Threesomes may be frowned upon in polite society, but when heavyweight London-based housing association L&Q announced earlier this year that it was in joint merger talks with both Hyde Group and East Thames Housing Group, few in the market batted an eyelid. This was, after all, just the latest in a series of proposed unions in the sector, albeit one that at a stroke would have made it the fourth-largest housebuilder in the UK, as well as one of the largest housing associations in Europe, with an open-market value of £30bn.

Threesomes may be frowned upon in polite society, but when heavyweight London-based housing association L&Q announced earlier this year that it was in joint merger talks with both Hyde Group and East Thames Housing Group, few in the market batted an eyelid. This was, after all, just the latest in a series of proposed unions in the sector, albeit one that at a stroke would have made it the fourth-largest housebuilder in the UK, as well as one of the largest housing associations in Europe, with an open-market value of £30bn.

Relationships with prospective partners can be difficult at times, which may partly explain why L&Q did not respond to Estates Gazette’s invitation to talk about its imminent ménage-à-trois. Early last month it became apparent that not everything was as harmonious as had been hoped when the deal fell out of bed. A press release stopped short of quoting irreconcilable differences, but it did cite “practical issues” that could not be speedily overcome.

In retrospect, the omens for a happy alliance were not good. Hyde was originally rumoured to be considering hooking up with a completely different partner (understood to be Notting Hill), but subsequently switched its affections to L&Q. By that time, though, the larger player was already courting East Thames. Three may be a magic number for some, but in this case it was obviously a crowd.

While Hyde walks away from the liaison (no doubt to be wooed instantly by one of the steadily diminishing number of London housing associations which had previously known only a bachelor existence), the other two remain committed to a now more traditional merger. Their target for new homes remains the same, but over what timescale has yet to be clarified.

Genesis, which was tipped to be the first of the London housing associations to make it over the threshold, unexpectedly dropped its merger plans with Thames Valley Housing Association at the end of last month. Genesis chief executive Neil Hadden, who had previously highlighted the combined body’s ability to build more homes each year, says: “It is obviously disappointing that we were not able to complete the merger, but we are very much looking forward to delivering on our corporate strategy and looking at other possible opportunities in the near future.”

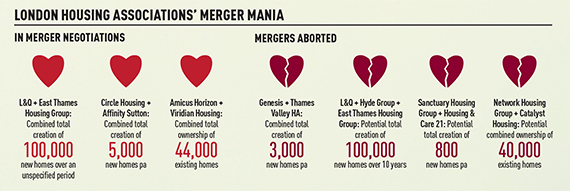

As the graphic on the previous page shows, there are three sets of partners involving London housing associations currently considering tying the knot. They, like the potential mergers before them and the likely many more to follow, all have the blessing of government.

It is not hard to see why: the common denominator is the promise not just of more homes, but a faster output of new properties in and around Greater London. If any of the existing couples make it up the aisle, expect housing and London minister Gavin Barwell to look prouder than the father of the bride and chief usher combined.

Savills’ head of housing consultancy Mervyn Jones says that while the critical mass of merged housing associations may make it easier for them to access cash than housebuilders, the lack of consented land remains a hurdle. He points to L&Q’s purchase earlier this year of Bellway’s interest in the 11,000-home Barking Riverside scheme in east London as a potential solution. “But few others have so far taken the strategic step of buying development land,” he says.

Merged associations may well be more willing to do this and their increased size may also give them more clout with politicians. “First they need to show they can deliver – then they will be in a good position, as we now have a government more prepared to listen than the previous administration,” says JLL lead director of residential advisory Richard Petty.

Geeta Nanda, chief executive of Thames Valley HA, has no doubts about the former. She says: “We need the flexibility to say, ‘In this climate this is how we can make it viable and who this works for’. Let us get on with it and we will produce.”

Amid the current frantic bout of hat- and confetti-buying some, such as Rapleys partner Nick Fell, calmly suggest that housing associations do not have to rush into full-on mergers. He says: “There are alternatives, such as sharing back-of-house staff or entering into joint ventures.”

Last month L&Q did exactly that. At around the same time as its initial London merger crumbled, it announced it was partnering with Trafford Housing to build 4,000 homes in Manchester over the next four years. How East Thames will feel about L&Q’s other partner remains to be seen.

Opportunity knocks for surveyors

Just a decade or so ago, many ambitious surveyors, drawn to the bright lights of the capital, would have simply rolled their eyes at the suggestion that they could further their career by taking on a post at a housing association.

Now, however, their attitudes have changed dramatically. And so have those of their would-be employers. Matt Halfpenny, business development director at the Property Recruitment Company, explains: “Housing associations are looking to attract quite different kinds of candidates than they were 20-30 years ago. Now they are asking me to get them someone from a private sector developer background who can purchase a certain amount of land.”

As housing associations increasingly distance themselves from what they might see as local authority mindsets, they are more likely to seek candidates from outside the sector. This has opened up the prospect of a new career path for surveyors who previously would not have considered working for a housing association. Neil Hadden, chief executive of Genesis, certainly expects more opportunities for development surveyors.

While there may be less embarrassment about putting housing association experience on a CV, many surveyors may still be approaching such a position as a three year-long stepping stone rather than a final destination.

Halfpenny says: “There is still a bit of a stigma attached to organisations that are perceived by some as having not been very forward-thinking in the way they managed and developed properties.”

That stigma could quite quickly evaporate if attractive pay packages are thrown into the mix. Transparency over salary levels means those heading for land acquisition roles have already seen pay scales rising from £50,000-£60,000 pa towards £75,000-£80,000, says Halfpenny.

He adds: “If you want to attract the best people to spot on- and off-market opportunities and have relationships with landowners, then it is going to cost money. Housing associations will have to mirror the private sector for pay and benefits.”

Nick Fell, a partner at Rapleys, who has previously been on the valuation panel for most of the G15 housing associations, agrees, noting that salaries are likely to align with those of private house builders. “And in fact, the quality of the work environment within a housing association could be better,” he says.