The UK is set for a fall in house price growth, transaction levels and housebuilding starts, according to JLL and Savills.

Both agents have revised their forecasts significantly since last year, and agree that the age of booming house prices is over for a while, partly as a result of Brexit uncertainty. Lucian Cook, director of research at Savills, said: “It’s Brexit that has created this period of low interest rates. But it is also about stamp duty on additional homes, the prospect of mortgage regulations and a reduction in tax relief.”

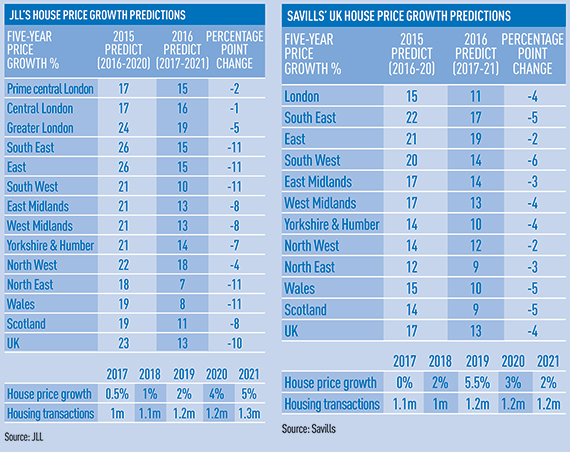

Savills predicts that prices will flatline in 2017, followed by moderate increases to create 13% growth over the next five years to 2021. But that overall rise is down from the 17% that Savills predicted last year for an overlapping five-year period to 2020.

This time last year JLL was predicting a UK five-year price growth of 23% by 2020. A year on, it has dropped its estimates for the next five-year period to 2021 to just 13% – a 10 percentage point correction.

Adam Challis, head of residential research at JLL, said: “The picture is a downward movement across the board but as ever, there are regional manifestations, both leaders and laggards. The weakest markets in our view are those with stronger ties to EU trade. The North East, Wales and the South West stand out a little bit.”

But even the South East, which has always been a strong market, has seen a large forecast change.

The region’s price growth to 2021 is now estimated to be less than that of the North West, which JLL says will be aided by an active Manchester market.

Savills predicts the lowest house price growth will be in Scotland and the North East, with the biggest correction to its 2015 predictions in the South West.

Another JLL prediction is a “falling back” in the rate of housebuilding, after a period during which the number of housing starts was “positive and encouraging”. This slowdown will be particularly visible in the centre of London, JLL added.

Housing starts in London will drop from 23,700 in 2015, says JLL, to an estimated 18,000 by the end of 2016 and then to 16,000 in 2017. It will take five years to catch up to 2015’s level.

Savills is putting off its prediction for housing starts until after the Autumn Statement, when a white paper on housing from housing minister Gavin Barwell is expected to be delivered.

However, the agent said that transaction levels, which it expects to fall from 1.2m in 2016 to 1.1m in 2017 and further to 1m in 2018, would affect the number of new builds.

Cook said: “[Low transaction levels] will create challenges for housebuilders to deliver homes. That’s why the content of the government white paper is so important.”

Meanwhile, rental growth looks more positive over the next five years, according to Savills. Good news for the growing number of investors in the private rented sector, although there is uncertainty.

The agent is predicting rents to rise by 19% across the UK over the next five years. In London, rents are predicted to rise by 24.5% and by 27.5% in Bristol and 17% in Birmingham and Manchester.

Lawrence Bowles, research analyst at Savills, said: “The prospects for Bristol, Birmingham and Manchester are strong. Their knowledge-intensive, high-tech economies draw in highly skilled and highly paid employees. A vibrant cultural scene, world-class universities and regeneration help drive rising demand.”

Bowles said that because demand has not been met by house construction, rents would grow.

Cities with fewer knowledge-sector jobs will see lower growth. Sheffield, Liverpool and Nottingham are forecast to see rental growth of just 8%, 11% and 12.5% respectively, said Savills. It added that an expected tightening of affordability, with higher inflation and a weak pound, would leave people with less to spend on rent.

• To send feedback, e-mail david.lindsell@estatesgazette.com or tweet @DavidLinsellEG or @estatesgazette