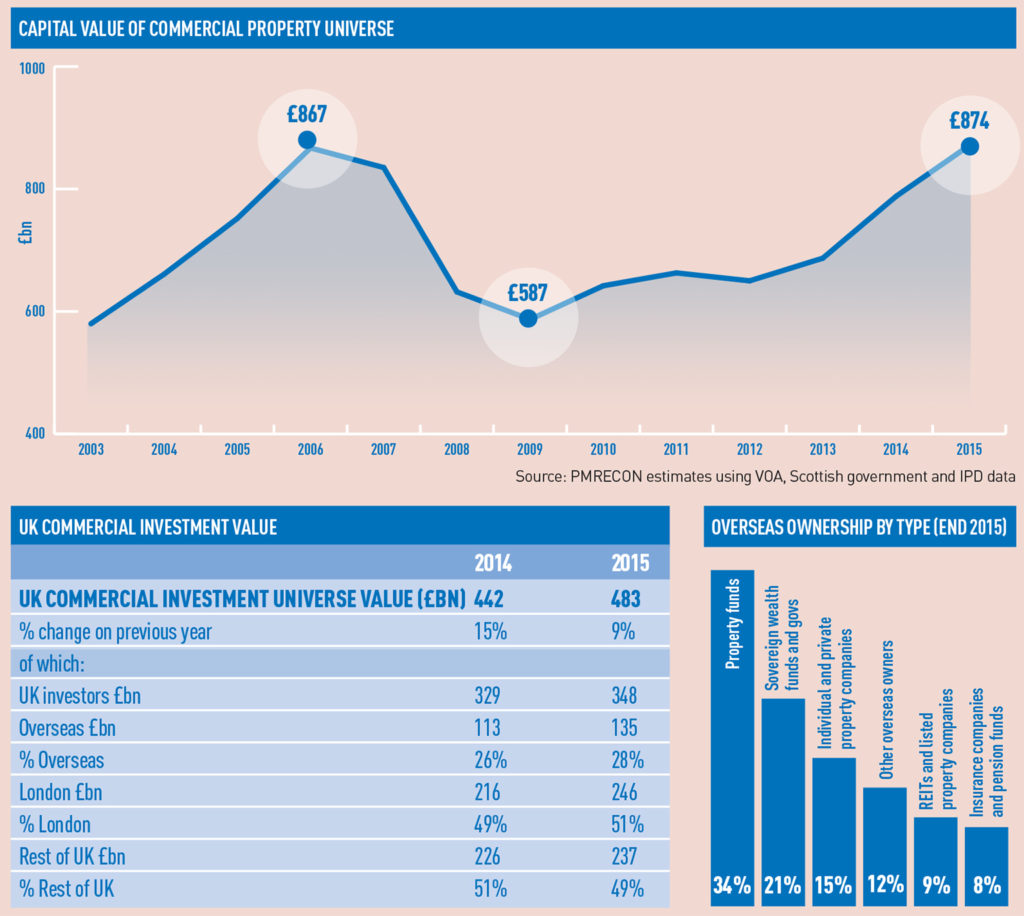

The value of UK commercial property owned by investors hit a record £483bn at the end of 2015.

According to the IPF research report The Size and Structure of the UK Property Market, overseas investor holdings rose 19.5% to £135bn in 2015, of which 21% came from sovereign wealth funds.

Funds made up 34% of foreign investment and more than a quarter of total investment.

UK insurance companies have seen their share of the commercial investment market dwindle to 9% since 2007, when it stood at 15%.

Domestic ownership accoun-ted for less than 40% of the City of London’s commercial investment stock at the end of the year.

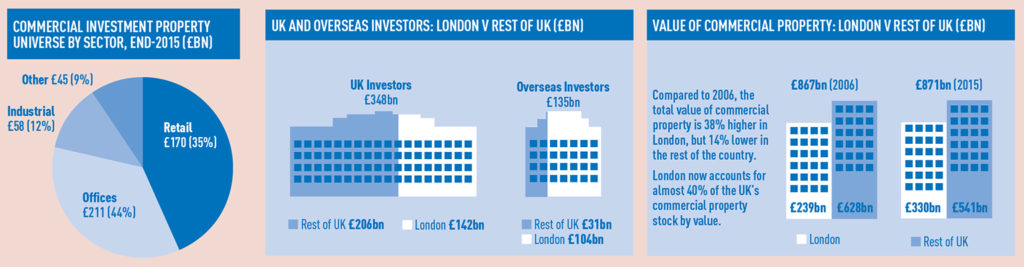

While the total value of UK commercial property in 2015 was 0.5% above the last peak in 2006, the value outside London fell 14% in the same time.

The capital accounted for nearly 40% of the total UK property stock and over half of commercial property.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette