As LondonMetric, CapCo and Gecina this week take on hundreds of millions in low-cost debt, investors are evenly split over the long-term impact of low interest rates.

As LondonMetric, CapCo and Gecina this week take on hundreds of millions in low-cost debt, investors are evenly split over the long-term impact of low interest rates.

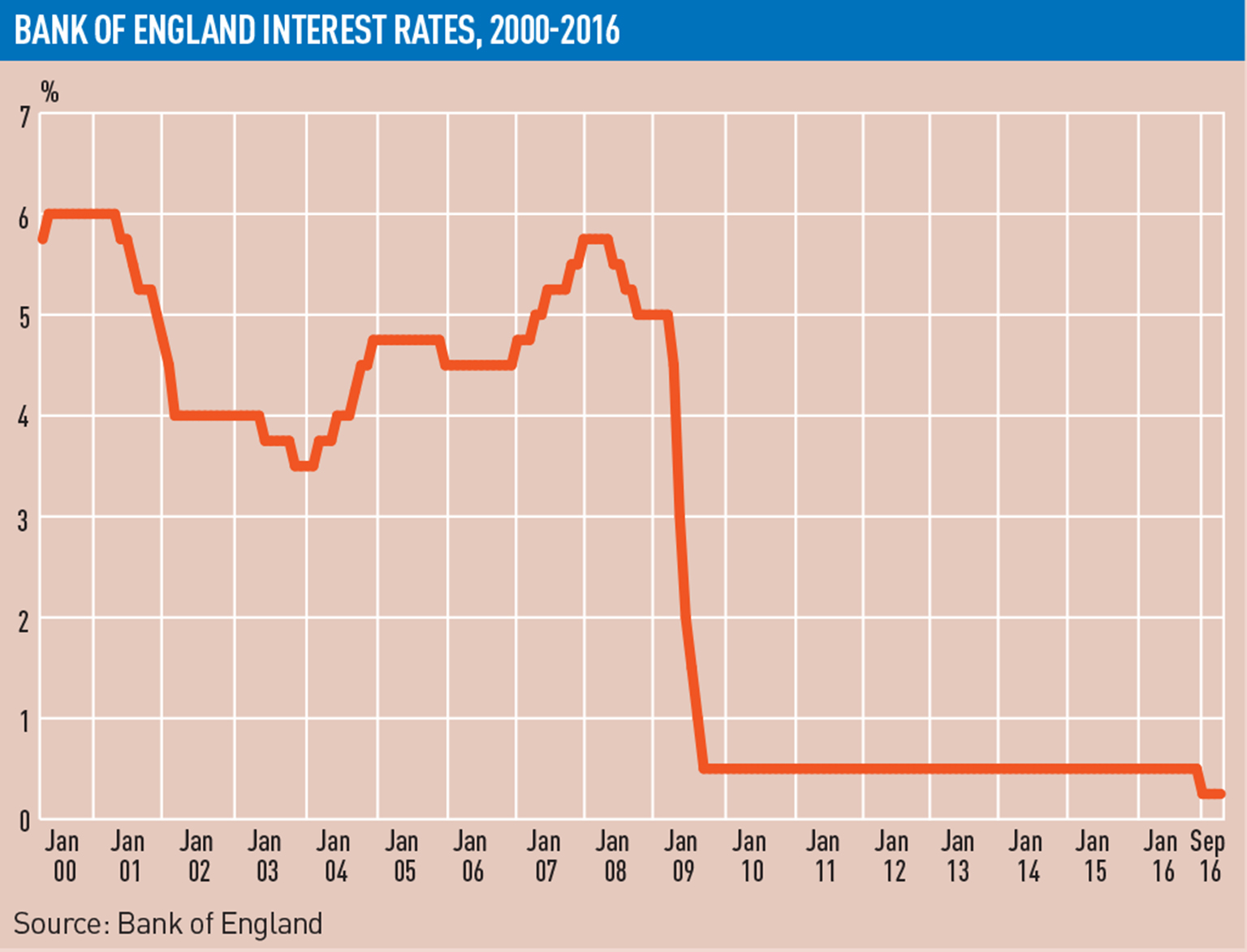

In a Moody’s survey of 91 investors and analysts, 51% of respondents said the Bank of England’s base rate cut in August would be beneficial because funding would be cheaper (see pie chart).

However, 49% said it would hurt the industry by creating the conditions for unsustainable valuations and reckless spending, especially as expectations were that interest rates would not rise in the coming years.

Are lower-for-longer interest rates good or bad for property?

The good argument

“Commercial property is a capital-intensive industry and the cost of finance makes a big difference to sustainability and profitability,” says Ramzi Kattan, a senior analyst at Moody’s.

In a low interest-rate environment, a company could refinance its debt at a much cheaper rate for longer. French REIT Gecina issued a €500m (£429.6m) bond last week with a maturity of 12 years and a coupon of 1%, a record low for the industry.

Although this is an exceptional case, most commercial property companies Moody’s rates could refinance themselves at lower rates than they are currently paying, Kattan says. A company might choose not to refinance, though, because the cost of breaking an existing facility could be too expensive.

The bad argument

With lower rates, there is a worry that firms will become more reckless with speculative developments and higher LTVs.

However, Kattan says propcos have become more disciplined and a combination of hindsight after the global financial crisis, prudent management decisions and shareholder pressure on listed companies has kept gearing at around 40% even when cheap funding has been available.

The other concern is that low interest rates often lead to yield chasers – investors which look for any asset that provides attractive yields. Compared with 10-year government bonds, which have a 0.7% yield, real estate offers relatively high returns.

The problem, Kattan says, is that yield chasing tends to underprice risk, which leads to unsustainable valuations.

Financing deals prompted by cheaper money

LondonMetric

- Private placement 22 September: £130m, 2.7% blended fixed-rate coupon, 8.3 years weighted average maturity

- Net existing debt (March 2016): £591.2m, 3.5% average cost of debt, 5.6 years to maturity

Gecina

- Bond issued 23 September: €500m (£429.6m), 1% coupon, 12.3 years to maturity

- Net existing debt (June 2016): €4.7bn, 2% average cost of debt, 5.2 years to maturity

Capital & Counties

- Private placement 26 September: £175m, 2.3% weighted average coupon, 10.6 years weighted average maturity

- Net existing debt (June 2016): £686.1m, 2.8% average cost of debt, 5.2 years to maturity

Low interest rates: the cause of the next housing bubble burst?

UBS’s Global Real Estate Bubble Index has blamed the overvaluation of housing markets in major cities on “excessively low” interest rates.

Combined with continued demand from China and a rigid supply, low rates create the conditions for soaring house prices.

As a result, London’s property market has seen a 50% rise in value since 2013 (adjusted for inflation). Real prices are 15% up from the 2007 peak while real incomes are 10% down.

The discrepancy between prices and economic growth, UBS says, puts the city at risk of a “major price correction” if supply or interest rates were to suddenly rise or international capital flows were to shift away from the UK.

When that might happen, though, no one knows.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette