Berkeley Group has fallen out of the FTSE 100 with housebuilders’ share prices taking a battering in the wake of the 23 June EU referendum.

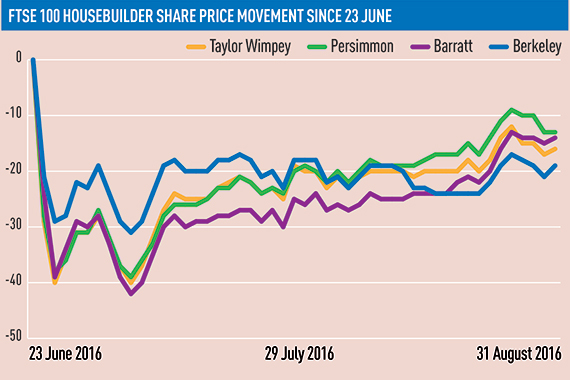

Berkeley Group has fallen out of the FTSE 100 with housebuilders’ share prices taking a battering in the wake of the 23 June EU referendum.

The company, headed by chairman Tony Pidgley, was the only one of the four housebuilders within the top index to have slipped out when the first-post referendum adjustment was made on 31 August.

This was despite the four, which also include Barratt Developments, Taylor Wimpey and Persimmon, suffering an average loss of 16.2% as of close on 30 August. Berkeley’s share price is down by 21% from pre-referendum levels.

Despite being omitted, Berkeley led the FTSE 100 in share price gains on the day of the review with a 3% rise, following it with further gains the day after.

Alan Carter, an analyst at Stifel, said: “It is a reflection of sentiment. If it was anything fundamental, the shares wouldn’t be up by 7% in fewer than two days. It’s simply a reflection of Brexit, timing, when the index gets reviewed, and the fact that Brexit killed the housebuilders.

“There’s no evidence to suggest it’s appropriate. It was a knee-jerk reaction, and now we’re seeing that it’s not bad at all. Berkeley will now start trading more on what the market thinks of the fundamental prospects of the business.”

The FTSE index is reviewed once a quarter based on how the listed companies’ market capitalisation rank against each other. Any FTSE 100 company falling below 111 in the rankings on the day before the review is automatically relegated.

Berkeley closed at 115 and was replaced with mining company Polymetal International.

Berkeley entered the FTSE 100 last September, giving the index an unprecedented four housebuilders. None was within the index from 2009 to 2013, the year that Persimmon entered.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette