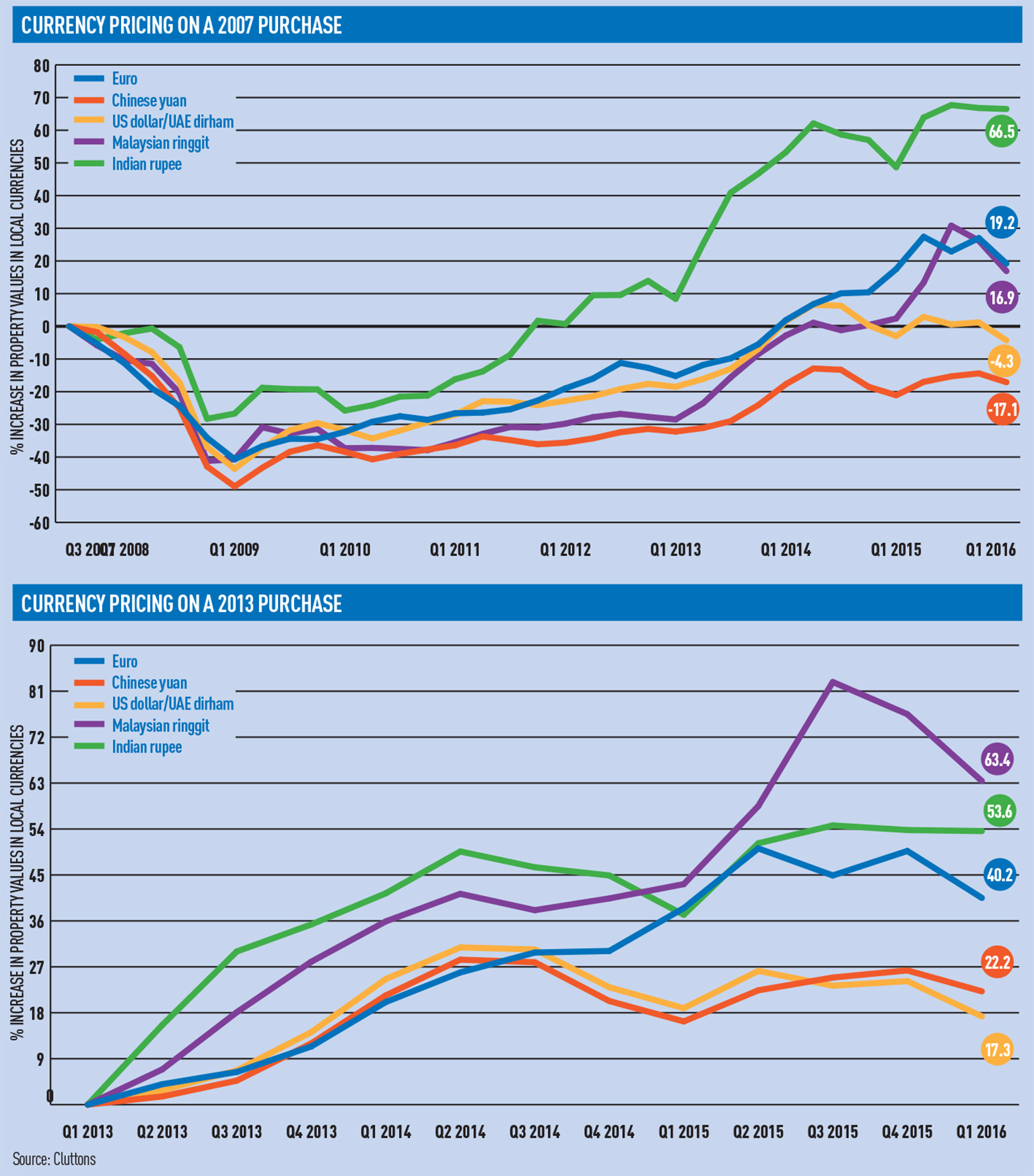

For London prime residential investors, international currency exchange rates can play just as much a part in returns as the shift in London property prices, according to Cluttons.

Its research combines the shifts in prime London residential pricing with currency fluctuations to show how much international investors have hypothetically made on investments in their own local currencies.

Since 2007, a UK sterling investor has seen property values increase by 35%. A Malaysian ringgit investor, on the other hand, has made just 16.9%. A US dollar or UAE dirham investor would have lost money, with values down 4.3%, due to the gradually strengthening dollar.

The best return would go to an Indian rupee buyer, who, due to the strengthening pound, would have seen values increase by 66% if buying in 2007. If they bought at the beginning of 2013, they would have made 54%.

Faisal Durrani, Cluttons’ head of research, said: “The significance of currency fluctuations is often overlooked and this is understandable given the relative strength of sterling in recent years against most major global currencies.”

The current weakening of the pound – a result of uncertainty over the outcome of the EU referendum – has started to erode some international buyers’ returns and has presented further opportunity for an influx of investment.

Goldman Sachs said in February that an exit from the EU could lead to a currency devaluation of up to 20%, making London real estate comparatively cheap.

Durrani said: “There is no doubt

that there is a strong wait-and-see approach gripping the market at the moment and international investors are primed to swoop in the event of a Brexit and an accompanying deterioration in sterling.

“The current weakness in sterling is likely to dissipate quite rapidly should the status quo prevail on 23 June. However, the question remains as to whether these international investors will continue to hedge their bets, or cash in on some pretty substantial uplifts.”

Durrani said that around 50-55% of the prime central London market is international, and 30-40% of that is from China and the Middle East.

Equally of interest is the value of investing in the UK now. It may be more expensive than it was in 2007 in Indian rupees, but for a Chinese buyer, due to the strengthening yuan, property is essentially 17% cheaper.

Should Britain remain in the EU, Cluttons predicts a 2% rise in capital value growth by the end of the year, with peripheral prime locations priced under £1,000 per sq ft expected to attract the highest demand. A 3.7% pa uplift is predicted in 2017 and 2018.

Cumulative capital value growth between now and the end of 2020 should reach 19.1%.

To send feedback, email alex.peace@estatesgazette.com or tweet @EGAlexPeace or @estatesgazette