- Viewing the commercial real estate market in terms of past behaviour is unrealistic, according to experts

- Things are not going “back to normal”

The slowdown in the commercial real estate market since the start of the year has created a popular pub debate topic among agents and investors – is the slump just an effect of the EU referendum, or has there been a fundamental shift in dynamics?

But at last week’s Mayfair Capital Investor Seminar at the King’s Fund in Cavendish Square, W1, which focused on managing investment risk, experts revealed the changes that had already occurred, irrespective of the current politics.

According to Richard Jeffrey, chief investment officer at Cazenove Capital Management, economic instability and subdued growth rates are here for the long term and business and real estate leaders must adapt and innovate accordingly.

He said that historically low interest rates, quantitative easing and foreign investment into the country have helped to boost UK asset prices close to the highs of 2007, but that these factors had created the perception that everything was now “back to normal”.

Striving to attain a pre-crash market is unrealistic, however, according to the man who oversees £31bn of investment at the Schroders-owned firm. He added that the 3%-plus GDP growth rates in many western economies at the end of the last cycle that were driven by increasing indebtedness is causing “a failure in thought leadership” at central banks. Jeffrey said the UK’s current growth rate of nearly 2% and a return to budget surpluses for many countries are more realistic goals.

In order to achieve this and prevent another crash, the US and UK central banks ought to have made good on their signals to increase interest rates some time ago, he said.

Fears that an increase in the base rate would cause a dramatic slide in commercial property prices have little bearing in reality, said Jeffrey.

In order to offset increased costs brought about by an interest rate rise or even a more dramatic collapse in the market, Mayfair Capital advocates a conservative view on debt and focuses on income-based investment, said Frances Ketteringham, the firm’s head of research.

The fundamental, underlying desire to maintain a stable market through economic instruments was in itself unrealistic and distracting, according to professor David Cadman, founding partner at Property Markets Analysis.

Volatility, uncertainty, complexity and ambiguity were the marks of the current global economy, he argued, adding that property investors needed to not just change their perception of the market’s behaviour but also learn to embrace it.

Climate change, says Cadman, should be the most pressing factor for investors. Focusing on existing trophy buildings was a poor strategy compared with developing new, long-term, environmentally friendly and sustainable schemes.

In short, property investors must embrace uncertainty, deploy income-focused strategies and create buildings that will last generations.

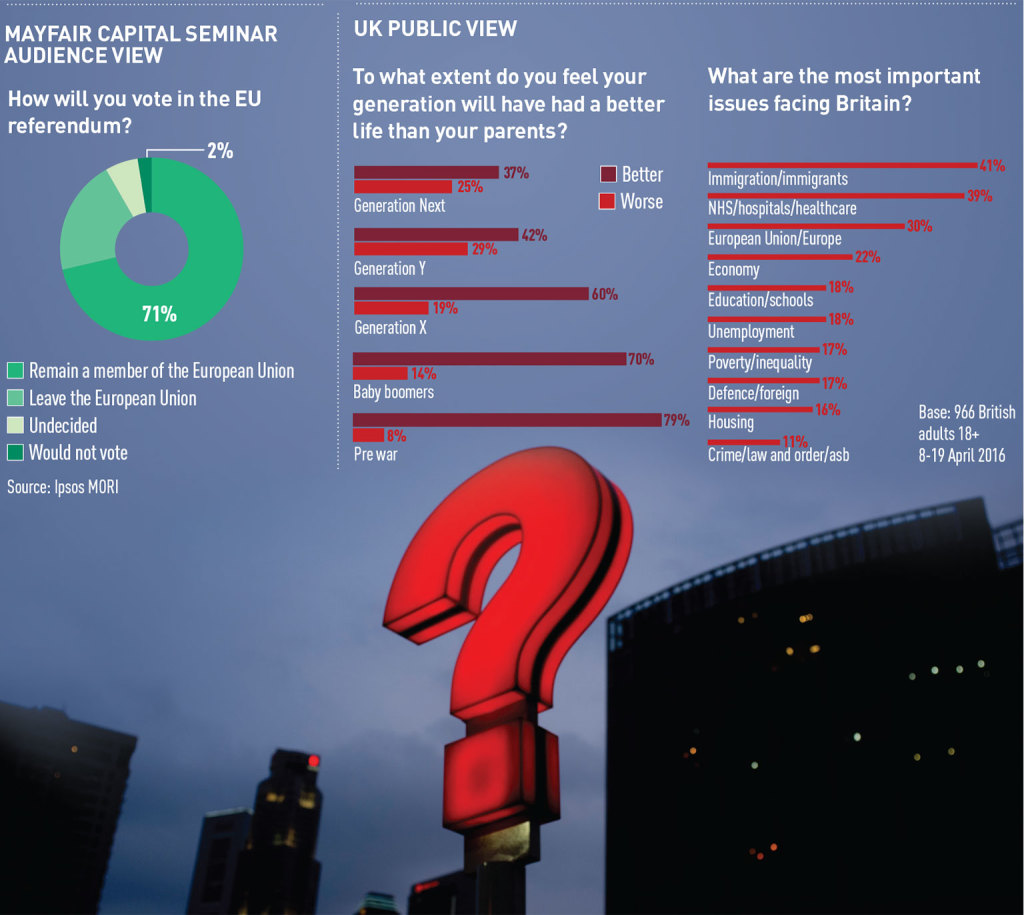

Poll results: how UK citizens perceive reality

Perception is a crucial factor in making investment decisions but it can often be dramatically detached from reality.

For example, if investors perceive that the current economic environment is underperforming, they may remain on the sidelines. But the reality may be that the economic environment is in fact “normal”.

Helen Wilson, managing director of consumer research company Ipsos Loyalty, speaking at the Mayfair Capital Investor Seminar, illustrated the extent to which this is the case, comparing the perception of the 160 property professionals in the audience to the perception of the general public and actual reality on a range of subjects.

Often the general public had a more negative view of the current situation.

• To send feedback, e-mail mike.cobb@estatesgazette.com or tweet @MikeCobbEG or @estatesgazette