Aviva Investors’ £1.5bn Property Trust will resume trading on 15 December, more than five months after it suspended trading.

Aviva Investors’ £1.5bn Property Trust will resume trading on 15 December, more than five months after it suspended trading.

Closed as a result of a rise in redemption requests after the EU referendum, it will be the last of the seven open-ended retail funds that suspended trading in July to re-open.

Aviva has sold £212m of assets to raise its level of liquidity since closing in the summer. The size of the fund has fallen from £1.6bn in June to £1.5bn at the end of October. A further £149m of assets are under offer, including the fund’s second-biggest asset, the Omni Leisure Centre in Edinburgh, up for sale with an asking price of £75m.

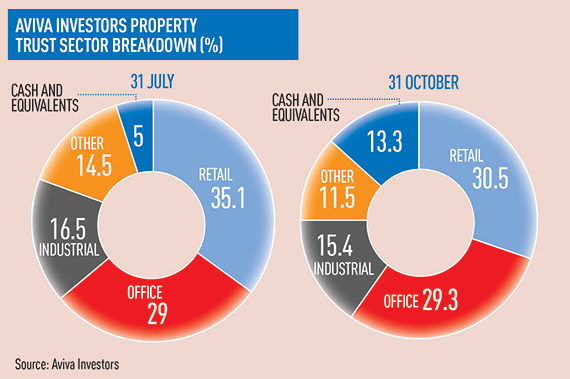

More than half of all sales between 31 July and 31 October came from the retail sector. With no major sales, offices were the only sector whose share grew in that time.

With confidence in UK real estate growing again, Aviva said there were no forced sales during the suspension, leading to an earlier than expected re-opening. Aviva had said in August that the suspension could last until April 2017.

Ed Casal, chief executive of Aviva Real Estate, said the fund used the suspension to focus the portfolio in fewer areas but with a diverse spread of assets.

It now holds an almost equal amount of office and retail properties, which together make up 60% of the portfolio.

It now holds an almost equal amount of office and retail properties, which together make up 60% of the portfolio.

The fund reached a cash level of 16.4% – £245m – when the announcement was made on 23 November, up from just 4.8% at the end of July. This was in line with other funds that closed after the Brexit vote.

Before M&G re-opened its fund on 4 November, it stood at 17.7% cash. The Threadneedle UK PAIF similarly had a cash level of 16.8% after it re-opened on 26 September.

By contrast, Aberdeen Asset Management’s property fund was 32% liquid just weeks after re-opening on 13 July.

In October, AREF commissioned independent consultant John Forbes to carry out a review of the open-ended retail fund structure. He is expected to publish his findings by Easter.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette