The office sector is the most likely to be affected by a vote to leave the European Union, according to property professionals.

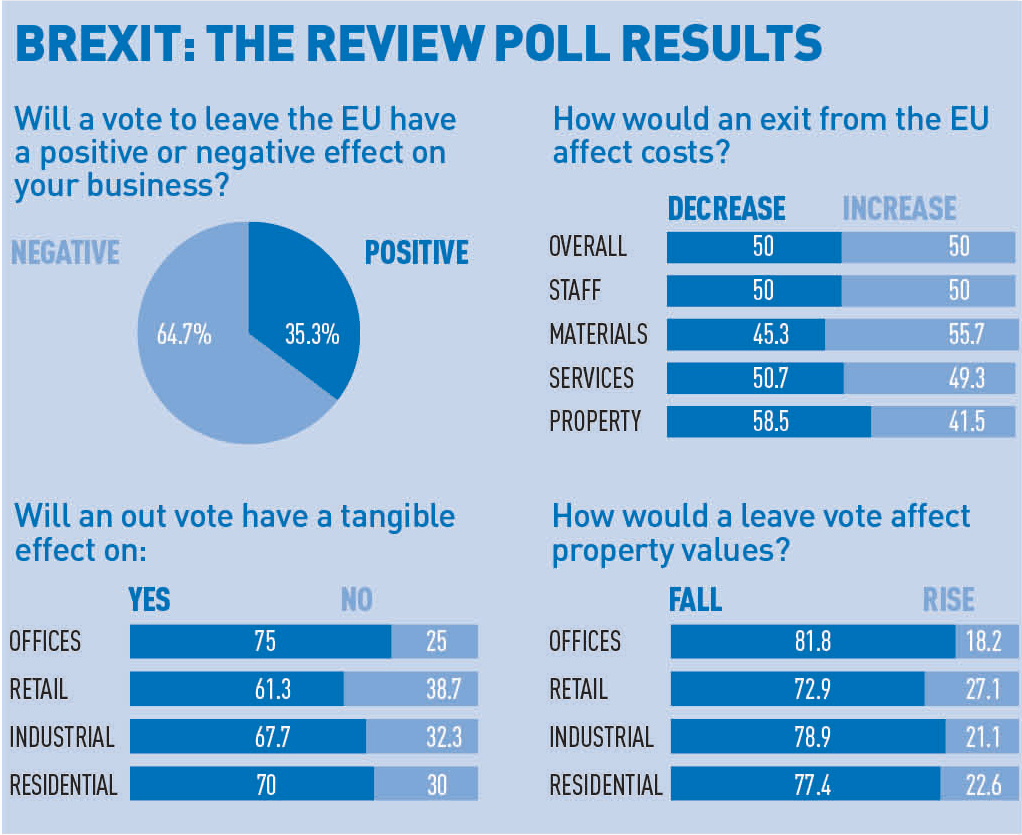

Of the 167 respondents to Estates Gazette’s REview poll, in association with Trowers & Hamlins, 75% thought the office sector would feel a tangible impact and 61.2% thought that this would be a long-term effect.

A fall in values of more than 6% was expected by 53.9% of respondents, with 12.6% expecting a drop of more than 21%.

Retail was perceived to be the most resilient property sector, with 61.3% saying there would be a dramatic change and only 47.6% saying it would be long-term. However, 48.6% still expected a fall in values of more than 6%, with only 9.4% expecting a fall of more than 21%.

Overall, 35.3% of respondents thought Brexit would have a positive effect on their businesses, with 64.7% foreseeing a negative impact.

Adrian Leavey, partner, real estate, at Trowers & Hamlins said: “The property industry appears to have responded to our survey by reversing the Euro-appropriate lyrics of the Clash: ‘Should I stay or should I go now? If I stay there will be trouble, an’ if I go it will be double.’

“Clearly the valuation uncertainty of an exit with investors’ and markets’ dislike for the unknown has had an affect on the responses. It will be good when the uncertainty of the result has passed – bring on 23 June.”

Given the overall resistance to leaving the EU, opinion was split evenly as to whether business costs would increase overall.

Some 58.5% of respondents said they expected property costs for business to fall, with 41.5% expecting an increase. A fall of 0-5% was expected by 28.9% of those polled.

Respondents were split over whether staffing costs would increase in the event of Brexit. Most expected a marginal change, with 31.3% expecting a fall of 0-5% and 23.9% expecting an increase of 0-5%.

Leslau: EU is ‘utterly undemocratic’

The biggest name in the industry so far to come out in favour of Brexit has emerged as Nick Leslau, chairman of Prestbury Investments. The property entrepreneur argues in favour of Brexit because “the EU is utterly undemocratic” and “European politics is inherently corrupt”.

Descended from Polish immigrants, Leslau says he abhors the “they-nicked-our-jobs” rhetoric surrounding immigration but adds that the UK’s advantages “need to be maintained and developed without the noose of the failed European project around its neck”.

Read Estates Gazette’s Brexit round-up >>

• To send feedback e-mail david.hatcher@estatesgazette.com or tweet @hatcherdavid or @estatesgazette