Alex Barnes navigates the increasingly complicated tax landscape for investors in, or considering entering, the private rented sector

Alex Barnes navigates the increasingly complicated tax landscape for investors in, or considering entering, the private rented sector

The private rented sector (PRS) in the UK has grown substantially in recent years and is likely to continue to do so. Growth in this sector has occurred for a number of reasons, including many people having insufficient deposits to purchase a property and the failure of wages to keep pace with house prices.

Numerous investors are increasingly looking to get into this sector and those investors come from a wide spectrum – from large corporates to private individuals. Some see the PRS as an alternative to a traditional pension, with rising house values and rents – in the main due to a massive undersupply of housing stock – seen as offering a better, and perhaps more certain, long-term return than equities.

This growth is in spite of the government continuing to clobber investors with new and increased taxes and chipping away at existing reliefs all as part of its apparent policy to boost home ownership.

So, what are the reliefs available and the taxes chargeable on those in or looking to get into the PRS and for those disposing of residential property other than their principal residence?

Buying residential property

Stamp duty land tax (SDLT)

Purchases of residential property by a company, a partnership (of which at least one member is a company) or a collective investment scheme are potentially subject to SDLT at a rate of 15% on the entirety of the purchase price. Suffice to say that what is considered to be “residential property” is hotly disputed. The SDLT legislation says that “residential property” includes property used as a dwelling, suitable for use as a dwelling or in the process of being constructed or adapted for use as a dwelling. The general rule is that the use of the property at the SDLT trigger date determines whether the property is at that point commercial or residential. HMRC’s own guidance provides that it may however consider as residential property a building for which the last use was offices but before the date of sale has had planning permission granted for use only as a dwelling. Understandably this is somewhat controversial.

There are various reliefs from the 15% rate, including where the property is let as part of a property rental business (albeit not all rental businesses qualify), but beware: having claimed the relief, it can be clawed back in certain circumstances.

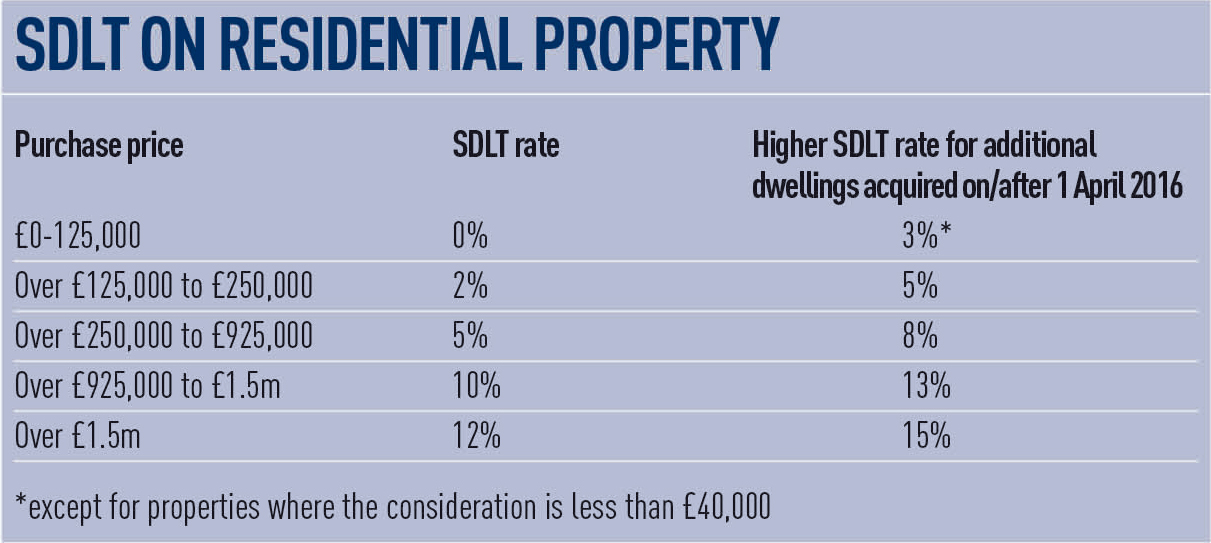

If a company can avoid the 15% charge on the entirety of the purchase price it will, as will private individuals acquiring additional dwellings, still be subject to an additional 3% SDLT charge on top of the current rates for SDLT (see table). These additional charges were introduced with effect from 1 April 2016 and there are virtually no reliefs from them.

It is possible that multiple dwellings relief could be claimed by purchasers on the purchase of two or more dwellings as part of the same transaction and, if available, this can significantly reduce the relevant SDLT liability. Alternatively, if acquiring six or more dwellings, the non-residential rate of SDLT, with a 5% maximum charge, could apply.

