AccorHotels has completed its £600m acquisition of FRHI Hotels & Resorts and its three luxury brands – Fairmont, Raffles and Swissôtel.

AccorHotels has completed its £600m acquisition of FRHI Hotels & Resorts and its three luxury brands – Fairmont, Raffles and Swissôtel.

The acquisition has bolstered AccorHotels’ portfolio with an additional 154 hotels globally.

It has paid for the deal by issuing 46.7m new Accor shares and a cash payment of $840m (£639m), which has been funded by Qatar Investment Authority and Kingdom Holding Company of Saudi Arabia.

The transaction gives QIA and KHC stakes in Accor’s share capital of 10.4% and 5.8% respectively. Ali Bouzarif and Aziz Aluthman Fakhroo from QIA and Sarmad Zok from KHC will now join AccorHotels’ board of directors.

Sébastien Bazin, chief executive of AccorHotels, said: “The acquisition of these three emblematic luxury hotel brands is a historical milestone for AccorHotels. It will open up amazing growth prospects, lift our international presence to unprecedented heights, and build value over the long term.”

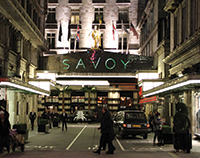

Iconic hotels which will join AccorHotels’ global network include the Savoy in London, Raffles in Singapore, Fairmont in San Francisco, the Plaza in New York, Fairmont Le Château Frontenac in Quebec City, and Le Royal Monceau Raffles Paris.

Bazin added: “By leveraging the operational synergies between FRHI and AccorHotels, we are well positioned to accelerate the growth of our luxury brands and offer guests even more exciting hotel choices and destinations to explore.”

Chris Cahill has been appointed as AccorHotels’ chief executive, luxury brands. Cahill, who most recently served as executive vice president, global operations, at Sands Corp, will lead the integration of the FRHI brands.

The vast majority of Fairmont’s, Raffles’ and Swissôtel’s hotels and resorts are operated under long-term management contracts, with an average term of nearly 30 years. They total 56,000 rooms across 34 countries and five continents. Six hotels are leased and one hotel is owned. Forty are under development.

• To send feedback, e-mail amber.rolt@estatesgazette.com or tweet @amberrolt or @estatesgazette