Investment did not get off to a good start this year, with just £3.5bn invested in Q1 2016, down by 32% on Q4 2015 and 10% on the Q1 2015.

At first glance, the Q1 vs Q1 comparison does not look too bad but, drilling down, the picture is slightly different. Most of the larger investment deals were overspills from 2015 and two deals – the acquisition of the 36.5% stake in King’s Cross by AustralianSuper and Resolution Properties’ purchase of the Thomas More Square portfolio – accounted for 25% of the total volume.

In the months leading up to the EU referendum activity was subdued as many parties opted to await the outcome – German investment company Union Investment delayed its purchase of 51 Eastcheap, EC3, for example. No doubt the vote to leave the EU will now prolong uncertainty.

So it is no surprise that Q2 did not get off to a good start. One of the largest City deals – Fubon Life’s £500m purchase of Cannon Place, EC4, – fell through after failing to obtain regulatory approval.

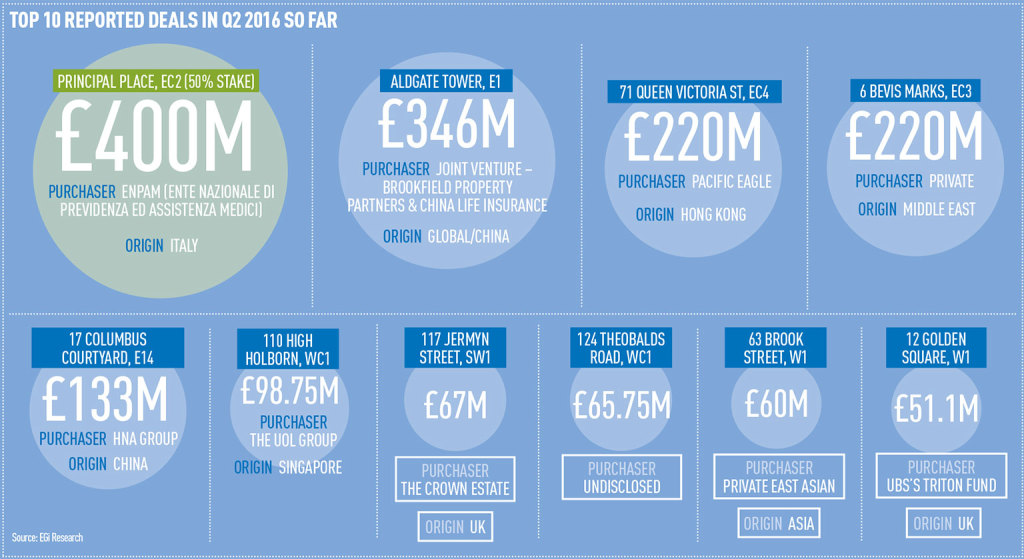

Nevertheless, there were investors undeterred by referendum uncertainty and a number of big deals in the City and City fringe. For example, Italian firm ENPAM purchased a 50% stake in Principal Place, EC2, for around £400m and UBS’s Central London Office Value Fund sold its four remaining properties for around £250m to four separate investors. The deal included EG’s HQ at 110 High Holborn, WC1, which was sold to Singaporean investor UOL Group. In the City fringe Aldgate Tower, E1, sold for £346m in April.

It is a little early for final Q2 stats but looking at the total amount for the deals reported so far the figures are ahead of the total investment seen in Q2 2013 (£1.8bn). And looking just at the top 10 investment deals reported for Q2 2016 so far, the market is ahead of the Q1 2014 low of £1.5bn.

What is interesting about the purchasers is the continued activity seen from Asian Investors who were involved in five of the top 10 biggest deals. Borrowing a phrase from 2016’s LREF, it appears “the Far East is still here despite the cool winds blowing through the market place”.

Subdued levels of investment activity are expected for Q2 and the following quarters, with some suggestions that aside from Brexit concerns the market may have also reached its peak. The EGi London data team is crunching the numbers for Q2 and the London Office Market Analysis will be published at the end of the month.

Victoria Bajela, head of EGi London office research