Do developers really restrict the supply of new homes to keep prices high? The fact that 750,000 homes across the country have yet to start despite being granted planning permission could be evidence for this. Right of centre thinktank Civitas has made that exact charge.

But there is more to the story. For example, a newsagent will always stock far more chocolate bars than they would sell. They never want to be in a position where they run out. It is exactly the same with housing and planning consents. A developer with no land and no consents that they can “bank” on in years to come, is simply not a developer at all.

Due to the irregularities and huge uncertainty surrounding applications and the process of getting them through the system, developers need a five-year land bank.

With a national target of 250,000 new homes built every year, the actual land bank needed to efficiently meet that would be closer to 1.3m.

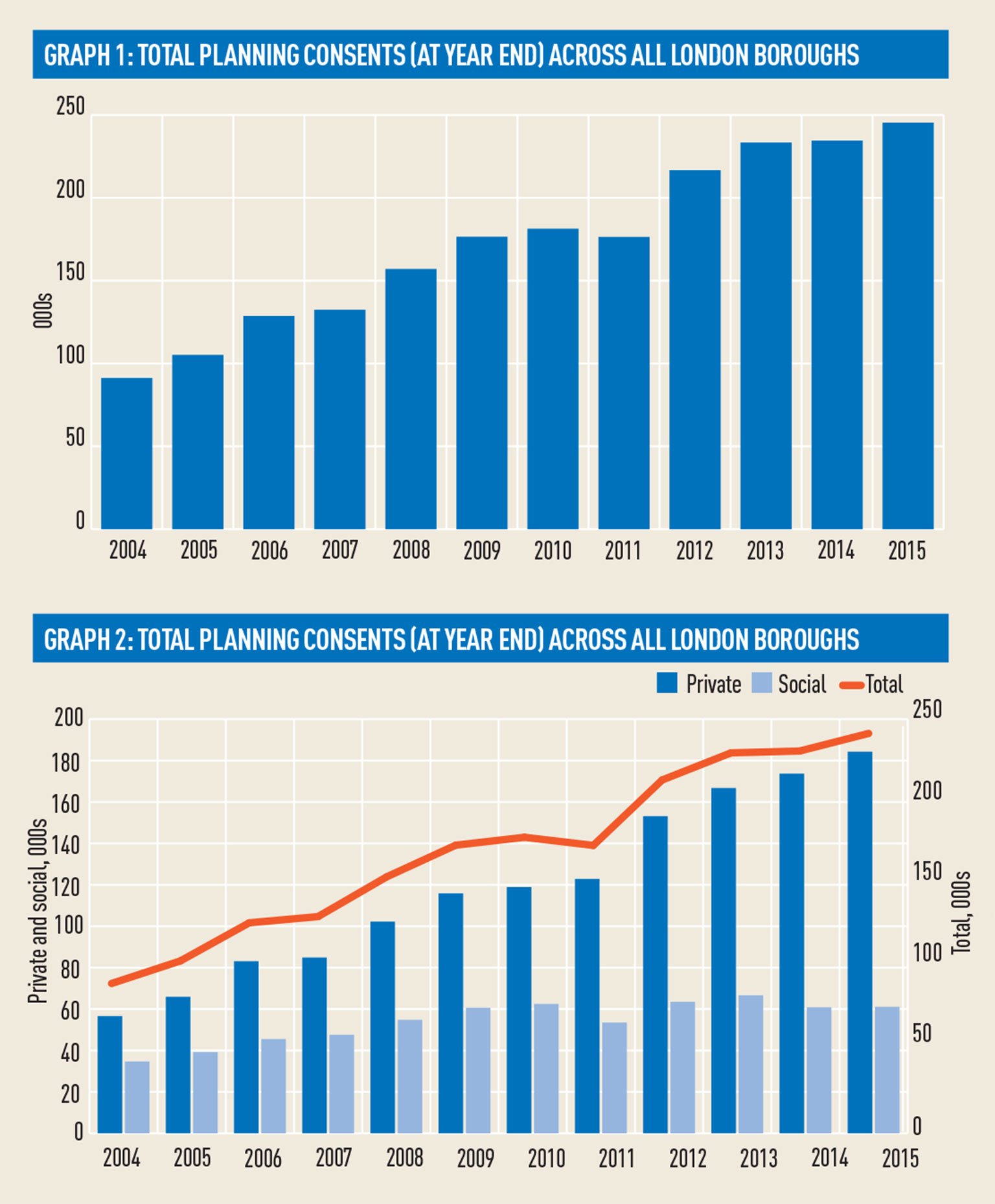

In London, the combined planning consents across all boroughs have been growing pretty much year-on-year (see graph 1).

The year-end figures for 2015 show that close to 250,000 homes have planning consent, but have yet to start. With a target of 50,000 new home completions every year, that holy grail of a five-year land bank looks to be in place.

Even more intriguing is the breakdown of the pipeline.

Graph 2 looks at the split between private and social consents. The social/affordable units in a state of “consented, but yet to start” remains fairly similar and has not really grown since 2009. But the private pipeline has nearly doubled.

If planning is not at fault, what is? As Tony Pidgley, chairman of Berkeley Homes, pointed out last week, transaction taxes are having a negative effect. Get those right, diversify tenure split, with more PRS/build-to-rent stock, and split large sites up with a greater pool of developers, all of which will accelerate delivery, and London might just get nearer to that 50,000 new homes per annum target.

So what about that 750,000 figure? A multiple of five on the number of homes currently being built each year (150,000) equals 750,000, which shows developers are not restricting the supply of new homes to keep prices high.

Interact with Wellman on Twitter @paulwellman_EG