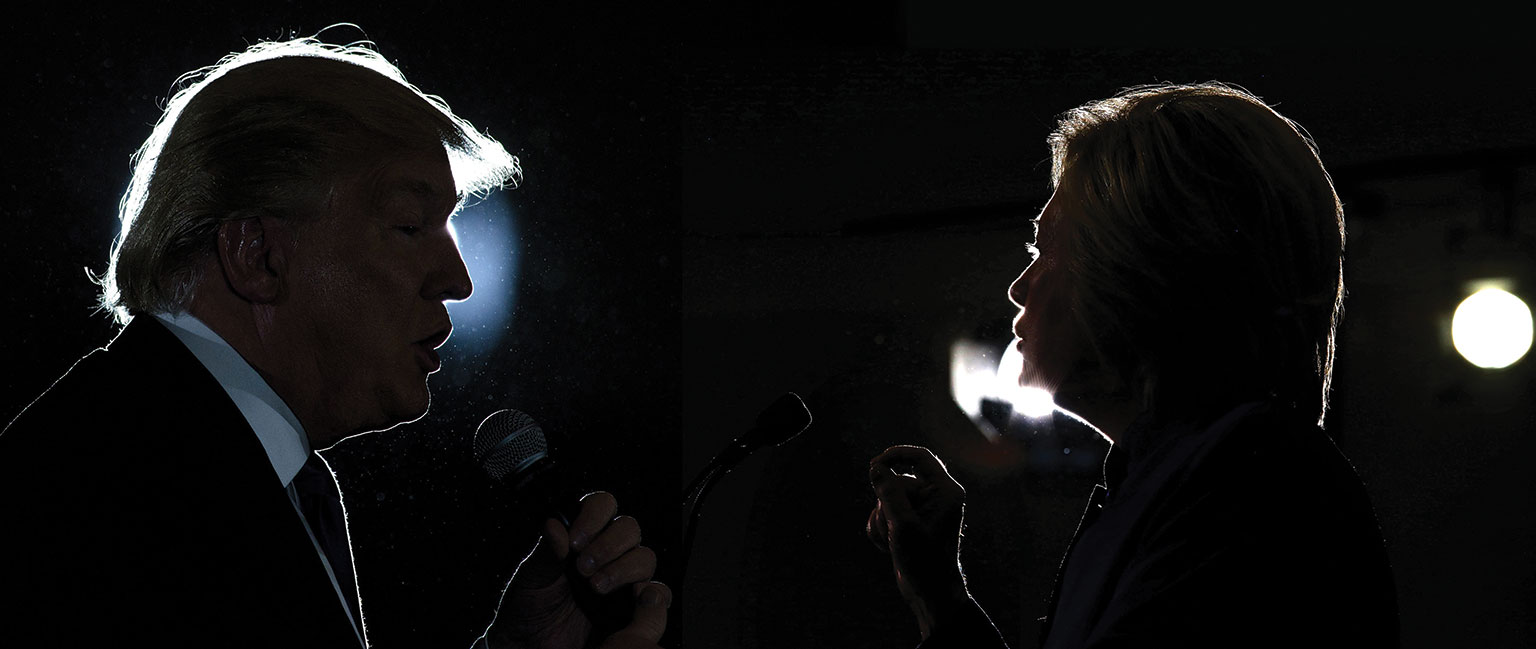

Janie Manzoori-Stamford assesses Trump’s policies following the remarkable result of the presidential election

Real estate tycoon Donald Trump has now won the Oval Office but what impact will his policies have on the property market in the US?

Trump is focused on cutting taxes, eliminating regulation and ending trade deals. He has pledged to increase spending on infrastructure, promising “at least double” what his rival floated while remaining vague on how he would raise the cash.

“We’ll get a fund. We’ll make a phenomenal deal with the low interest rates,” he said, when he announced his aims in August. “People, investors. People would put money into the fund. The citizens would put money into the fund.”

Trump has suggested that the cost of paying for his infrastructure programmes can be covered by enticing the almost $2.5tn in US corporate profits being held overseas back into the country through tax cuts. A great idea in principle, but by no means a guaranteed revenue source.

“What is clear with a Trump programme is that massive tax cuts without any clear economic case for revenue generation that can maintain basic services and infrastructure represents a huge risk,” said Adam Challis, head of residential research at JLL before the vote.

“Any major business will be looking at big tax savings on the one hand with a level of support, but on the other hand with a level of real concern about what that means for basic infrastructure.”

The US has been in recovery since its economy bottomed out in 2009. Growth has been resolutely slow, averaging just 2% a year compared with the 4% that is typically achieved in rosier times. But while it is also the fourth-longest period of expansion in the country’s history, US economic cycles last, on average, seven to nine years. So a downturn could well be on the horizon.

Trump: ‘I want a major tax cut’ • Clinton: ‘We need to get the wealthy and corporations to pay their fair share’

Heidi Learner, chief economist at Savills-Studley, said before the vote: “The next president will be inheriting a period of growth that has lasted for more than seven years. It would be unfair – especially coming out of a deep recession – to expect the next four years to continue as the past seven-plus have.”

Politics and property

But what does this mean for the rest of the world? And for global property markets specifically? The US economy is a key driver of advanced economies around the globe.

Pippa Malmgren, economic adviser to former president George W Bush and founder of London-based DRPM Group, suggested before the vote that if Trump became the next occupier of the Oval Office, the US could become even more attractive to foreign capital seeking real estate opportunities.

“He will lower taxes and suddenly the US will be a very competitive place for people investing in property. And Britain will face competition not from the EU, but from the US,” she said. “And since the international community doesn’t like him, they’ll all be selling dollars. That will make the US even more competitive and reduce the price of properties across the country.”

Could a Trump victory deter property investors from putting money into the US? Challis thinks so.

“There is no question that some of Donald Trump’s, to put it mildly, xenophobic commentary would curtail capital flows into the US fairly directly. And that capital has to go somewhere. Britain and the EU, as the other large bastion of relatively safe, democratised markets, would be the obvious counterpoint,” he said

The Brexit factor

Britain’s vote to leave the EU may provide further clues about the complex market responses to geopolitical uncertainty.

Investors pulled £483m from UK property funds in July as they digested the referendum result. Around £18bn was frozen in UK retail funds as several major asset managers, including Aviva, M&G and Standard Life, called a temporary halt to withdrawals. But the panic was short-lived and within a fortnight many of these funds eased the restrictions.

At the same time, the fall in the value of the pound against the dollar sparked speculation that Britain’s property market might, for foreign capital, be experiencing the equivalent of a blue cross sale.

“That’s what’s happening in Britain right now,” says Malmgren. “Sterling is down and everyone is saying, ‘Hallelujah, it’s a sale’. How often do you get 20% off British property assets? Even in the financial crisis this didn’t happen.”

But is that exactly what is happening? Savills-Studley’s Learner thinks not.

“Pre-referendum, we saw a real pause in overseas capital inflows and while deals continue to be made, it would be unfair to say we have seen a wave of new investment capital coming in, even though we could argue that the weakness of the pound presents a real buying opportunity,” she says.

“We should look at real estate in general as being a safe investment. Perhaps any weakness at the margins could be seen as an opportunity for more capital to come into the US. Would a strengthening dollar make overseas investors look elsewhere, such as other G7 countries? It’s unclear, but flows from China would likely be unaffected, for example.”