I spent a week in Africa recently, accompanied by Peter Welborn, who has overseen our Africa business for many years.

I spent a week in Africa recently, accompanied by Peter Welborn, who has overseen our Africa business for many years.

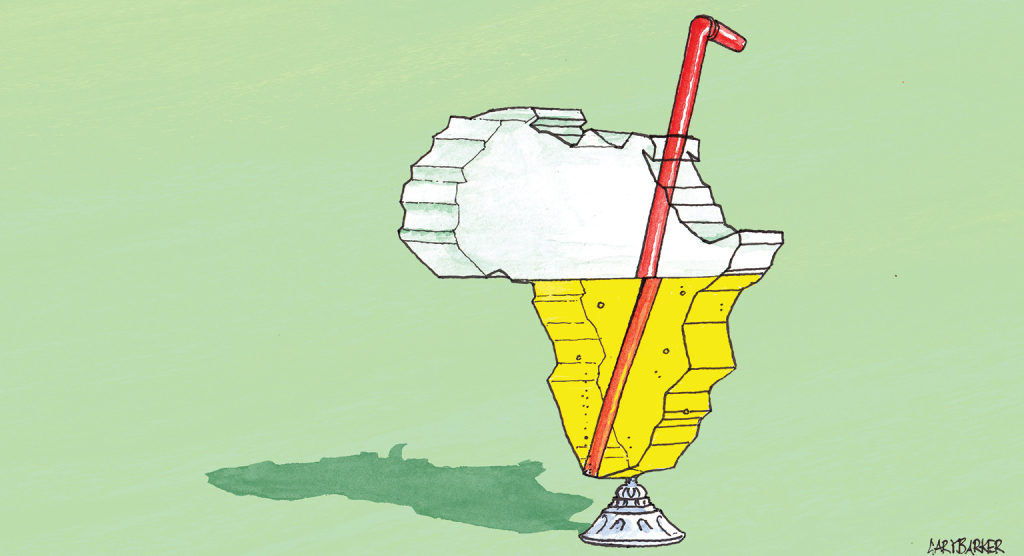

What is this place, Africa? Earth’s second-largest continent, at 30m sq km, it is three times the size of China and home to 1.1bn people as well as an array of cultures, languages and histories.

The continent’s 54 distinct countries makes any summary banal, but there are some common themes.

Economic growth has been improving. The middle class is expanding aggressively, natural resources are abundant, and global investors looking for diversity, particularly from the likes of China, India and the US, have been investing and becoming trading partners.

To contrast this, of course, are poverty, famine, war and corruption, which make comparisons with other parts of the world difficult.

Knight Frank has been committed to the region for the best part of two generations – we celebrated our 50th anniversary in Nigeria in 2015 and now have 700 people in 23 offices across nine countries. I met with the leaders of our businesses in Tanzania, Uganda and Rwanda, and while in Johannesburg visited Pretoria.

Our focus on consultancy, property management and valuations has built a dependable business producing good profits, despite exchange rate challenges.

If, as we predict, the transactional markets mature and have greater international relevance, then I believe we should be excited about the region over the next decade or two.

The continent’s standard of infrastructure varies enormously. East Africa’s is poor, while South Africa’s is good. But construction quality appeared to be consistently good, particularly for offices and logistics.

As in Europe, Africa’s logistics facilities are focused upon distribution for e-tailing. Rents are low, yields are high, transparency is sometimes lacking, but global multinationals are commonplace and I am sure their commitment to the region will only grow further, drawing in investment capital in the medium term.

Residential prices over the past few years have varied enormously, with some countries 40% down from their recent peak, others up by 40%. But prime markets will develop as wealth creation continues.

We expect to see a broader market establishing itself. Institutions and high net worth individuals across the continent will soon be looking further afield for diversification as their plans mature.

Our business is about people, and if the happy, committed and loyal people I met are anything to go by, then we have every reason to be optimistic. Indeed, at a staff gathering in Nairobi, I acknowledged the contribution of 91 of our team who had qualified for long-service awards – impressive by any standards.

In Africa, there is a great spirit and positive outlook. Although there may be setbacks, the region’s economies will continue to mature, and real estate will take a more prominent role.

Alistair Elliott is senior partner at Knight Frank