MSCI is revealing improvements to its residential index, following industry calls for a more comprehensive database.

MSCI is revealing improvements to its residential index, following industry calls for a more comprehensive database.

As the professional rental market has grown, so too has the need for an independent and accurate index. Without one, precise and consistent performance returns cannot be recorded, or benchmarked against peers or other asset classes.

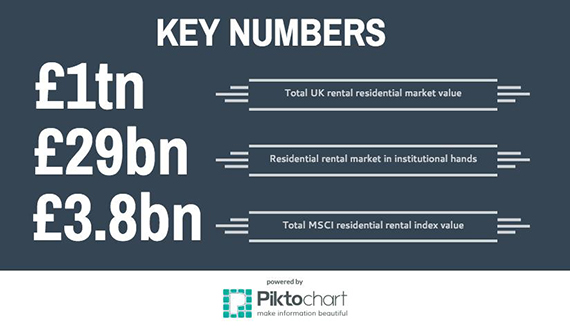

IPD, and later MSCI, which bought IPD in 2012, have collected data for the UK Residential Index for the past 15 years. As the rental market has grown rapidly recently, there have been concerns the index has not kept up.

The index is relatively small, valued at around £3.8bn, heavily weighted towards London and only released comprehensively on an annual basis.

It has struggled to grow in scale and attract the new breed of investors. One operator said prices needed to drop to attract people into the index to begin with.

An Investment Property Forum paper, created by its residential steering group, listed three key hurdles to further residential investment. One was the need for a “widely adopted index”, a direct reference to MSCI, while the others referenced the need for accurate valuation methodology and management consistency.

“The IPF has identified the lack of a representative, recognised and widely adopted index as one of several fundamental hurdles to the establishment of a large-scale residential investment market in the UK,” says Jean-Marc Vandevivere, a member of the IPF residential steering group and chief executive of Platform.

“MSCI/IPD has been running the residential performance index for more than 15 years and has a huge cache of historic performance data, and we are at a point where it needs to have even greater coverage because the larger it becomes the more meaningful the results,” adds Duncan Salvesen, director at Dorrington and another member of the group.

MSCI said that in response to the feedback paper earlier this year it was outlining improvements for the index to provide a greater degree of comparability and transparency with other sectors.

Specifically, proposals include asset level, rather than unit level, measurement, and quarterly reporting that works from “desktop” level valuations, which should reduce the cost of measurement and management.

It is also proposing more standardisation across data collection, particularly to management costs.

Some of the delay in the expansion of the index may be natural growing pains. While many investments have been announced, there are still relatively few operational schemes. As more are finished next year, owners could see more value in joining the index.

“What is unquestionable is the appetite to invest in this sector,” adds Salvesen. He said getting more investors to participate in the index was the shared goal.

“We want a sector that is recognised as a mainstream asset class, and a quality index is a critical part of that objective.”

MSCI’s proposed improvements

- Consistency through global data standards The standards mean property assets around the world are measured in the same way and to the same criteria.

- Easier provision of data and analytics Moving from unit to asset level measurement to reduce burden of data provision, in line with the wider commercial market

- New classification of assets as both stabilised and non-stabilised, with additional income from amenities and services separated from contracted rent.

- Guidance and costs for in house management If assets are managed in-house, the costs will need to be captured and apportioned.

- Valuation frequency A step up to quarterly, rather than annual measurement, using “desktop” valuations between external valuations.

IPF hurdles to large-scale PRS investment

Different valuation methodologies

Existing residential stock is valued using vacant possession valuation – the value for the sales market.

For a residential asset to be comparable to an office investment, it must be valued through yield or net operating income. The IPD/MSCI total return calculation, which measures capital and income growth to create a total return, is the industry standard.

The need for a widely adopted index

Long-term investors require a widely adopted index to benchmark their performance.

The IPF said an index must be supported by all professionals to support scale and relevancy, and be integrated with other sectors. It must measure capital, income and total return, be produced every quarter, and should have a tool that is supportive to improving management.

The need to develop professional management capabilities

How blocks are managed needs to be thought about in more detail, from how tenants are looked after to how costs are reported and measured.

Part of the function of the MSCI index needs to be the accurate measurement of management costs, and how that affects gross to net yield calculations.