Value added tax (VAT)

No VAT is payable on the acquisition of residential property, but VAT incurred in connection with the purchase, such as VAT on professional fees, is likely to be irrecoverable from HMRC and therefore an absolute cost.

If the property acquired is a commercial property that will be converted into dwelling(s) it is possible that VAT will be charged on the purchase price. If VAT is charged this will increase the SDLT liability, as SDLT is payable on VAT. With planning it should be possible to ensure that such VAT can be recovered from HMRC, albeit it may create a cashflow cost. Even if the VAT is recovered, the SDLT on the VAT cannot be reclaimed.

Capital allowances

It should be possible to claim capital allowances on plant and machinery in the communal parts of a residential building and therefore, on the purchase of any such property, any capital allowances available for transfer should be sought as these could reduce tax on rental profits going forward (see below).

Owning residential property

Rental profits

Tax will be payable on rental profits. This will be at either 20% for UK corporates (being the current corporation tax rate), at the relevant individual’s marginal rate (up to 45%) or at 20% for non-UK landlords. From those rents can be deducted the usual deductible expenditure including interest payments (albeit see below) and capital allowances.

For private individuals, mortgage interest can currently be deducted in full against rental profits. From April 2017 that relief is to be restricted and by April 2020 it will only be possible to claim relief at the basic rate (currently 20%) of whatever interest the property owner pays. So, for example, where an individual landlord pays £10,000 of interest in 2020, he/she will (assuming basic rate tax is still 20%) only be able to reduce their rental profits by £2,000 for interest payments (whereas now they could reduce such profits by £10,000).

For corporates, interest should still be fully deductible from rental profits, albeit that too may be under threat as a result of the Organisation for Economic Co-operation and Development’s base erosion and profit shifting programme.

For tax years up to and including

2015-16, landlords of furnished lettings were entitled to a “wear and tear” allowance, calculated as 10% of their income. From April 2016 this allowance has been abolished, although a tax deduction can still be claimed for certain expenditure incurred replacing items in the relevant property.

VAT

VAT incurred in connection with the letting of the property and the maintenance of it is in the main unlikely to be recoverable unless it falls within certain de minimis limits. No VAT is chargeable on rents.

If commercial property has been acquired with a view to converting it to residential property, it is possible, in certain circumstances, to benefit from a reduced rate of VAT (5%) which can soften the VAT impact if VAT is irrecoverable on the project.

Annual tax on enveloped dwelling (ATED)

ATED was introduced in 2013 as a deterrent to holding residential property in a corporate structure. It applies to properties with a value in excess of £500,000 and can now be up to a whopping £218,200 per annum. ATED does not apply to individuals and should not apply to any other purchasers of residential property that intend to let it as part of a commercial letting business as there is a specific exemption for such letting activities.

Selling residential property

ATED capital gains tax

If no ATED charge is payable during the ownership of the property then there will be no capital gains tax charge (CGT) under the ATED CGT rules. For any residential properties that fall within the ATED charge, UK CGT will be payable on some/all gains arising from a disposal of residential property. Certain entities will be exempt from ATED CGT, including companies with institutional investors, open ended investment companies, charities and registered pension schemes.

CGT

CGT will be payable by all UK taxpayers, whether corporates or individuals, on gains made from the disposal of residential property.

Since April 2015 many, but not all, non-UK owners of UK residential property have been brought within the UK tax net and will now be subject to UK CGT (“non-resident CGT”) on some/all gains arising from the disposal of residential property if they are not already subject to an ATED CGT charge. Certain entities will be exempt from any non-resident CGT charges including companies with institutional investors, charities and registered pension schemes.

There can be no double charge to CGT under both the ATED CGT and non-resident CGT rules. The ATED CGT rules take priority and only if CGT is not payable under those rules will it potentially be payable under the non-resident CGT rules.

VAT

No VAT can be charged on the sale of residential property and any VAT incurred by the seller in connection with the sale, such as VAT on professional fees, is likely to be irrecoverable from HMRC and will be an absolute cost.

Complex tax rules won’t stop the PRS

Owning UK residential property is no longer as tax-efficient or attractive as it once was, with the government’s on-going policy of restricting available tax reliefs, increasing existing taxes and introducing new taxes. It is arguable, however, that the government’s policy to try to restrain the growth of the PRS will ultimately backfire as many of the additional costs incurred by landlords will get passed on to tenants by way of increased rents.

Despite the recent changes, investors’ desire to get into the PRS continues unabated and while house prices continue going up and housing stock lags woefully behind demand, the PRS is likely to remain popular for many years to come.

Alex Barnes is a tax partner at Irwin Mitchell